Shorting at $27 and covering $53–that is an abject disaster. Letting a stock double against you in an hour is usually bad risk management or bad stock selection1what do I mean by this, it means trading a stock with a liquidity profile where it can skip against you so quickly that you either freeze up or you’re moving the market yourself just to get out. AVOID them if you cannot handle that situation–in this case, it’s both.

I probably just covered the dead high like on BBBY.

Well, I had this going for me: my cover was NOT the dead high.

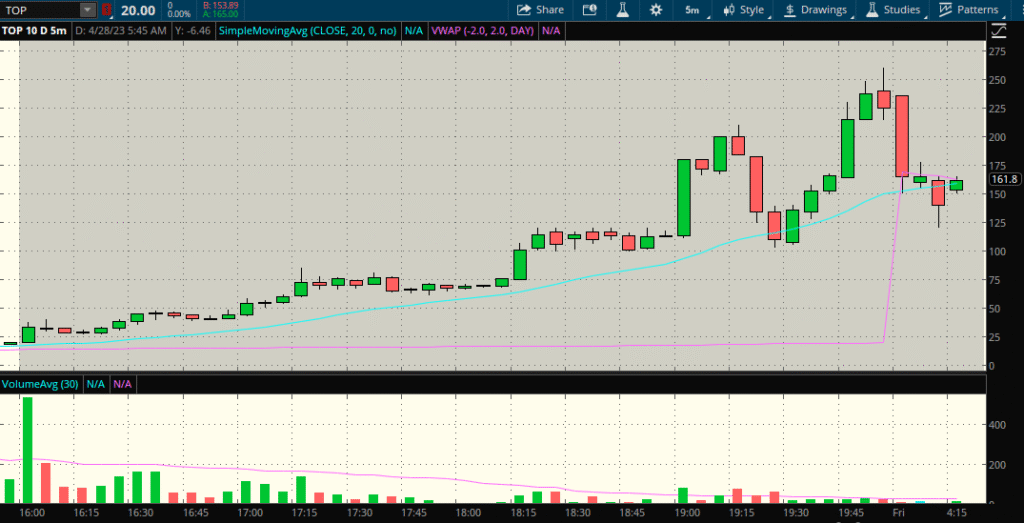

TOP TRADED TO $250 IN THE SAME AFTERHOURS SESSION. IN A COUPLE HOURS, IT TRADED 5X FROM MY COVER PRICE.

WTF?????????????????????????????????????

This would have been so much worse if I had wired in additional money. Thank God I came to my senses.

For a brief moment, I actually started to believe all the stock market conspiracy theories — that there’s a real, malevolent force pulling the strings. In this case, it’s a cabal of Chinese businessmen perched atop some gleaming skyscraper, watching every short seller through hidden feeds. They see our screens. They see our pain. And they’re squeezing us dry.

Surely, that squeeze had compiled some 7 or 8-figure losses and ended some careers. I walked away with a bruised ego and a loss that, while painful, only amounted to a single-digit hit to my liquid net worth. It’s easy to say that now though. In real time, trying to bounce back was the furthest thing from my mind.

Once the tears dried up, I decided to step back for real. No brinksmanship where I’m just thinking about it only to then pull the good result out of my magic hat and feel like I’M BACK! Now I’m making sure I can’t even tempt myself. I wire every dollar out of my brokerages and shut off all platform data. I unsubscribed from all my newsfeeds and scanners. It’s done.

Why keep torturing myself? Something had felt broken in my trading since the start of the year. TOP was just the coup de grâce. For the entire summer, I decide to just focus on real life. The birth of my first child was coming up and I did not want to start fatherhood with my head in my hands all the time. Family is what matters. Trading is just a brain-rotting bullshit activity.

