The thing about retirement for us traders is that it just kind of happens. You don’t announce it and get a farewell party with a cake. You either just blow up with no money left or you just gradually move after losing interest. I’ve never met a trader who said “once I make ___ millions of dollars or once I reach age 65, I am done and moving on.” You do it until you don’t.

It’s some time in late December of 2025 and here I am, sitting on my ass, doing nothing. I haven’t traded for months. I’d rather do nothing all day rather than trade.

I don’t have any purpose. Trading doesn’t inspire me to be at my best anymore.

I don’t have any confidence. So even money is no longer the motivation of last resort liked it used to be.

I don’t have any tolerance for pain. This might be the most significant development because in the past, I have traded at max depression and rock-bottom confidence and I made it through the other side. What’s different now is I just can’t sit through positions anymore. Having risk on is surefire way to physically and mentally wear me down. I often regret it immediately and then I want to flatten out and convince myself to quit. It’s hard to follow any coherent plan under such circumstances.

Without actually trading and being engaged in markets, I found it difficult to connect with writing as well. I just had zero market thoughts to dwell on so what would I even write about? So yeah… long absence. I’ve been dedicating more of my time to my investments, particularly in venture capital and the pre-IPO space. I’d like to write more about that for another post. Anyway.

Silver: The Shiny Irrelevant Metal

I don’t like commodities. I have never traded them on a regular basis and in the special circumstances when I do trade them, I rarely make any serious money. I just don’t get them. Doesn’t matter what they are–energies, softs, metals… just don’t get them. What even is silver? It hasn’t been “money” the way gold has been money, for centuries. It’s a shiny metal you get for finishing second in the Olympics. It hasn’t been relevant to financial markets for over a decade. Fun historical tidbit–did you know the massive in-flow of silver into the Spanish economy during the 16th century led to the Price Revolution which eventually led to hyper inflation that destroyed their economy and eventually their entire empire? Silver might actually be an ancient succubus, trying to seduce kings and modern nobles, only to separate them from their wealth.

You know, I try to stay in the dark about markets nowadays. I follow a few story stocks that are relevant to some of my pre-IPO investments but otherwise I want to stay ignorant of real-time stocks in play. Breaking news, squeezy manipulated small caps, whatever’s moving super fast… not my game right now. Don’t you dare ping me about some Chinese small cap up 10000%. DON’T DO IT.

The only thing I try to look for are setups similar to the ones I wrote about in 2024. Parabolic liquid setups, where the risk-reward is too great to pass up. I told a few traders in my inner circle to ping me if those particular setups came up. The plan would be to trade them as a one-off and then go back into retirement after they resolved.

