If you missed the first mailbag, it’s here. These are real questions from real traders, fielded from my e-mail, twitter account, or comment section. If you have any questions, just ask away. Let’s get started.

1. How’s your trading going in 2024?

Eh. I think it’s time for me to take a hiatus from active trading1I am still managing my long-term portfolio with a couple key swing positions but no day trading until further notice. I find myself directionless and without any love or passion for the game. I often feel riddled with anxiety and all kinds of fucked up thoughts swirling in my head. I thought I could fight through it but I’ve reached my breaking point.

For much of 2023, trading was just a part-time gig for me. I focused most of my time on taking care of my newborn and my recovering wife. Whatever spare time I had was then spent on writing. It felt liberating to just say “I don’t want to trade today because I don’t feel like it”. I traded about 50% of all trading days in 2023 (many of those days were just one trade and done by 10am type days too)–by far the lowest number of trading days in any year I’ve had.

Then in December, I started ramping it up a bit and all of a sudden found myself back into full-time trading, perhaps for the wrong reasons. My kid was going to start daycare and my wife’s maternity leave had ended. So that left me at home thinking I had to occupy myself and be the breadwinner again. I didn’t want to just watch TV and eat junk food and feel guilty like I had during the early parts of 2023 when I took a long break from trading. So I forced myself to trade every day. At first it seemed ok and I ended 2023 on a positive note by getting green on the year. I thought I could carry that momentum into 2024 and just hope for the best. I didn’t even review the year or review my worst losses like I usually do. I didn’t set any goals. I had this nagging feeling that I hadn’t really committed to making some much-needed changes, I just wanted to turn the page immediately and not think about it.

In addition to all that, I picked up some good vibes from all the people who had reached out to me while I was writing Prop Trader Series–rookie traders, marginal traders, consistently profitable traders, and even some masters of the game–all to say that they’ve been where I have been, felt what I felt, did the dumb shit I did, and saw parts of their lives and careers reflected in my journey. I felt more connected to the trading community and that’s nice for someone like me who can often feel isolated and alone. I also felt humbled, like maybe my brain was finally in the right place to learn new things again. I thought these good vibes would help but they didn’t carry over into any meaningful action.

In January, I felt like I was repeating how I started the previous year. Volatile results. Tons of negative emotions. My mind just feeling it’s now 100% consumed by trading and unable to find any balance. Doing the same shit I vowed not to do, like a crazy person who cannot listen to himself. Feeling super-conflicted about my stock selection and strategies, torn between having made money in the past on certain risky plays and wanting to move away from these methods so as to evolve towards a more Platonic trader ideal. Constantly questioning why I’m even at the screen. Completely bereft of any creativity and unable to write. January actually finished OK PnL-wise but PnL can mask a lot of underlying issues. I remember this thought echo-ing in my head… “this (the money) isn’t even worth it.” It’s not worth how terrible I feel every day, primarily a result of how I treat myself. That harsh inner-critic that many of you picked up from reading Prop Trader Series, is very much a real part of me. Spending too much time in that state often has me drifting into full-blown nihilism mindset where I just start lighting money on fire. That’s exactly what happened last year–a January where decent results masked poor process and then in February, the rent finally came due. I don’t want to go down that path again.

Anyway, I’ve decided enough is enough. It’s time to push myself to an uncomfortable brink. Either I re-invent myself as a trader and resolve some long-term issues or I move on entirely from trading. It doesn’t make sense to keep doing something that makes me fundamentally unhappy. I question if I even have the juice to do it at this point in my life. It might be the hardest thing I’ve ever tasked myself with at a time when my mind isn’t exactly confident it can take on a great challenge. I can’t just keep doing the same thing over and over and end the day wanting to to bash my brains in.