Here’s some stuff I did while in I confined myself to trading timeout

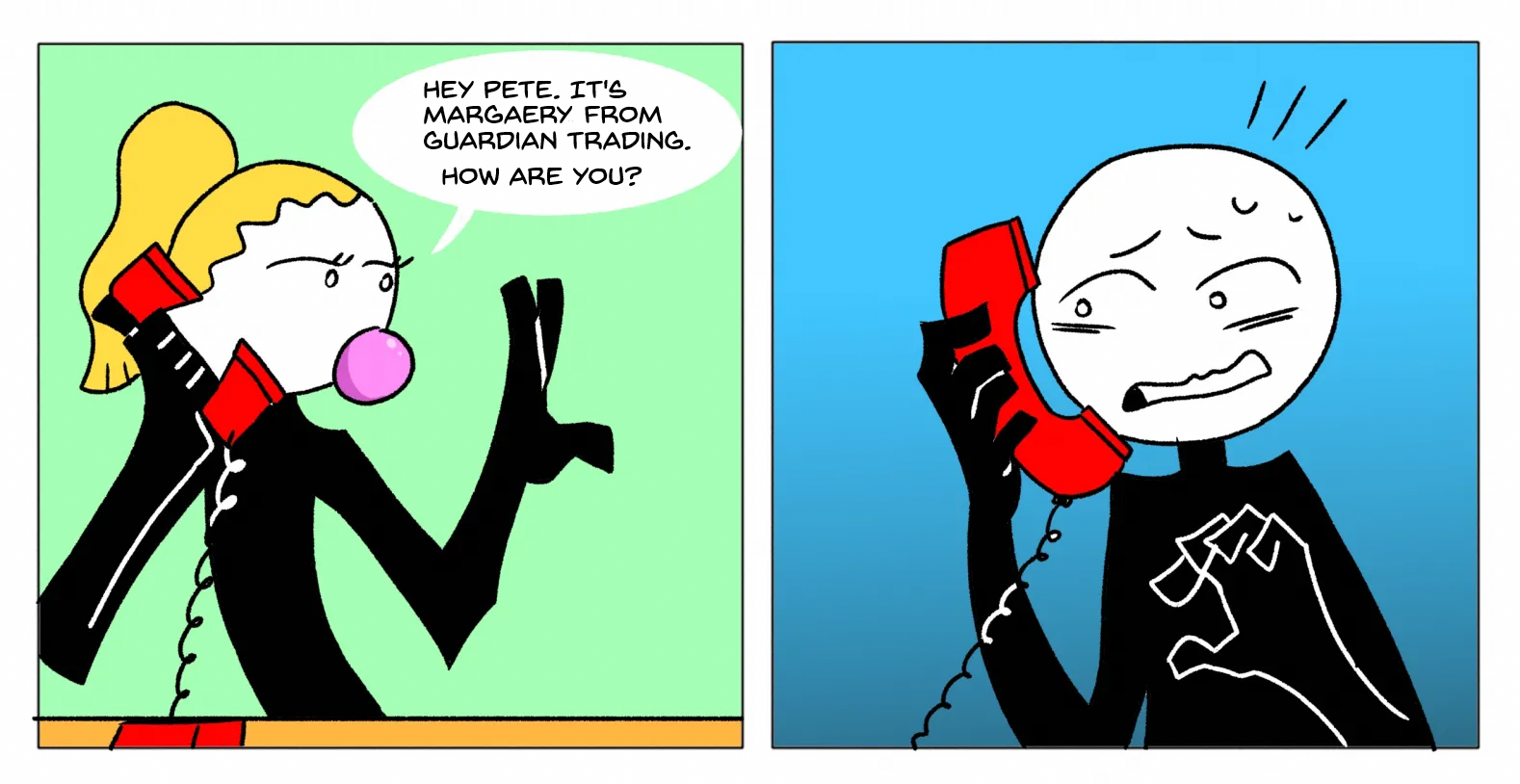

- I got obsessed with this online graphic novel about an author’s life story where he basically got kidnapped by the troubled-teen prison complex. I enjoyed how he illustrated the little soliloquies that go on in his head when pain or stress are at peak intensity levels. Reminded me of trading.

