8:00 AM on Friday morning on a chilly February the 16th.

One person is blowing up my gchat with comments about one particular stock.

Clockwork1if you haven’t read Prop Trader Series, Clockwork is a guy who traded next to me at MBC Securities for 3 years and we’ve been chatting 1 on 1 on a daily basis about trading ever since then: I’m short SMCI from $1040 pre-market. I’ll take the pain on it, 4th day 4 ATR gap up, never seen anything like that. I might just short more on opening print and close my eyes lol

I know that this SMCI has been a pain in the ass for short-biased traders for the last 3 weeks. I don’t want to join the pain train and get into these plays before they’re ready. I don’t have that prop trader’s “fuck it and chuck it” attitude in me anymore. Heck I don’t even know if I want to trade today, I’m supposed to be on hiatus.

Clockwork: I might just buy a ton of 0DTE puts on the open. What do you think of buying 1000 strikes that expire today and hold for $900 washout?

I havent traded options in a year. I don’t even know if I have an options account anymore. I thought I was going to take a break, why am I even here at my screen contemplating this trade? I feel sick in the head. A deep, strong part of me says don’t even trade today, don’t ever trade ever again, it makes you feel bad, it’s not healthy for you. Another part of me says… one more trade. Just grab this one and then you can take a break. If you lose–whatever–you already know you’re a washed trader anyway.

Clockwork: All my friends are long, people that don’t even trade. They got talked into it and they market order in on Robin Hood, I’m not even kidding. This feels like mother of all blow off tops. $1000 puts might open at $10, buy 100 risk 100k. Goes to 1mil, makes your year?! OMGGG PTO WE GOTTA BUY THOSE PUTS!

I start typing.

Pete: It’s aggressive…….. but I like it. I even like the $900 strikes. This setup normally fills two gaps if it’s the big red candle today–today’s gap and yesterday’s. That if it’s truly the mother of all blow-off tops, A+++ setup you’re talking about.

The first step for me to get options access. I go to customer support on my primary retail broker. There’s a small amount left on there, about $22k. I had withdrawn most of my money the previous week, wanting to take a serious hiatus. Like yeah–that’s where my head has been at, I’m just taking out money to not even tempt myself and here I am anyway wanting to trade options. I question whether I’m truly in control of my life sometimes.

Retail support: sorry we dont allow options trading for account under $25k.

Frick. No big deal. I’ll go to the slack channel of my prop broker and ask them for options access.

Prop support: Pete you have to get approval from the clearing firm to trade options and we don’t have time to do it, we have too many risk events to monitor at the moment. It’s a no-go for this week.

FRICK. Well that’s not good. Oh well. I usually don’t make money on options anyway, who am I to think this is some amazing opportunity? Maybe this is a sign from above that I shouldn’t be doing this. Options aren’t a free lunch anyway–parabolic stocks usually have massively inflated premiums on the put side. Timing and execution is always key no what matter what you trade and I haven’t been on point with either.

Then I look at my ThinkOrSwim charts to monitor some of the pre-market action and I notice that I still have $30,000 sitting in there. It’s been inactive for sometime. I log onto Schwab’s trading portal and apply for level I options trading. Click, click, click and done, then I see a fresh e-mail in my folder.

PETER, Our specialists are reviewing your application for options trading and margin access. We’ll send a Message Center update within 4 business days.2https://imgur.com/a/GkYKnRK

FRICK! Four business days!? Okay I guess I have to get on the phone and ask them to speed this up. This is literally the last hope for me to trade options on SMCI today… and they put me on hold for about 10 minutes. It’s 9:20 and I’m inching awfully close to the bell and I don’t even know what I want to do just yet.

Hello sir, how can I help you?

I tell them I need options trading… NOW. IMMEDIATELY.3I’m polite about it. And to my pleasant surprise, they are super quick to expedite approval. No questions asked outside of verifying my identity. You’re good to go.

Let’s pause to talk about SMCI.

A Trade Breakdown: The Story of Super Micro

So what even is this SMCI anyway? SMCI is an information technology company called Super Micro Computer Inc. and it currently holds the title for “hottest large cap stock of 20244350% YTD performance by February 15th’s close. It’s been riding high on Artificial Intelligence themes, being an infrastructure provider in the AI space. On Janurary 19th, SMCI reported blow-out preliminary results and jumped to an all time high price close of $423. Since that day, the stock has been a rocketship–trading as high as $1000 by the end of Thursday, February 15th.

