The new year began. Already we had our second dropout from the 2011 training class–kid named Lo who returned home back to Hong Kong. By my accounts, he was a nice guy who seemed to do the work and buy into the program but maybe he had other pressing issues or he lost patience and realized it wasn’t for him. I’ll never know. Now there were 8 of us.

(continued from Anxiety)

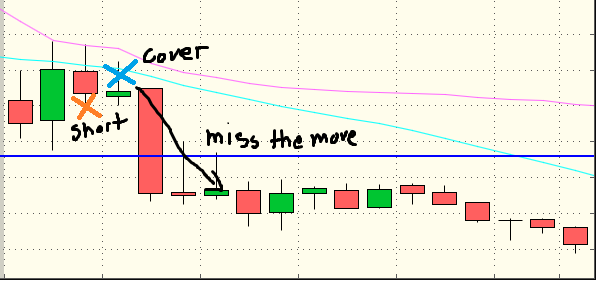

I continued to struggle with anxiety. I had a lot of trades on the open that looked like this:

I’d get in, get uncomfortable with the volatility, then get out prematurely for a small loss only to see the move I anticipated playing out. I’d see the stock plummetting without me and feel the shame wash over. I must be the biggest fucking pussy in the world. I’d take long walks by myself at lunch to take a cooler.

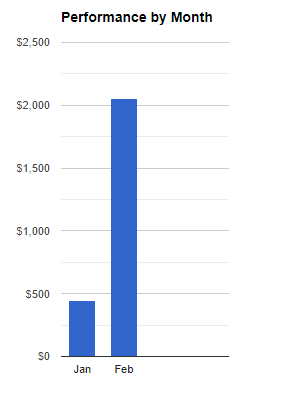

I asked Victor–is this normal? Why does it seem like I can’t do better? I review it, I journal it, do a little breathing exercise and then I tell myself JUST DO THIS, and then I just fuck it up anyway. He reiterated that I was profitable a lot earlier than most trainees were and that most traders didn’t make six figures until year two or year three while I was still in year one. He told me to stop being so hard on myself. The up’s and down’s continued the first couple months of 2012 but I was still profitable:

Weeks would pass by and I would just stop seeing familiar faces and eventually realize they weren’t coming back. Most were unprofitable traders let go by management. But there were a handful of traders who were marginal winners and had even been assigned as mentors to some of us and they chose to leave. I remember one particular guy tried hard to be a good leader by example with vocal communication on the desk, he did many of the tradecasts, and he wrote some thoughtful articles for the blog. Seemed to have a good relationship with management until one day there was just a lot of yelling in Victor’s office and the guy was apologizing and leaving. Turns out he left for one of MBC’s rival firms, Chimera Securities. Victor had held this guy up as one of the poster boys of MBC’s work ethic and trading talent and now he’s stabbing us in the back and abandoning ship! One had to ask the bitter question: why couldn’t MBC keep anyone over a year? What’s wrong with us?

Meanwhile the MBC Education Machine kept growing. Our floor manager would e-mail us “dress code is mandatory tomorrow” and that’d cue us in that a film crew was coming next morning for more marketing material. Live shots of the desk in action! An average day at a Wall Street Trading Desk! I’d see myself in the promotional material–super serious face, collar way too tight, eyes 5 inches from the screen. Bet whoever’s watching thought I was an intense pro holding a portfolio of 30 million dollars in risk and not some newb who made $2000 last month. MBC started an options education program. They started a forex education program. Nobody on our desk even traded those products. They were selling their proprietary scanner for thousands of dollars. The secret formula for the scanner’s most popular filter–“MBC Stocks with News”–was just relative volume. Money was pouring in from everywhere except on the trading desk.

What was an average day for us? We would start with our prep at 8am and then Avery’s meeting at 9am. He’d draw a bunch of lines and call them “inflection points” and behind all these price levels were multiple conditional statements about what the stock could do at those price levels. If it “held below”, it’s a short or a sell-target. If it “held above”, it’s a long or a cover target. There were never any confidence-inspiring statements like “this is a stock I’m buying dips at $20, it has room to double over 5-10 days”. Nobody understood how to make these morning meetings into actionable trading strategies but if one of his stocks traded cleanly from one of his many lines, he’d let all of us know about it… how did you guys miss this layup? I discussed it in the morning meeting. I don’t know man, why didn’t you make millions on the trade? Reid would look at the pnl monitor like a hawk and report back that Avery’s results were way less impressive than we were led to believe. Phil Mickelson, my ass!

Then there were the trading ideas from the rest of the desk, sent to the group email or chat window. We’d regurgitate the same shit as Avery. A stock, a price level, and a conditional.

Joe: If BAC holds over 11.10, it’s a long.

Bill: If JPM holds below 33.33, it’s a short.

Tommy: If DOW breaks through $40, it’s a long.

These things either never happened or just as often–it would just hold over the level, you get long, it goes up a little bit, then it goes back to your entry and ends up a big nothing burger. We were constantly missing whatever special sauce that made technical trade setups good, either with a high win rate or highly assymetrical risk-reward. When you asked someone why they would trade that stock over the countless others, the best reason you would get is “they had good/bad earnings” today. Too often the price level would be the only thesis in itself. I kept thinking to myself: you can draw this horizontal line on every single stock, surely there can’t be an edge on everything. We never seemed to be in the stocks that moved the most because those stocks didn’t sit at horizontal levels for an hour and consolidate to the penny, they just moved. And we were scared of too much movement, as sad as that sounds. Nobody wanted their daily stop triggered in one false move.