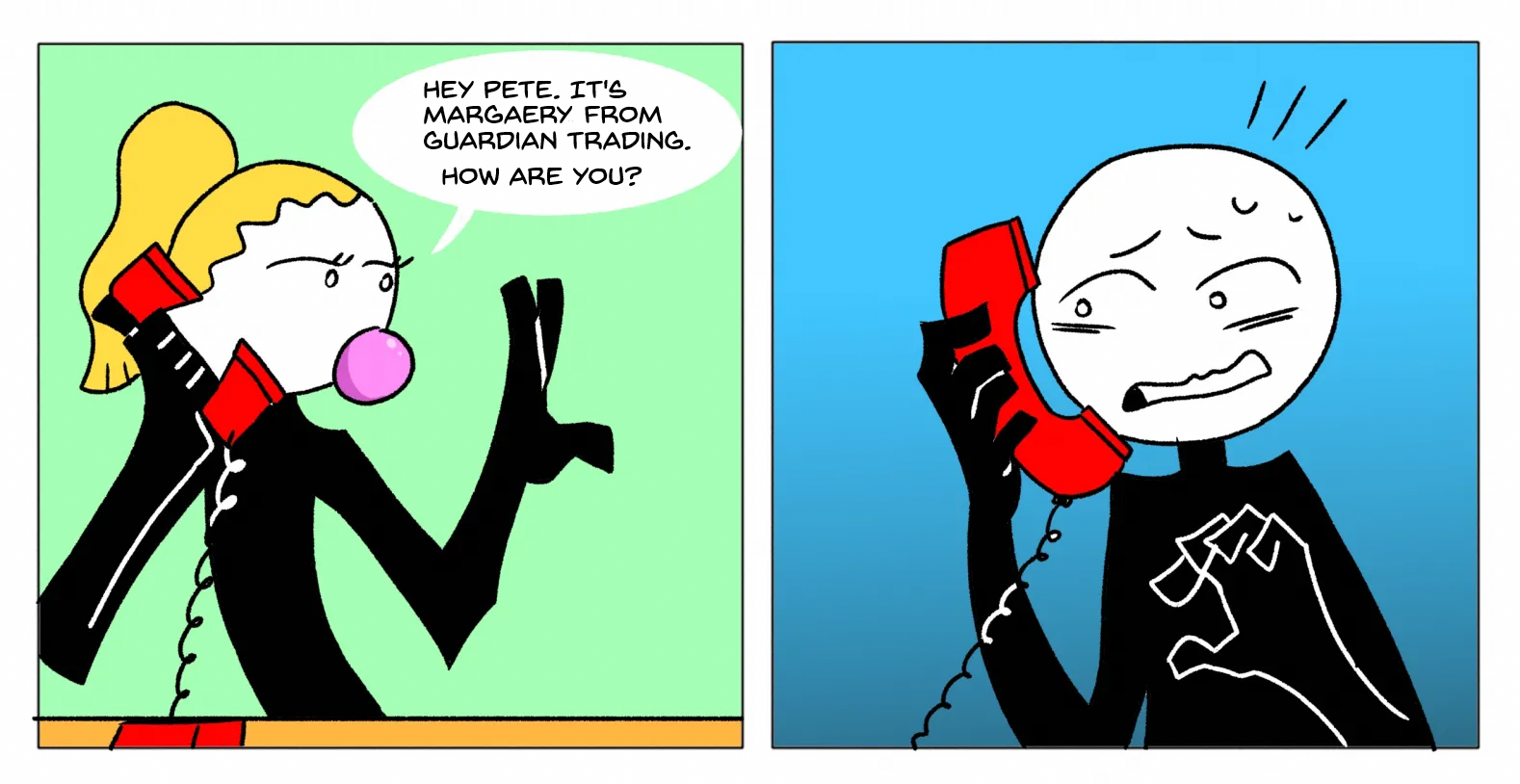

Some kid in late December: Hey Pete, check out silver. Interesting?

So here’s my first shot at this–silver gaps up over $80 on Sunday but fades to negative territory before Monday’s open. I don’t even have a futures account anymore so I’m stuck trading the ETF proxies like SLV and AGQ. Doesn’t look like one of those A+ mega parabolic setups where I can get into the 0dte puts with 5-10x payoff potential. Might still be OK for a quick trade. I avoid the options but I short AGQ at $180 the next day pre-market. It trades to $157. Very clean and orderly and my execution is solid, thus not triggering my impatience/anxiety issues. Not too shabby. I collect $35,000 on the trade. My first profit in god knows how long.

Then there’s this dead period over the next several sessions where I don’t even consider a trade. This is actually good discipline on my part. That $80 touch and Sunday overnight gap reversal was an OKAY setup, which resolved into a a decent correction, and now you don’t have extreme conditions anymore. Still a steep trend that could trade volatile in either direction but no longer in the sweet spot and there’s too much 24/7 bullshit to deal with as it trades in overnight Asian markets.

Nonetheless, I still check the price of silver (as well as gold, platinum, and palladium) every single day. Despite fancying myself being this detached operator who doesn’t care and can re-enter retirement at anytime, the old habits creep back in. The “wanting” of a bigger trade slowly grows as the trend continues and perhaps the bigger blowoff and subsequent collapse is yet to come. The story is simply not over yet. I have to continue to monitor this situation, as much as it irritates me to do so.

I make my second trade on Jan 13.