There were a lot of smart people who got on the SMCI rocket. The fundamental guys are long SMCI. The macro guys are long SMCI. The catalyst-driven/momentum guys are long SMCI. The social-arb guys are long SMCI. Follow the right people on FinTwit, you will see all kinds of different traders who have bought from before or after the breakout price and have printed serious money on SMCI. These are great traders using proven strategies to take advantage of principles like momentum, breakout, post-earnings drift, episodic pivot, and social arb. You can and should try to study their process for why and how they got into SMCI early and were able to sell for home-run gains.

Me, well, I am not the guy to teach you about any of that stuff. That’s usually not how I make my money, outside of some outlier trades5(mostly bitcoin). What I have been historically good at in my trading career, is usually mean reversion trading (also called countertend trading). It’s a simple formula: a rocketship stock accelerates too far into an unsustainable parabolic shape and it will sharply correct to the downside. Nothing goes up in a straight line forever. SMCI was overdue for a huge mean reversion move.

A Trade Breakdown: The Parabolic Phase

To study the SMCI parabolic move, you can’t just look at SMCI in a vacuum. You have to study previous large cap parabolic blow offs, which are usually rarer than small-cap or mid-cap parabolic moves. Where was the turning point? What occurred on the chart? How did the first daily candle close? How do B-setups evolve into A-setups and how do those evolve into A+-setups? You also have to study large cap extended stocks that *don’t* have parabolic blow-offs and how they are much more difficult to short for the short-term trader.

I could probably write a billion words on this part but I’ll try to keep it short and personalized. Two of my best day trades ever occurred on large cap parabolic shorts–TSLA on 2/4/2020 and MRNA on 12/1/2020. I surpassed the six-figure profit range on both of these trades. Since those 2 trades, I don’t think this setup has occured since. I remember a lot of extended large caps that corrected without blowoff moves and I remember a lot of small cap and mid-cap companies with parabolic moves, but no true large cap parabolics since then. Not every trade unfolds the same way but it is good to study prior setups to form similar expectations.

Mean reversion traders believe in an implicit axiomatic truth behind all their setups–nothing ever goes straight up forever and it’s NEVER different. It can be the greatest company in the world but this truth still applies. It is just a matter of “when”. The big mean reversion move happens, you’re short, you take profit as it reaches “the mean” (however you define that), and then you move on. The stock can go up 100x after that for all you care6TSLA eventually traded much, much higher than its 2/2/2020 local top, it doesn’t really matter. It’s not a competition, we can all make money. Remember the old Wall Street truism: “bulls make money, bears make money, pigs get slaughtered.”

The biggest challenge in shorting a parabolic stock is the waiting game. To properly stalk the move, you have to strike a careful balance between wanting to catch the move and not being too jumpy with FOMO, so as to avoid taking a bunch of a papercuts7(or worse, just flat out taking pure pain with no stop like a Mr. West-esque whale trader) before the stock is ready for a correction. The short sellers who exhaust themselves with heavy losses before it’s ready are the going to be the same ones throwing in the towel in the final blowoff phase–and that is ideally where you want to strike. It is critical to have some analytical framework to define what is parabolic versus what is simply normal or extended–this can be with technical indicators, stock filters, sentiment analysis, options chain analysis, or a confluence of them. Experience in having witnessed the same situation unfold, over and over and over again, doesn’t hurt either.

I’m not going to sit here and tell you it’s easy. It is NOT easy to find this balance and execute this setup properly. I documented my trades in ARNA in this post from over a decade ago to frame the mean reversion trader’s dilemma: do you force yourself to pile into volatility to not miss an A+ mean-reversion idea or do you stay super disciplined waiting for the “perfect setup” and then risk missing any unexpected rug pull? There’s no easy answer and only you can determine how you want to trade it, IF you think this is a setup worthy of trading. It is 100% OK to pass up on this trade if you don’t see the value in it. You think any of the traders who made 400% long give a shit about shorting the parabolic top? They don’t. Me? Well…I’ve been trading for 15 years and I know I have mean reversion DNA in my trader bones so this is just what I do for better or for worse. I’m a sicko who likes to do the hard countertrend thingy, I don’t glorify or celebrate it but I have accepted that it is simply a part of my job. Certain frothy stocks need a cleanup job and I am just the janitor for the day.