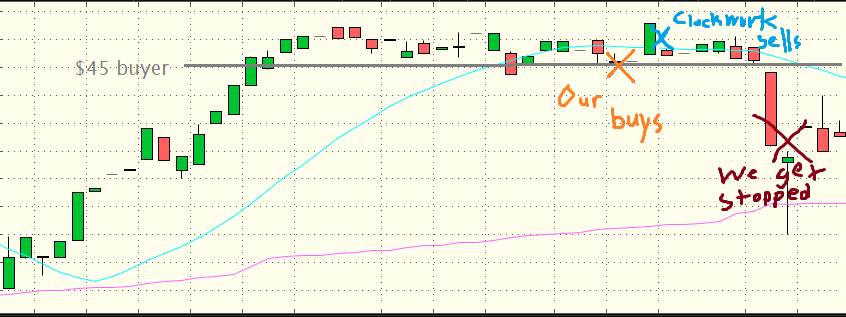

Then there were the live tape calls. Someone would yelp out Buyer on SNDK at $45! Don’t ever join in on these. Everyone would buy on $45 to catch a puny 10c move, the fastest guys would already be out for their 10c profit before SNDK came back to entry, and the rest of us would unknowingly hold the bag. Clockwork mastered being the fastest guy who sold before you could blink. I don’t even want to see this back at 45!!! and you’d see he’s already flat at 45.11 a few seconds after his entry. Then the rest of us stood in our tracks while the buyer would dropout after being re-tested too many times and trigger all our stops. You might lose 50c on bad slippage and your upside was just 10c. Unfortunate.

“Holy shit, that was so bad!!!! We all got screwed!“–Clockwork, while being the only one who made money on the stock. I like to think he pretended he stopped out like the rest of us, for the sake of unity. Then SNDK might trade to $48 later and we’d all bitch about why we were trading this way, only to do it again the next trade.

Sometimes Victor would get away from his business duties and trade with the rest of us, maybe in an effort to loosen things up and boost morale. It had the opposite effect. He’d get all chummy and talk about basketball with Eagle or baseball with me as he tried to bid into 1000 shares of Broadcom (BRCM). Then a few minutes would pass and he’d throw his hands up and ask “why can’t I get this stock?” Eagle would suggest he market into the stock and Victor would say “oh no, I only bid and offer into my trades. It’s an old school thing, you wouldn’t get it.” Then the stock takes off without him in it and he’d be in total disbelief–“WHY CANT I GET INTO THIS STOCK?” All this because he wanted to haggle over a penny on his entry price. He’d fixate on these small things, either lose money or miss winning trades, and get so pissed. Once he took off his watch and just chucked it at the door and then he stormed off. I don’t even know what it was about.

Then there’s a whole of bunch of nothing in the afternoon. The profitable traders don’t want to give their hard-earned opening gains back so they sit. The negative traders try to navigate ugly, grinding mid-day price action and chip back small gains in order to break even. When he was down, my mentor Jimmy had this process of flipping through every single stock chart on the MBC scanner hoping for that one unicorn consolidation play, where he could risk whatever was left on his daily stop, that he could ride back to break even. This is it Pete, this is my unicorn. I’m all-in or I’m done. DONE ya hear me? — he’d say that a lot. You walk through the lunch area and you’d overhear conversations about going to dental school or law school after “all of *this*” runs its course. The day ends, you’d look at the risk monitor and see the desk traded 500,000 shares total and grossed $2000, not enough to even be profitable after fees. We were going nowhere.

Tuco in particular felt displeased at the low morale that was accumulating on the desk. Tuco was a highly social trader who saw the upside in trading with a desk instead of at home, you would had a team of experienced traders who would give you valuable ideas and well-timed entry points that you wouldn’t see if focused only on your trading. Instead, we were just bringing him down with our lack of experience and our 50-50 piker callouts. Tuco put in deliberate effort to trade the “intraday swing” timeframe–where ideally you buy something on the open and hold it until the close as it continues to trend. He didn’t want to trade the tape anymore, he wanted to hold positions and take pain, if neccesary. He encouraged many of us to do the same and to cease with the super granular micro trading. He tried, he really did.

Then he’d slip up and do exactly what he said not to do. He’d regress back into 2006-2008 type of trading tactics. He’d see levels where a potential bottleneck was forming. He’d try to smash through it with 20,000 shares and get all of us into the play too, thinking the stock had way more room than just a stupid 10c move. That this could be the real leg the stock makes for several points. We’d all just be the brilliant traders initiating the breakout and riding it from the very beginning as a trading desk–what amazing teamwork!

Then the stock would drop out on all of us and he’d lose his shit.

I think he felt he let us down too, not just himself. Looking back, I could see he was a trader stuck between the good old days where trading short-term momentum worked well and the future days ahead, where you had to trade the larger timeframe trends to prevent too much noise trading against the algos. The old habits are hard to break.

Tuco sent an email to all the top traders like Eagle and Jimmy (and I was included for some reason). The message? We have to make some changes, NOW. A few points he made:

- We need to have real ideas with conviction behind them, no more “trade the tape” bullshit.

- We have to trade stocks that actually move

- We have to give our trades the real stop, we can’t get taken out anymore because of piker nonsense like “the buyer dropped for 10c”

- Forget what Victor and Avery say.

- Can’t be scared. If you’re scared, get a dog — he’d say that a lot.

He invited us to a weekend work session where we’d go over some plays. Mean reversion plays where you catch a huge reversal or pullback plays where you buy into big trend. Catch multiple points instead of cents. Victor and Avery were not invited. He promised us this: I’m going to take real risk, win or lose, from now on. Join me if you want.

(to be continued in Apple)

This explains so much of my experience gchatting with Tuco around that time (and gives some color on why he probably went out on his own…spoiler alert for other readers lol)

Brilliant posts! Keep ’em coming!

Some quality content Pete! Am wondering if you were ever featured in Victor’s second book, sounds like it would be around the time you were with the firm?

I want to read Victor’s book.