- So with “Elan” as inspiration, I started writing again.2When I first published the original FNMA post in 2014, it was a huge hit. It went viral on FinTwit and even made it into unexpected channels like hacker news and Ycombinator. I even got it published in a now-defunct trading magazine. I had so much momentum and I just completely squandered it. Then trading got too popular across too many trading social mediums while the era of blogging pretty much died and well, now there’s no way I can get that moment back. I always meant to write about my prop trading days but I just kept pushing it back. I thought this was a good way to start from the beginning and try to understand how I had evolved3devolved?, and also double as an opportunity to show an audience what goes on at a real prop firm4(as supposed to those fake prop firms that do combine style trials)

- I spent more time on FIRE subreddits. I think the term FIRE started to become en-vogue around 10 years and while I read a lot of it, I never felt like I fit in the early retirement movement. I didn’t work an exhausting 70-hour corporate work week. I could take time off whenever I wanted. But then this shit 2023 year had me seriously thinking about uninstalling trader.exe for good so I had to plan accordingly. I realized that I had taken for granted that I would just print money every single year and be fine. What happens if it all that income disappeared? I had to make sure there was a sufficient safety net.

- First step: I had to get our personal finances in order. We had too many accounts and all this dead money sitting there after my trading accounts were drawn out. I started to consolidate and create an asset allocation plan, just in case I decided that I did want to retire and quit trading.

- Spent a lot of time on “BuyNothing” Facebook groups where parents would give away toys or baby clothes, then we’d take long neighborhood walks to pick it up

- Lots of visits to the OB-GYN. Looking at ultrasound pictures. Narrowing down baby names only to expand it again a week later.

- Cooked a lot of stuff–a lot of grilled meats, Mexican comfort breakfasts, noodle dishes. I grilled some Korean-marinated short-rib (galbi) at a neighbor’s pot luck and people liked it, I guess.

- Exercise, although I’m no gym rat. Sometimes I kick around this idea of building myself into this Ubermensch who can bench 250 and run around with unlimited energy, I’d hire a personal trainer and eat better, blah blah blah–never happens. I’m just not that into it. I’m basically in the gym to collect steps and multi-task.

- Watching a lot of prestige TV — I think I rewatched all my favorites: Sopranos, The Wire, Mad Men. Started some new ones at the time that became favorites like The Bear, The Last of Us, Beef, Pachinko. Watched a lot of it at the gym actually.

- I tried to get really good at pool. I mean, I’ve dabbled on and off throughout adulthood—whenever I had the time—but now I was clocking 3+ hours a day, practicing at noon like I was trying to go pro. I figured if I trained harder, maybe I’d hit some kind of breakthrough. But it didn’t shake out that way, much to my chagrin. And honestly, that stung. I was really hoping this would be the thing—the thing that filled the hole trading left behind. Pete: a winner who wins at stuff. Objectively NOT a loser. That was the fantasy…

- Started meeting with a trading psychologist to discuss long-term issues that have sat on my mind for the longest time

Let’s talk more about that last one. I truly believed I was the most broken trader of all traders. Nobody is more broken than me, they just aren’t. There was so much wrong with me and thus so much to talk about.

I talked about entitlement, something I felt every time I would put on on risk. I thought I deserved to not only catch good trades but to catch them on clean moves–where they wouldn’t be excessive volatility that would induce mistakes. The more aggravated I felt, the more entitled I felt. I’m suffering therefore I deserve compensation. When a stock would make a move I didn’t expect, I would freak the fuck out and start scolding it like an animal urinating on my doorstep.

I talked about comparing myself to others or feeling envy. I knew too many verifiably-good traders and I had all these network connections where they’d openly post their trade ideas and PnL. Unlike a rational person who acts in their best interests, I chose not to colloborate so that I could make money. I’d just trade my own ideas and when they didn’t work, I’d start to seek out evidence that everyone else was doing better than me in the pursuit of pain. I’d constantly question myself–what do they have that I don’t? Why couldn’t just I trade *that play*? Why couldn’t I put on that same kind of crazy risk and make millions? Why is it so easy for him to shake it off but I have to feel all this shame when I get blasted? Relax–no I don’t want to, let’s go on my phone and make myself feel bad.