THE OPENING MOVE

So it’s 9:20 and SMCI is trading with a 5% gap-up in the morning around $1050. I’ve never traded an option on ToS my entire life so now I’m fiddling around the interface to get familiar with it. I have to decide at what prices the puts would be worth a blind shot–to take the contracts at opening print without even waiting for some kind of technical trade setup.

Here’s where the magic happens: for those ten minutes, I’m having a moment of sheer genius unlike I’ve ever had in my entire life. I have now become the Rain Man of options trading. I hyper-calculate SMCI’s gamma, delta, theta, and vega and I just see something that the market makers don’t: the SMCI options are fundamentally mispriced by a magntitude of 100 sigma. It’s unbelievable how in-the-zone I am.

Just kidding, I’m no smarter than an idiot caveman on options. STOCK GO DOWN, PUT GO UP. I did do some quick and dirty math. I see that $900 weekly strikes closed around $2 yesterday. Since SMCI is opening higher and it is now options-ex day, the put premium will likely decay closer to $1 and $1 seems like a pretty good price. I could envision $SMCI down 10% today (and that’s being conservative), which would bring it to $900. If the stock washes through a big whole number on a powerful plunge, it usually finds “the eights”, which would be $880. At $880, the $900 strikes would trade to $20 at a minimum. So I see at least 20-1 risk-reward. If the -20% intraday move is in play… the stock will be near $800 and the $900 strikes would trade close $100. The risk-reward seems incredible to me. I decide that I will take some options exposure on the opening print so I don’t have to put a ton of pressure on myself to time an entry setup.

I send in my order: 50 contracts to open on the $900 puts, expiring today.

9:30. I get filled around $1. Couple minutes later I sent in another order to fill 50 at $1.15 average. Mentally, I was thinking roughly $10k in blind premium is acceptable. I can add more on confirmation.

So now I got 100 contracts. Clockwork tells me he’s got $50k in premium on the $1000 strikes. We sit and wait. The stock is strong and holds the opening 5-min low of $1025. It trades close to the pre-market high of $1080 and a high new breakouit seems inevitable. Above that price, it could find $1100 or even $1200 today. It ALWAYS feels like that on parabolic stocks before they break. You spend your whole morning looking at the vertical daily chart with a 99 RSI in an attempt to muster conviction–this is completely unsustainable! Yet here we are again. Grinding tape and unlimited bids buying the dip for the 12903019th time. Here we go again with another new high.

And the more damage you take on the way up–if you had short attempts at $700, $800, $900 and got stopped out—the worse it feels. You must be the biggest moron in the world to even think about shorting the fastest rocketship in the stock market.

But hey, I didn’t overcommit. If my puts expire at 0, I’ll just go back on hiatus and not give a shit. At 9:45 the stock trades under $1050 again. A new low under $1025 might work as a trigger but I’m hoping the stock goes sideways a little longer and at least closes an opening 30 minute bar without going under that $1025 low–that way it can create a pent-up, obvious range break for me to short.

It doesn’t want to sit on the range lows and give the whole world a juicy, obvious trigger. It just wants to break lower and break some hearts. 9:49, $1025 is breeched and volume starts to come in. I’m not ready to do anything just yet. 9:51 it breaks under $1000 clean and I’m like… SHIIIIIIIIIIIIIIIIIIIIT, this is the moment isn’t it????????????? I have to add.

I send in an order of another 100 contracts at market. My quotes don’t even seem to be updating properly so I’m not sure what the ask is at on the $900 puts. Don’t care, just want more. All I see is that my order is stuck without any fills and I’m wondering what is going on.

In the meantime, I indiscriminately hit 300 shares of stock at $994 on my prop account. At 9:52 the price plunges to $950 and there is no bid. I add another 300 shares at $950. I just chased the dead low after a $1000 point washout, I know I’m a jackass and it’ll probably bounce to punish my excess but I believe in lower prices at this point so who cares? In the meantime, I have to figure out WTF happened with the options order.

