Hi readers. Let’s talk about my 2025 trading year for a moment. I set a very modest goal1unlike most traders who constantly want to make more, this goal represents a fraction of what I made in 2024 to start the year and I hit that goal in early July. Now I find myself feeling a strong need to slow down. My inner voice says “Pete, you’re too into this right now and I don’t like it.”

Here are some random tidbits about my trading year. During this year, I have taken over 50 days off–days where I just don’t hit any buttons at all.2This isn’t to suggest that I’ve re-invented myself into some ultra patient sniper trader. I just do what I feel like and sometimes I might trade 1 mil shares with 250 executions in a day and sometimes entire months with no shares. I don’t have a subscription to a live scanner or live news feed. I don’t back test anything. I don’t log any of my trades. I barely prepare at all. I almost never trade pre-market or afterhours. Here’s my routine: I drop off my daughter at day care by 8:30. After that, I go to the gym for low intensity cardio and during that, I’ll look at stocks on my phone via free sites and social feeds. Once I’m back around 9:20, I drink my jumbo fruit smoothie-BTW this is the best part of my morning. If I feel like it, I trade. If I don’t, I don’t. Whatever happens, I try not to judge myself. Doesn’t work–I still do judge myself–but I try not to.

These facts are just a roundabout way to tell you that I’m not taking this seriously anymore. I refuse to, for the sake of my own well-being. I don’t know if things will ever return to normal like 2010-2022–when I put all my energy into trading every single day with the sole intent of making as much profit as possible. Tomorrow, I might just decide to pack it in and do something else for the rest of the year. Or I continue to show up, do something, make or lose some money. I don’t know. There is no plan.

For a long time, it’s been on my mind to write about 2023–the worst trading year of my career. Ever since that year ended, I felt I had re-evaluate all of my beliefs and I’m still processing what exactly happened. My purpose right now is to find some kind of closure so I can end this current chapter of my career–whether this is just one chapter in the middle or the last chapter, period. Writing about this turbulent year, I guess, is a part of that purpose.

On paper…

2023…

… ended as a small gain. I didn’t blow up. I didn’t go bankrupt. Nonetheless, it’s the starting point where things just kinda went to shit for me. I had a million stupid trades that year but for the purpose of this blog, I can narrow it down to just three that stand out. They represent peak-bad trading on my part. For the longest time, I wanted to bury any thoughts about those trades and about the entire year as a whole.