I talked about nihilism. I’ve been doing this too long and I’ve seen too many stupid things. I see the most reckless traders escape their way out of drawdown by quadrupling down and getting bailed out by a single candle. I see retail buying the absolute worst stocks and making 10x their money. I see these massive coordinated pumps involving the most arrogant pieces of shit imaginable and they get away with it. SPAC’s, NFTs, meme stocks–all of them so conceptually stupid that I hate talking about “work” now. It gets harder and harder to reconcile these observations with a world I would want to live in. I start to deconstruct all the so-called “cool things” about being a professional trader and I’d repeat them sarcastically in my own head5U gEt To Be Ur OwN bOsS yayyyy!. I question whether capitalism is a good thing and whether money is actually the root of all evil. Eventually I just drift away into the belief that the only meaning is no meaning. We’re all going to die anyway.

I talk about how I’m just a plain ol’ bad trader now. I lose too much on losses. I don’t make enough on my wins. My equity curve went from steady to intolerably volatile. I have too many biases that prevent me from taking obvious plays. I’m slower than I used to be. I used to be first to get out and now I’m the guy who gets out when it’s obvious the trade is a dud. Everything’s battle, nothing feels effortless like it used to. I literally cannot do anything right.

I don’t remember much of what Mr. Psychologist told me, most of our sessions were just me unloading pain. I do remember we tried to compare my eventual recovery to a pitcher who rehabs in the minor leagues. 6I’m a big baseball fan who loves baseball metaphors, they always hit I have to take it slow and see the current results as a product of being on day 1 of rehab. I’m throwing my fastball that’s down 8 ticks from my prime and it’s getting absolutely slugged. But it’s ok. Rehab starts don’t matter, it’s just ramp-up. 7As a baseball fan: I can’t count how many times I read about a top pitcher rehabbing in AAA ball and giving random homers to nobodies or walking 5 guys in a row, only to then go out on the mound and pitch near perfectly weeks later in a major league outing.

In other words, he told me to trade small. Just scale it down to where it doesn’t matter, even if it’s like $100. Try some stuff. Figure out what works. Re-build momentum. For a week, I tried that. $100 trading, see where my head is at. And then I screwed up.

Remember when Silicon Valley Bank (SIVB) went belly up?8(this is not the bad trade I’m referring to in the title, btw) This was around that time. Then it became SIVBQ, trading around $1-2. I thought I’d try to trade like it was FNMA or AAMRQ in the good ol’ days. I thought I’d be like old OTC bandit Pete who could play momentum and get in and out of it off the turns. I got lost in the moment and thought I saw something on the tape and clicked into 40000 shares–this is manifestly NOT $100 trading.

Immediate downtick.

Got stuck. Got out way later than I thought I could and took a $15,000 loss in a matter of minutes. Why did I do that?! Now I’ve lost even more trust in myself.

There was a lot of pain being vented but no real answers. Eventually I exhausted the amount of sessions I had paid for and I stopped working with Mr. Psychologist. Not because I didn’t like him or anything, but deep down, I felt this helplessness after each session. We’d talk about pain, we’d talk about a solution, I would feel this fake five minutes of optimism… and then when the Zoom call ended, I’d just go lie on my bed, think about all the negative shit I had repeated to him, and come to the same realization.

I’m broken. There’s no way I’m gonna get fixed.

Fatherhood arrives

I’m back to real life. My daughter’s born in July and it keeps me busy, in a good way. My hands are too full to wallow in self-pity. I’m doing night time feedings. Both sets of grandparents are hanging around a lot. I’m cooking post partum soups and doing bottle feeding. I learn what swaddling is. I learn about colic. It’s nice. Most of the time, the little one is just sleeping, so my mind wanders out of boredom

Some random-ass day, July 18th 2023.