I don’t know what will happen, I’m not here to swear to you that I’m going to come out of this as a better trader than ever. It’s possible you just won’t hear from me in a year because I’ve moved on with my life. I took a day off to write all2then I got sick before final edit so this took far longer than it should have this and honestly, I already feel great. I feel relieved. I went for a walk and ate a pizza and I actually savored the taste rather than just scarfing it all down to fill some bottomless void. Music feels like a rich sensory experience rather than just injected stimuli neccesary to jolt my lifeless husk of a self at 9am. I feel like a brand new person when I am able to just completely let go of the market.

That’s my 2024 so far, hope yours is faring a lot better and that you’re richer than your wildest imagination. I still have a lot of self-work to do, either trying to fix whatever is broken to trade again or doing soul-searching to figure out what’s next.

2. Does tape reading still work?

One of the themes I tried to touch upon in Prop Trader Series was MBC’s attempted internal re-focus from tape scalping towards intraday position trading. We tried to focus on multiple contexts–earnings breakouts, junk stock parabolic corrections, tech stock catalysts, distressed situations, and other unique stories. Essentially, you let the story of the stock play out for a bigger move, as long as the price action is on your side. Of course, many of us struggled with that initially because we got caught up in trying to compete with the algo’s on the tape. But with experience and increased confidence, you learn to properly weigh these intangible factors rather than being super-reactive all the time.

I once asked Victor, what was it like trading in 2008? This was, at the time, MBC’s best year as documented in Two Good Positions and tape reading was a huge part of it. His response was something like: “You didn’t need any ideas to start a day. You just find a financial with a lot of volume, play momentum, be in the money right away, get out when it slows. The better traders would even flip position.” You just follow the flow. It’s ultra short-term reward-focused, which requires less analytical thinking and less patience.

My opinion on the current state of tape reading NYSE/NSDQ in 2024? It’s an indicator, not a strategy. SOES-era 1990s trading and 2008 Great Financial Crisis, the tape could be the strategy by itself. FNMA in 2013-2014, that tape was the strategy. Now it’s just an indicator and one of many pieces of the puzzle. Good tape reading will give you better micro timing and better entry/exit prices. It won’t make you millions of dollars.

3. How much do you think a trader like Jimmy was compromised by focusing exclusively on micro price action and ignoring news?

It wasn’t just the fact that he only traded micro price action and ignored any context (although it’s more apt to say he’d pick and choose when we’d weigh context into equation, depending on his need to trade his PnL). To get really over the hump as a trader and print in good markets and bad, you need to treat everything seriously. Pattern recognition is just one aspect of trading. You have study little things like exit strategy, how you analyze price, how you place orders, what plays aren’t following through and why, bigger picture market structure and how it changes, and so much more. You need to have your best setups on mental lockdown–know it like the back of your hand what to expect and how to execute. I think Jimmy had just enough skill to print during a good market or during the SOES era but not during average markets and unfortunately, he started right after the 2008-09 bear market ended. He was too streaky and that ultimately kept him stuck in that “marginal trader” stage.

4. Did anyone of you go to work on the trading desks of the big Wall Street names?

I remember a couple guys from my day–one went to Point72 Ventures and another went to Bridgewater. They were two desk favorites known for their hard work and then featured in Victor’s book. They left MBC before their 3rd year. Maybe they could have been good traders if they had stuck around long enough.

Two top traders from 08-era MBC opened their own hedge funds. Tuco and Rowboat started Green Ivory Fund in 2013.

Two guys who interned during my first and second year (but never became MBC trainees) started and sold off lucrative crypto trading businesses–one started an options market making firm and another started an options analytics hub. Prior to their crypto businesses, they both had Chicago prop backgrounds at Akuna and DRW. Neither of them knew one another until meeting up 10 years later.

5. How do I get on a prop desk?

This is the most common question I get–how do I trade at MBC or some other equities firm?3Most people are asking for a fully-backed position, the easiest way to get a seat is to simply put up money at a broker-deal firm I hate to be the bearer of bad news, but you should understand that the “keyboard equities trading” subset of prop trading has shrank substantially in the past 15 years. There aren’t nearly as many seats as there used to be. If you don’t fall into 2 distinct categories–young talent and veteran talent–you have a slim chance of getting through the door.