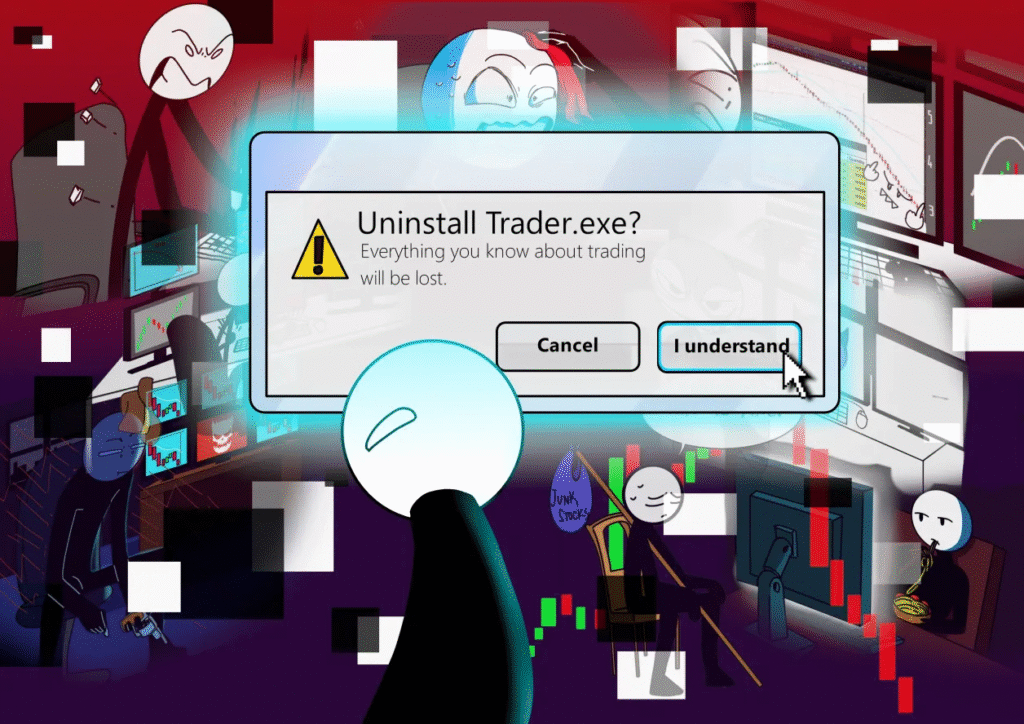

I used to tell some inner-circle friends of mine that 2023 had me wanting to end myself. That’s a bit of an over-dramatization because deep down, I think I know I have it too good to truly feel that way. I don’t want to say stuff like that anymore, even as a a joke, because I don’t want to make light of something that serious.3if you feel that way, please contact 1-800-273-TALK. Money and markets are not worth your life A better way to describe it is that I wanted to uninstall certain parts of my programming. I wanted to uninstall trader.exe.

I wanted to get rid of that part of my brain that thinks about markets and habitually checks what the market is doing. I felt I was stuck in a repeat loop of all these negative thoughts rushing at me like an avalanche, no matter how many days away from trading I kept taking off. I couldn’t handle it anymore. Too painful.

Let’s just get on with it.

Trading Principles

I have a few trading principles I adhere to but I don’t write them all down like I’m Ray Dalio. I just know them when they become relevant. These principles are not based on some theoretical concept of expected value, they’re based on a decade-plus of self-discovery of one’s own trading identity. There are certain things I can do well and certain things I cannot do well. It would simply be too much of an uphill battle to try to improve upon things I don’t do well. Here are two principles:

1) Don’t swing trade on the short side

2) Don’t try to short a stock to zero

You can peruse my entire blog. There is not one trade I’ve ever dissected where I shorted something and I had to hold most of the position for longer than a few days to make the bulk of the money. There is not one trade I’ve ever dissected where I shorted something and held it to 0. This is because I just don’t do that. I have experimented with it, yes, but it never found a permanent spot in my playbook. I stick to mean reversion patterns on high fliers. Stock goes from $1 to $100–I short at $90 and cover $60 and after that, I move on and stop caring.

Here are the reasons why these principles exist:

- All kinds of stupid things can happen so just being aware of having a risky position on for an indefinite amount of time takes a lot up of mental bandwidth.

- You might have to check up on news and filings constantly.

- You have to endure more volatility.

- You’re going to have pay interest the longer you hold it.

- You get paranoid of unusual low liquidity trading outside of market hours.

- Stocks that can go to $0 tend to squeeze the most.

- You get too comfortable and start to lose awareness of the uncertainty you can open up by extending your timeframe. To be that convinced of $0 on anything will pull you into such a strong bias that you lose any price sensitivity4(you are now ignoring adverse selection and any price movement against you, you’re basically declaring it is 100% wrong)

- I honestly think it takes a sick mind to be a short-biased trader who embraces duration. When uninformed traders talk about how “shorting = unlimited losses”, it’s mostly boogeyman talk but that concept can actually become reality when you extend your timeframe too far without airtight guardrails.5and yes, I know you clowns, you can use puts but the premiums are always too high if your timing isn’t precise

When I go against these time-tested principles, it almost always ends in regret. Either the boring kind of regret because I simply wasted my time or the worse kind of regret where I lose a lot of money.

Let’s talk a time when I went against my own interests on this BBBY trade I made in early February 2023.