I don’t even want to think about trading. I’d be insane to even entertain the idea. I could retire right now and there’s no shame in that. None. The real madness would be to boot up trader.exe again. That’d be lunacy. I don’t even want to open the app. I don’t want to check Twitter. Don’t look at the symbols. Don’t look at the top gainers and losers. Don’t even glance. You hear me? You crazy man. Just walk away.

5 minutes later

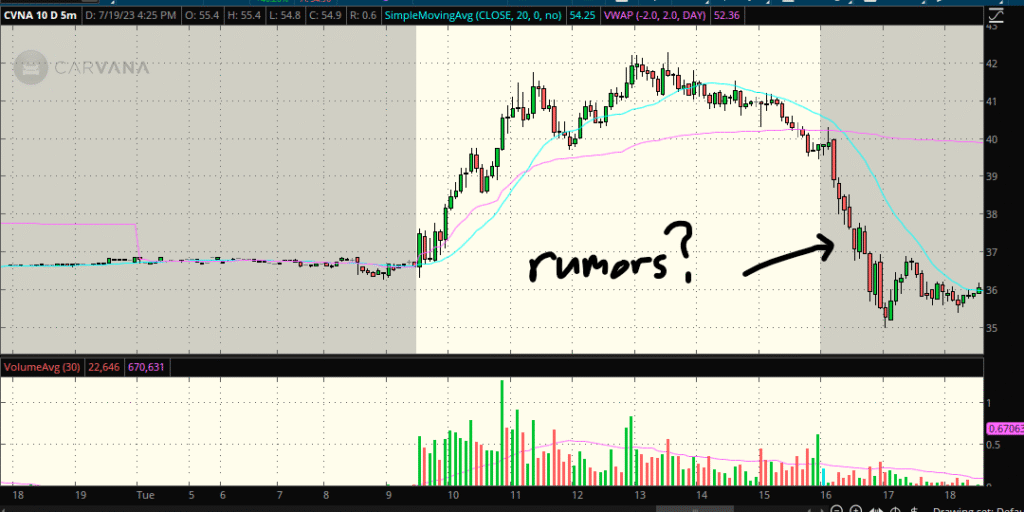

I’m looking at symbols on my phone. I stumble on CVNA. In my absence, it’s been going places. From $2 to $42 in 2023. I’m skeptical, as is everyone else. Their business appears insolvent and perhaps this prolonged bounce is just retail frenzy thinking it’s 2021 again. I start trading it a little on the short side–100 shares here, 200 shares there. It doesn’t really do much into the close. High of $42 and closes around $40–still a strong stock. I close out. No harm no foul.

I check my phone an hour later. It’s down 10% to 36. Oh shit, something happened and I missed out. I look up the news and I see traders are anticipating their earnings report the next day. I think someone knows something, that’s why it dropped out. I had real no investment in catching this play but it’s something in my brain gets activated to think that there’s a sneaky 1000 IQ play here.

So I hit 1500 shares at $36. Within minutes, I have convinced myself that the recent up has priced in any upside for CVNA and that it should tank 20% tomorrow. This is completely random on my part because I never try to take positions into earnings. It’s not a play I make.

Then I just try to forget about it. I think I know I’m being stupid but I stay in denial. What’s done is done.