I see the $900 strikes bid jumped to $4… so it turns out I didn’t have enough buying power to take on another 100 contracts there. Look at me, I seriously just made a newb BP-exceeded order error while point-and-clicking my buy buttons. This might be the biggest trade of my life and I’m goofing up fundamental shit they taught us in the training program 13 years ago. Speed is key, every second counts. I adjust my order to add another 35 contracts around $4.50. I have almost my entire account “all-in” on 135 contracts of the $900 puts.8(looking back, I had another $3000ish to deploy but I didn’t, another mistake considering how high those puts traded).

SMCI goes under $950 and ticks back over to get to $970. I spam a bunch of limit offers between 980-1020 to add short on my prop account. None of them ever fill because the short-lived $970 bounce is as high as it goes and SMCI prints $900 ten minutes later. Then $880s minutes after that. Like I said: If it flushes the whole, it’ll find the eights.

Clockwork and I haven’t said much since it broke under $1000. We’re both just concentrating on our execution. I’m up a lot of money. He’s up a lot of money. The trade is working like a dream. Finally, I say something.

Pete: Is this real? My options are $30 bid.

I said that like a joke almost, to break some tension. But then I honestly did wonder: wait, this is a real trade right? I didn’t accidentally fuck up and stay on paper trading mode or something? That thought freaked me out. What if this is all fake money that I didn’t realize because I’m trading options on ToS for the first time ever? So I check the Schwab homepage to see the equity and…

… it’s sitting at $300,000. In the morning the account was at $30,000. I just 10x’d the account and it is indeed, very real money.

It’s not even 11am yet. SMCI trades as low as $865. My options PnL flickers around $300,000 and my short stock position floats around $50,000. This is now a record-breaking day trade for me. I decide I have to lock in because I’m too sane for my own good. I sell 100 contracts and keep 35. I lock in just over $200,000. I cover 1/2 my stock in the low 880 for another $28,000. The rest I hold all day to see if SMCI can trade lower.

Clockwork: I’m up 700k. Locked in most of it too. This is great. We did it!

After that, the SMCI downside momentum weens off a bit and price rotates around $900. The CEO is slated to speak on Bloomberg at 11am so maybe the market just wants to hear the interview before the next move happens. We both think the interview will be a big nothingburger and that the prevailing momentum of the day will hold. While waiting for it to end, we chat for a bit.

Clockwork: shit I needed this. been grinding and going nowhere for a few months.

I feel you, bro. Both of us had experienced career years in 2020-2021, only to face our own unique set of challenges as the pandemic era wrapped up. Clockwork got caught taking too many shots in the dark with ‘buy the dip’ trades on declining SPACs and other speculative plays, which left him grappling with drawdown for most of 2022. I managed to hold my ground in 2022, but 2023 was a different story—I got taken for a ride in several short squeezes that really threw me off course. Although we’ve recovered from our lowest of lows, it’s clear we’ve both been knocked off our A-games for quite some time. Still, having this conversation, brainstorming and strategizing together after more than a decade of back-and-forth on trading, feels right. It’s a good reminder of the power of teamwork and dialogue in navigating through tough times.

THE CONTINUATION MOVE

As a rule of thumb, the best parabolic reversals end up selling off all day or within the next several days. Even those who missed the volatile opening move under $1000 should still be stalking the short for futher continuation. I normally visualize that first thick daily red candle engulfing several of the prior green candles. By the morning we already had the double gap fill. The next high probability target would be the triple gap fill on Wednesday’s closing price of $793. I’ll round it up to $800 for good measure.

As we sit on our partial positions, we still try to analyze the price action in real time and look for signs of a continuation move. The CEO’s Bloomberg interview leads to a small bounce to $920 but it quickly fades back under $900 and the price range starts to contract (the 5-minute candles get tighter). The next break of $865 appeared imminent9Lance Breitstein, one of the top equity prop guys of our generation, calls this a “bouncy ball setup”. Someone else might call it a bear flag or a descending triangle. It doesn’t matter what you call it, you have to internalize this setup to make $ off continuation plays.

Around 11:15, I add back my stock position, plus a bit more, to get to 1000 shares short with a lowered stop of $920. I decide to just hold my 35 puts to expiration. I’m expecting a big red candle to flush the lows.