Bed, Bath, and Beyond (BBBY) — one of the worst trades of my career

BBBY. It’s a meme stock that’s had multiple major pumps across a couple years. This is usually where I describe the stock’s history–like in 2022 when what’s-his-name bought call options and the stock went up (percentage amount over time period that I have to research). I won’t be doing any of that. Fuck talking about meme stocks. Let me just give you a small aside about why Pete absolutely hates meme stocks and does not want to discuss it intellectually in any capacity.6nor will I ever watch that stupid movie

Small flashback of Pete trading meme stocks two years ago (2020)

Look. I don’t want the personalize the battle between bulls and bears. There are certain short sellers that use pejorative terms like “bagholder” or “retail fodder”. They want to signal that they are informed and others are not. Whatever. I never agreed with that approach. It’s all just numbers going up and down in the end. There’s no such thing as “deserves” in the stock market.

I know that, I do. But here’s the thing… while the 2020-2021 covid years reflected the best years of my trading career, I actually felt a massive amount of resentment during the time. At that time, there was such a high level of emotional intensity being spent that I could hardly “enjoy” the success. I exhausted myself and I’d string myself up on every small mistake. When that one certain stock went up and meme stocks became a thing, it made me very angry. Within my own internal thoughts, I started to become “one of those guys” who I swore I’d never be like. I held this perception that it was getting too easy for certain people who did absolutely nothing but blindly believe in bullshit. Meanwhile, I poured my heart, sweat, and tears into grinding every dollar. There was this inciting incident that hit too close to home: I traded this certain stock very poorly one day and had to take a break, so I went into my apartment’s commons lounge to just chill. I didn’t want to think about work or be near a computer. Then I got a barrage of texts from multiple family members and friends about that certain stock. Then a few minutes later, a couple giggling school girls walked in and sat across from me and amazingly, started to talk about this stock.7(I swear I’m not making this up) They heard about it on TiKTok, bought it that week, and had tripled their investment.

That set me off. It felt like the universe was mocking me in my own home. I must be the only idiot besides that hedge fund asshole to lose money in this thing. It’s one thing when it’s just online chatter, but now this certain stock had become such a mainstream cultural phenomenon that I was now being forced to tolerate its existence in real life. It made me feel ugly inside. I stormed back to my apartment and just went to town by indiscriminately chucking every small object in sight while screaming obscenities.8and in a super layered and hard-to-write-about way, I felt ashamed for being angry. why should I care if random people fluke their way into money? nonetheless, I did care… extremely so in that moment, and that awareness made me feel like a bad person

I had to move on because there were too many opportunities every day. I couldn’t afford to stay upset. So I buried that shit real deep. I didn’t resolve it, I buried it–there’s a difference. Looking back on it, I think these episodes destroyed any of the more positive beliefs I had about trading–that hard work pays off, that luck would even out in the long run, or that being profitable was a fair and proper demonstration of skill. What replaced them wasn’t a new philosophy but just a slow drift into nihilism.