It’s not a great trade, might just be an okay one again. There’s a setup where it breaks the opening range lows and I get in for roughly the same risk as the prior trade from weeks ago. It immediately trades against me. I’m sitting in it for hours, just ticks away from being stopped out over the highs. The mental game starts to work against me.

This was stupid. I want to get lunch and watch a movie, why am I slaving myself over this? I’m supposed to be retired now.

I get out. It’s going to trade over that high, it’s obvious. I don’t want to waste any more attention on this.1I know I can set a stop and walk away, I know, it’s painful to know this and not be able to do it somehow

Then I decide to watch a movie in the afternoon2Dead Man’s Wire, nicely made tense movie but nothing special. I give it a 3/5. Ah, peace and freedom of the mind. I’m going to forget this ever happened. I don’t want to spend the rest of the day checking silver like a needy piece of shit, the trade is over, forget about it. My original stop probably triggered anyway.

Movie ends around 2:30pm EST and I check in on my phone. Did not go over the high. It is in fact, trading near the low.

I get back before the close. Price is at the lows. Don’t get back in. Don’t get back in. Ah fuck, I gotta get back in.

I hit the bid to short. It closed weak, it has to gap down. I feel like an idiot with my premature stop out so the best way to correct that feeling is to grab the quick win and pretend you weren’t an idiot a few hours ago. SLV/AGQ tumbles into a new low, which seems like a good sign, so I decide to take the entire position overnight.

The next few hours heading into the Asian open at 8pm EST unfolds as a series of internal bargaining as I lie in bed and stare at the ceiling. It’s just a half percent, it’s just noise. Asians will sell it, they know it’s extended and it closed weak in America. Gotta ignore it, be a man, take the real risk and hold it overnight, PROVE ME WRONG.

7:50 I can’t tolerate this shit anymore. Flatten position. See below for recap.

Cumulatively I am now -$20,000 on shorting silver. The original profit from weeks ago? Wiped out. Finito. I’m red now, like all the other losers who are shorting silver. Awful.

You see Pete, this is exactly what I wanted to avoid. I don’t want to get in and out of things. I don’t want to revenge trade or over trade. I don’t want tough decisions. Yet here we are, dealing with all of that. Can’t handle this shit anymore. Why are you doing this to yourself, you ding-dong.

I decide it’s over. I had my shot to keep this saga in positive territory and now I’m in a drawdown. I don’t want to bother. Commodities aren’t my game. I try to stay in the dark again, pretend this fake comeback attempt never happened.

Guess who pings me this time later in the week?

I’m trying to stay in the dark but Clockwork is still very much plugged into the market. He’s reading all these tweets from other traders and sharing it with me, usually against my will.

Story’s not over though. I get it. I start to check the price every moment again. It’s like there’s this invisible hand, forcing me to go to my screen and torture myself. Rather than enjoy life with its limitless possibilities, I need to see how this shiny metal succubus dies. I doubt I’ll make a lot of money. I lack the will and the constitution.

Every day Clockwork tells me he’s naked selling deep OTM calls.

Then the next day he tells me how much he’s down as implied volatility continues to jack higher. It’s an obscene amount. I don’t really get it. He’s a professional trader who can still take pain, I guess. I’m not a professional anything at the moment. He’s on his own saga now.

The days go by and waste away as silver grinds towards $100. It was always going to get there. Stupid of me to even try to short before that. I hope one day it just plunges 50% and it dies and I don’t care if I have any position, I just want to be over it. I hate that I planted this seed in my mind and can’t get it out.

Gotta give it one last go

It’s Monday, January the 26th. We live in a $100/oz silver society now. The metal bugs have won. The king of all metalbugs, Peter Schiff, throws a $2 million party to commemorate this landmark event. We’re getting close folks.

I have it to give it one more shot, despite every impulse in my body telling me I should book a first class ticket to anywhere, fuck off on a beach, and sit this one out. My shoulders ache. I’m only sleeping 4 hours a day. How I used to feel when down $200,000 and trading millions of shares a day is now how I feel down 1/10th the amount and trading only once a week. They say what doesn’t kill you makes you stronger–it’s a fucking lie. 16 years of trading and I’m now a weak, old man at the prime age of 37.