An hour later, I’m wondering why the stock hasn’t cracked yet. I start imagining the possibility of the stock having a larger reset back over $900–maybe the market makers just want to pin the stock at $900 for most of the day and have my options expire worthless. It just sits on $880 and I find myself too attached to my PnL. So I make my first unforced error: I lightened up my position on a weird hunch.10the low IQ stop would’ve been $900.01 and I could’ve just done that and it would have worked

It was not the right move and I knew it. At 1pm, SMCI finally tested the $865 lows and broke clean. I reluctantly added back my stock position at lower prices, but not the options I had sold. Then Clockwork, who hadn’t been saying much about his position, suddenly chimes in:

Clockwork: I added, fuck this. I hit 100 of the 850’s.

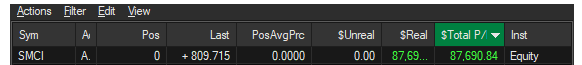

That was the right move: staying aggressive for the clean continuation move. I ended up overthinking. He hedges his puts into the low $800s and his PnL is now a hair over $1 million. My combined PnL ends up around $420,000 and I flatten everything out to one last put contract with an hour before close. SMCI closes near the dead low of $800 and I market out this last contract at $95 to end the day. Final tally with screenshots below:

$332,663 profit on options

$87,690.84 profit on stock

A little more quick and dirty math after the day ends: 135 contracts X $95 X 100 = …

If I held every contract until my last print’s price, the position would have been liquidated for $1,282,500. I left a ton of money on the table11lets not even talk about my potential PnL if my second 100 contract order had executed. It’s by far the greatest risk-to-reward ratio on a trade I have been involved in. I make a note of it but it doesn’t affect my mood. Just participating in this trade at all overshadows any regrets. The day could have unfolded in countless ways, and I’m well aware that I could have easily missed the opportunity altogether given my low confidence throughout the week. I’m also well-aware that even if I had been in peak trading form, I could have found myself in an overly aggressive state of mind on SMCI and ended up shorting too many times before the final move had occurred. I ended up striking the perfect balance–losing almost nothing the entire way up12I did lose $3000 shorting it on Thursday at $950 and then catching a big windfall profit with great timing on the first negative day.

FINAL CHART AT CLOSE

Anyway. That’s the SMCI trade. I don’t feel like the greatest trader ever or anything like that. I honestly feel very lucky13(and for the record, I’m going to continue to be on hiatus unless an extreme opportunity like this comes by and no, small cap parabolic moves do NOT fit those parameters). I know a lot of great traders messed it up or missed it entirely and I’ll repeat: it’s not an easy trade. It’s a tremendous mental challenge to take on this play and I don’t pretend to have a secret formula to catch the trade without all the warts14(the many papercut losses, having to take pain, drain of mental capital, high IV and time decay if playing options–to name a few). I’m just documenting what happened because I view these ”extreme moments” as a snapshot in market history–a moment to study and further our knowledge and then be prepared for what’s next. Best of luck on the next one.

Great read, tick by tick, many points to learn from (even the admin issues). Looking back at the options data, downside 900 and 800 strike (largest) were pinning targets on opex. Thankyou for sharing.

Amazing read, Pete, as always. You have a knack for this, and I’ll hope you’ll keep writing!

I’m a newbie trying to break into retail trading as a side hustle and reading your blog is one hell of an encouragement 😁

Great writeup Pete. You look at the daily candle and it’s just 1 big red engulfing. Interesting to get a feel for how it went down all day, the long hours in the middle of not much happening

I think this and FNMA are the best trading writeups I’ve read on this blog, congratulations on the trade!

so, you buy strikes that are above your target? above the mean revision?

if you are shorting a stock at 150 with a 100 target, you will be getting 110-115-120 strike?

yeah basically. I imagine a stock’s range and the two choices would be the heart of the range (conservative, higher premium, less risk for expiring at 0) or the very edge of range (aggressive, lower premium, higher r/r, vulnerable to time decay and expiration). $900 seemed like a good choice because I figured the big red candle, if it happened, would be so wide you almost always get 2 gap fills.

Love hearing about the back and forth chatter with you and clockwork…well done sir.

How much risk in terms of % you took in this trade Pete?

I was willing to risk the entire $30k account but my entire trading pool is larger than that. I was (am still) in a transitory period with trading accounts so hard to grab a percentage number. Risking $30-50k on top setups is normal for me.