Moving on…

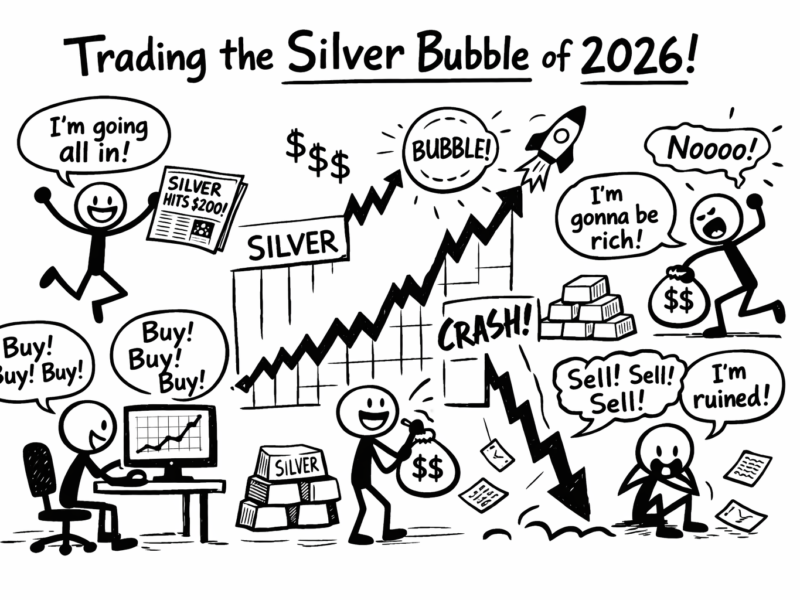

SO…. back to BBBY–anyone with a brain knows it’s likely to go to $0. But getting short for that $0 event is a matter of knowing how close it is, so as to minimize volatility, carrying cost, and stress9(unless you’re one of those quadrant-2 pain freaks who doesn’t care about those things). I don’t masquerade as a deep research guy, how would I know when bankruptcy would be? It could be weeks or months… and principles are principles.

EXCEPT… I happened to be in contact with a guy, let’s call him Ralph, who I had recently met at a brokerage sponsored trader’s meetup. And he specialized in precisely that kind of stuff–deep research to figure out when an insolvent company finally calls it quits. And moreover, I had a trusted contact at this particular brokerage who had confirmed to me that this dude, indeed, was a huge fucking deal–like $30 million in a year kind of a deal. We chatted over prime rib and lamb chops that night and then exchanged contact info. Later on, I was in his Slack channel asking about his positions.

Ralph: you know, I believe the BBBY bankruptcy is practically imminent. Could be any moment now and I’ve been building a short position.

I asked him about his position size. Let’s just say it reflected a high level confidence. I now started to entertain the idea of just slapping on a few thousand shares. Guess principles are not always principles, they’re more like guidelines. I believe the stock was trading in the mid $2 range at this point.

So it’s February 2nd… Thursday. I see the stock has popped to $4 pre-market.

My day trading eye had identified this pre-market spike as an opportunity to just short 10,000 shares in the high 3’s and see what happens. BBBY fades a bit off the highs and closes in the low $3’s. I don’t have to hold it for bankruptcy, I could take the quick gain too. But I don’t. I feel comfortable holding it just to see what happens. Maybe I can lucky.

Next day, Friday. Another spike pre-market. Hmm… a little uncomfortable to see all my PnL disappear, however briefly, and I’m kinda straddling the line between being a day trader and position trader on this particular name. You know what I had a bad habit of, back then 2 years ago? I *sometimes* add when I’m uncomfortable and feel threatened by an adverse move. It’s like to an aggressive coping mechanism to re-assure myself. Feel a little pressure? Take matters back in your own hands and feel in control, damn it.

Pete this is actually a good thing the stock went against you a bit. More size to add for you before the real reckoning. Ralph thinks the bankruptcy is any moment now. Taking the quick gain would have been pikering. You actually didn’t have enough size the first go-around and this is your chance to rectify that. Stand for something real damnit.

So there I go, adding to 16,000 shares. Nothing crazy yet. Now I’ve unwittingly talked myself into more duration for this play and lowered my price average.

The following Monday, I had some day trades that went sour early on. I zero’d out my day trades and decided to go downstairs to play pool. I had enough of looking at stocks. Meanwhile, I told myself to be a proper position trader and ignore the micro price action on BBBY so it just sat on my books with me fully expecting a 90% gain within the month.

Around 1pm, I check my phone and I’m surprised to see it broke last week’s highs above $4.

Wow it’s giving me an even better price to short. Guess I’ll really load up.

I’m not even at my computer. I’m not really thinking. I’m still angry about a lot of things. I impulsively double my position to 32,000 shares. This $4 breakout isn’t real.

Within 20 minutes, it trades near $5. Oops. My inner monologue continues to posture strength.

Even if I’m down $100k, I’ll just wait it out. The last few years have been good, I can add some ammo and outlast this. You cannot get squeezed out like a chump. Absolutely zero reason for this to be going up right now. Let’s just keep adding.