I’m hands off in the morning and it’s already noon and we peaked at $117 on the futures. Pretty steep move but I’m praying for it to hold up for a gap up through $120. Then and only then will I put my neck on the line and risk six figure amounts.

It’s 1pm. I’m supposed to be eating lunch. A big red candle. Sigh

I chase into it, despite a 20 min deliberation period where I tell myself to not chase into it. It costs me an ideal entry price. It closes weak but I’m not exactly sitting comfortably. I step away from the screen to take my daughter outside to play in the fresh snow after a record-setting NYC snow storm.

While dragging her around in a sleigh, I notice silver craters another 6% in the afterhours. Unclear what happened there. I bring up the mobile trading platform and cover. Cumulatively, I’ve swung back into my original profit range of +$35,000. Alright fine, that’s fine… did what I could with a tricky situation.

I continue to watch it trade into the Asian open with no position on. Seems like it’s broken now yet it keeps creeping up again. I’m both relieved and disturbed. Is this still not over? How far does it want to go? $150/oz? That doesn’t seem possible yet but these metal bugs are just so relentless.

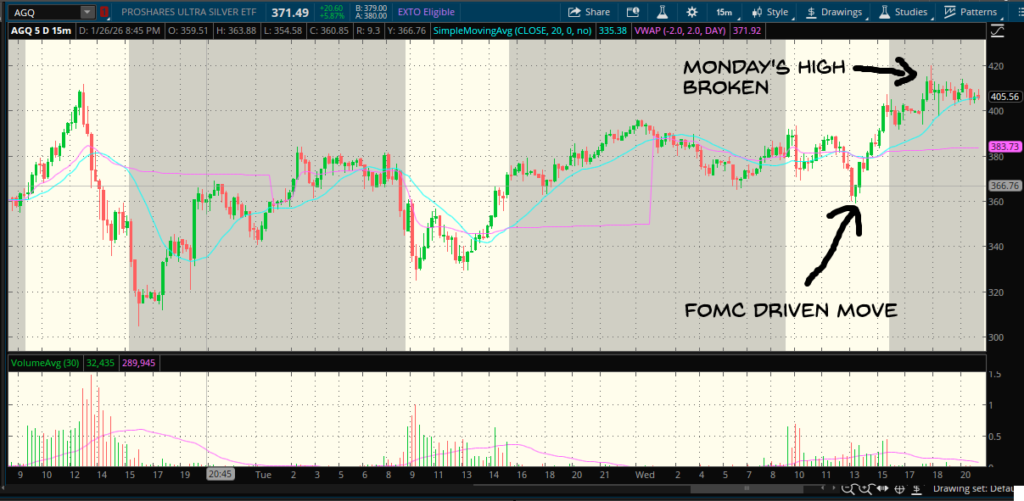

Next day, I wake up at 4am. Nothing ever good happens when I do that but I’m doing it. I short a small amount at AGQ 370. This is only the type of shit I do when I’m getting too invested in my bias and I’m painfully aware of that. I go back to bed and try to get more sleep… doesn’t happen. I just check my phone every 15 minutes and it sucks.

Silver plunges just prior to the NYSE open. I add into my position. I think there’s a chance this is it… the big unwind where it just trades lower all day and I don’t have to worry about anything. I’m up at $45,000 at one point. It seems good… until it isn’t.

It reverses yet again and I trail out, giving back 2/3rds of my profit. $15,000. Every tick as tit goes higher, I just know that’s end result and gotta accept it. Whatever man. See you at $150/oz.

The next day I don’t even bother trading it. There’s an FOMC event at 2pm. No thanks. It has a fake sell-off and then rallies after. Afterhours it makes a new high.

Then it’s Thursday and we finally breech $120/oz on futures.

I haven’t talked about gold yet, have I? Even though the SLV price action suggests some imminent top is near, the gold move has likely given silver some last gasp of strength. We’re now in a $5000/oz. gold society.