The next morning

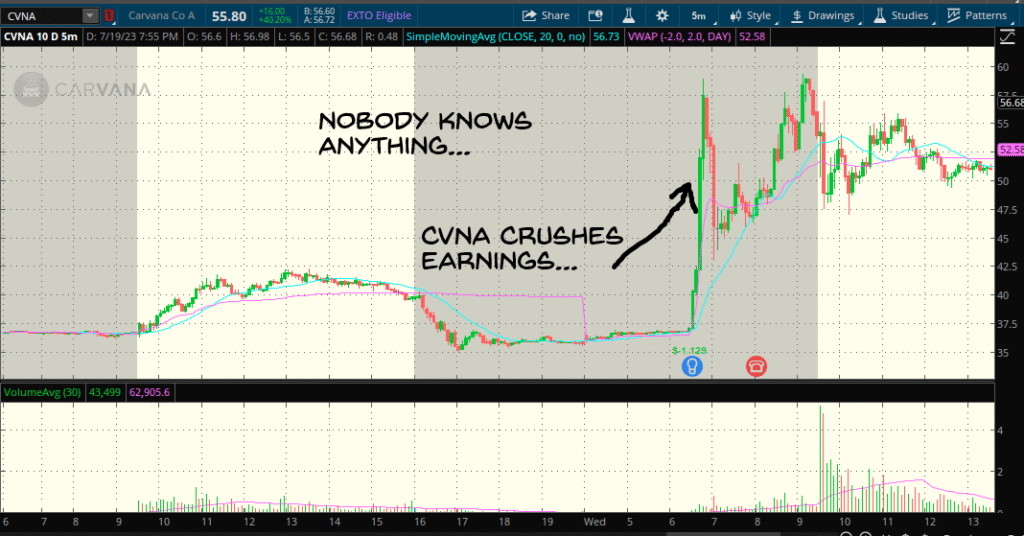

All the night time feedings, all the midnight colic-induced crying from the little one has messed up my circadian rhythm. I don’t wake up in time for the morning earnings announcement. It’s already spiked over $50.9CVNA is now a $400 stock–imagine telling people that at this time

I cover and lose $22,000. I start laughing.

Jesus I’m such an idiot. Of course that wouldn’t work.

Honestly, I thought I’d feel worse. That was just the last bit of stupid that needed to be debugged from my trader.exe so it could finally operate correctly. I felt hopeful the worst was behind me.

I ended up trading on and off for the rest of the year, clinging to one modest goal: just break even. By October, I was back to zero. By the end of the year, I’d scratched out a small profit. It wasn’t about the money, not really. I needed to be able to say I’ve never had a losing year. That streak meant something to me and still does.

If you asked me to name a single winning trade from those months, I couldn’t without looking it up. None of it felt like winning. And the negativity never really left. Every day was a grind—not just against the market, but against myself. I had to fight to keep the emotions contained, to put them in a box just long enough to get through the trade. Some days, that box barely held together.

So here’s where I am now with trading:

- Not doing it full time. I have spells of absence, then I come back and trade until the itch is scratched.

- I’ve accepted that my best days might be behind me. As long as I maintain some minimum baseline of profitability, I’m okay. It’s important to still keep my CPT card.

- There’s definitely this feeling I could do a lot better if I tried. I just accept that feeling and put it in a box. Could change later, don’t know.

- I don’t care about making the most money possible and being elite master trader anymore. There’s a price to pay to get to that level10even then, it’s not guaranteed and it’s too costly for me. I used to think greatness/excellence/winning was the number one thing, now I don’t and I refuse to feel any shame about it. It’s just a job now and that’s okay.

- I don’t want to know anyone else’s PnL, ever.

- I want to be far less online. Don’t want to tweet, don’t want to engage with FinTwit, don’t want to spend all day in a trading discord. It’s an occasional informational neccesity, at best.

- I like being happy. Or not being unhappy. So if I feel anger, FOMO, anxiety, tilt, any of that… I know I can always step away before it builds up too much. I never want to repeat 2023 again.

- I never trade Chinese scam stocks. I’d rather gouge my eyes out.

I made some assumptions in my previous reply. Sorry about that.

I feel that you are in the right mindset after reading the list in the end.

Nobody knows the meaning of life. You do what you like to do. If what you like is unattainable it’s a sad and bitter existence.

Fortunately it doesn’t look like you belong in that group.

Live happy (and write more if you enjoy it)!

Beauty of blogging…throw it out to the internet, dgaf what happens next…bc it’s out of your control.

The personal public accountability journal.

Hey Pete,

Sorry for out of context question. And ofc if you don’t mind sharing.

But how do you prompt AI to make for you pictures like that? I think is really cool format and I’d like to make some for my personal use xD.