I hit a few balls around and tell myself to stop checking this position. It’s a position trade, not a day trade, so I had to be true to the plan and hold it until bankruptcy is announced.

Sometime later, I’m at 50,000 shares now. I don’t know what the fuck I’m doing.

Close to 3pm and BBBY breaks over $5. I’m alternating between practicing pool while pretending that absolutely nothing is going on and checking my phone in a state of panic.

There’s a part of me that was a quiet voice from a couple days ago but it’s speaking louder now. It’s the part of me that remembers why I have principles.

Pete, this isn’t what you do. Why are we doing this? What are you trying to prove?

I’m staring at the phone. BBBY starts to speed up over $6. I’m down close to $100,000 now. I have no real exit plan, I just assume I’m going to get bailed out by staying in long enough. Regret sinks in. The voice gets louder.

You’re such a pretender. You are not some high conviction trader who runs a hedge fund. You’re just some pussy day trader who can’t take any pain. Why did you put yourself in this situation?

That’s the turn—from the lie you delude yourself into to the truth you can’t outrun.

I’m now at max pain, max shame, and max regret. I deserve it. There’s only one thing that happens once I’m at that point. It was always going to happen. It happened since before the day I was born.

You just cannot overwrite or deny your own programming.

Flat.

I lock in a $120,000 loss.

I fling my phone away and I desperately try to pretend none of that just happened. If I have to process that ridiculous calamity of a trade that should have NEVER HAPPENED, I’m going to want to uninstall. The cope starts to begin.

Maybe it will go to $10 tomorrow and I have a chance to make some of it back by hitting a day 2 extension blow-off. I’m usually not the guy who covers the dead top.

I check my phone again around 5pm.

I don’t open my platform for the rest of the month.

Time heals all wounds?

First day of March. BBBY now trades at $1.39.10on April 23rd, it finally did go bankrupt. just posting this for posterity It hurts but you gotta get over it, right?

I decide I feel OK and boot up the ol’ trading platform.

First thing I see is that I’m down $20,000… because I am long 10,000 shares of BBBY from mid 3’s. Apparently I forgot to cancel some bid-to-cover orders I had placed on BBBY after I had flattened out and they got hit at the afterhours low after the ATM announcement. What a nice surprise.

I market out. I go to broker support and send a message.

Turn off data and software. Don’t turn it back on until I say so.

Feel your pain. I see stocks trade crazy like this every day now , and for sure there are 1000 stories just like this one,

Timing

Is

Everything

I once said – turn off shorting for me. They said – We cant, but we can convert your account to Cash and you wont be able to short.

I still short from time to time, like OPEN the other day, but only on Day4-5. Never D1 gaps anymore.

In the 2010s I was 99% short. Since 2021 I’ve been probably 95-98% long.

After seeing people losing millions on VAPE VWAV I am so glad I stay away from random shorts.

Jesus Pete, way to leave us on a cliffhanger. One of the reasons I gravitate so much towards ur blog is you seem to capture moments few discuss. I have found myself in that situation where I come back to the platform and low and behold some limit or stop order went through putting me in additional pain.

I also got short the 2021 market after seeing everyone make money hand over first out of frustration and ate it.

Whenever I see the email notification that you’ve written a new post, I pour a glass of wine and genuinely look forward to the next 20 minutes of my evening. It’s a pleasure reading your reminiscences.

I second this

Sometimes I boot up 2k, pop open a bottle of wine, take my clothes off and just shoot around with LeBron for hours type tweet

How much of this is due to all the stress related to having a baby? Unless you have some form of support (read: parents), it can be a very tiring experience. Note that I’m not belittling your obvious happiness – it’s just an observation I have about new parents, especially the first time around. Don’t uninstall Writer.exe (yet)!

Your comics/writing is so good I struggle to find the words. As a trader of 10 years, I find you perfectly nail the experience with creative humor. I’ve read almost every post. Your work is seriously good. Aside from that, I strongly appreciate you revealing the truth about MBC securities too. Best wishes.