If gold is positive, silver probably won’t get annihilated just yet. Now we have two extended precious metals in the market. Heading into Thursday morning, I’m thinking I’m not committed yet but I have to prepare for anything. We’re so close but it’s not quite an SMCI-level layup. Still a lot of voices in my head telling me to just fuck off forever. There’s this fear of losing if it sucks or fumbling the bag if the move is amazing. Better to not try at all, really.

We’re at highs in the morning. And I click a few buttons… in. Then I click a few buttons to get out. There’s zero commitment in my trading. And then it plunges. GLD drops 30 points and SLV drops 10 points (AGQ equivalent is like 90 points). I chase much lower and I don’t have any size. I’m up a very sad and paltry $15,000 after covering into the washout.

On the bounce, I’m faced with a dilemma. Commit to this or back away? I take a half-measure kind of play–I risk my morning profits on a bounce with a tight stop. It doesn’t work, morning profits go poof. I can’t believe they’re buying the dip yet again. I feel oddly at peace. By the close, AGQ is back to 400 and GLD is back at 500, both close to unchanged for the day. It doesn’t make any sense. I don’t know anything anymore.

There’s some weakness at the 8pm Asian open. Bids drop out a bit and both GLD/SLV are down around 3-5% initially. Figures. Not that surprising… one of those “big-H” sell patterns. What can you do?

The Final Meltdown

So it’s Friday morning. I wake up and check my phone. Both metals down substantially more. AGQ below 300 and silver futures in the 90’s. GLD in the low 450s. I didn’t want to take a position overnight and I didn’t want to trade futures at shitty graveyard hours. What can you do? Missed the turning point, it’s over for me. Risk-reward says chasing now isn’t a good idea.

I leave my desk. I’m not going to self flagellate any further. I’m going to watch a movie.3The Secret Agent, it’s a Brazilian movie. Lots of good scenes and performances but also too long and weirdly unfocused at times. 3/5.

I check prices after I get back. Silver futs at $75, a 38% drop from the all time highs just 24 hours ago. AGQ is at $125.

Never in my wildest dreams. Most times you get a mean reversion, every now and then–you get the overshoot, a pure flip to panic on the other side.

I look at some unread messages. Clockwork says he lost money buying that bounce. I don’t dare ask how much. I look through Discord because some kid in one of my old trading chats pings me. He says he turned a $400,000 day (from shorting silver overnight) into a -$150,000 day from trying to buy that bounce. He says he’s reading my blog to feel better about himself. Ouch.

There’s a lot of carnage. I guess once upon a time, that could’ve been me. Oh wow a lot of panic on silver, this is way overdone. I’m going to start scaling in. And then lower and lower, you scale more and more, and it’s a shit show. It happens. I did it 12 years ago. Don’t feel I need to do it again.

Apparently there was some ETF apparatus in the works that day–AGQ re-balancing lead to an exaggerated dip on silver. I don’t know. I tried to read about that stuff and I got bored in 2 minutes. I don’t care anymore. I’m just relieved the story is over and I don’t have to care about shiny metal succubus anymore. Another decade will likely pass before I trade it again. In the end, I was modestly profitable and now I’m stepping out of the ring again. During this entire trading saga, I just couldn’t shake off this inner voice telling me to stop.

You’ve done enough Pete. It’s time to move on.

Man haha im Andrew, a trader at SMB been here around a year now. These are gold and love the hidden lore and funny references to things like the eternal envy status . we check him all the time here , especially when he was blowing up in SLV. Dont think your articles go into the void, we all enjoy them here . Happy trading man!

I try to keep my head in the sand about anyone’s PnL but one way or another, someone in my circle is always sharing with me. Thanks to all of you for reading my work, I love that I’ve become the historian/archivist of an earlier time at the firm.

Whoa! did not think those tweets are real. Now I have a burning need to know who Eternal Envy is! Is he from MBC, Pete? Great writeup btw.

He’s a guy named Jackie Mao, known from his spell in professional Dota2. Don’t know if anything he posts is real or not, the point is I’d rather not follow. I only know this stuff involuntarily.