Young talent: College graduate who has already been trading for 3-4 years. Ten years ago, this wasn’t as common so I was shoe-in candidate. Then day trading found its way into the mainstream with the Covid-market boom, crypto, meme stocks, Robin Hood and the rise of zero-commission trading, the rise of smart phone trading, Dave Portnoy, Wolf of Wall Street, discord groups, and many other factors. Now there’s a 1000 guys like me every year. There’s going to be an 22 year old prodigy who has studied markets since age 15, has made $100k already and he’s going to be taking one of the very few available seats left.

Veteran talent: Proven trader with at least a ten year track record and also trading serious size to move the needle for a prop firm’s PnL. Most of these guys are already at a prop firm or they don’t need one.

So yeah, it will be difficult for you.

Let’s say you’re a 28 year old engineer with 4 years of trading experience and you have inconsistently profitable results. You’re the textbook marginal trader who doesn’t fall into either the young or veteran talent bucket. The best way to make yourself desirable is to have other skills–if you’re a big asset in coding or data tracking, try to leverage that a bit. Be willing to help the senior traders with your skills. The best of the best quants don’t go to the keyboard equities subset of prop, they go to Jane Street or Goldman Sachs. So the old school firms like MBC are always in need of quants. The second best way is to just know someone deeply embedded in prop who can vouch for you somehow. They need to be able to comfortably look the hiring manager in the eye and say “this guy is the hardest worker I know“.

If you think you fit into one of the two ideal molds but maybe on the fringe, then being likeable goes a long way. This is more a life principle than anything else–if people like you, they want you on their team. If you’re an asshole, you better make a lot of money or they won’t take you. If you’re a weirdo who everyone is unsure about, they may take the likeable guy over you. Read Two Great Positions and you’ll see that Victor and Avery hire guys who fit the culture and are fun to shoot the shit with about markets and sports. Being on a trading desk is supposed to be a fun experience compared to trading at home.

Keep in mind, this is now the post-covid working environment. Many of the top traders have gone fully remote and you won’t be able to sit right next to them to learn all their tricks like a sponge. One trader relayed to me his experience in coming back to work at WTG’s Austin desk sometime in 2021: “Many of the top guys stayed home. It was wild man people were in the office testing positive for COVID and not giving a shit. The 20 something’s we all just called them [head trader]’s minions. I felt like there were toddlers running around. Everyone paid for different chat services to call out their pumps. There were guys in there in 250k holes (drawdown) who hadn’t been fired just chucking shares at anything.” Needless to say, he left shortly after that. It might not be the experience you dreamed about.

You have to ask yourself: Is it really worth it? Do I highly value a team environment? Do I highly value direct mentorship and do I know the trader who will mentor me is the guy who’s the right fit? Do I like being next to traders and vibing with them? Do I care more about development, support, and buying power than I do about profit split? If you want to be a great trader, work on trading. If you want to surround yourself with good people, be very social online and find the authentic traders who can make money and openly share their trades (they are out there). You don’t have to do prop.

One quick story I will share: many years ago, a guy contacted me online to pick my brain on the in’s and out’s of prop trading. This guy later applied for Trillium4for those who don’t know, Trillium is the successor firm of Datek/Heartland Securities, the original #1 SOES firm, having meticulously researched every available detail about them online. He compiled this information into a PowerPoint presentation and had a prepared script to explain why he was the perfect candidate. He blew away the hiring manager to such an extent that the manager made sure he would sit next to the firm’s top trader for mentorship. If you really want to be at the top prop firms, you’re going to have to go the extra mile in your own way. Don’t tell me why you should get a seat, show me.

6. Given that MBC is not your typical 6 fig sales and trading job you get out of college, can you speak to what sort of reputation you think MBC has on the street? Did you ever meet people who work in sales and trading at a big bank for example and you tell/told them you’re a prop trader?

I honestly don’t even know if Wall Street has any awareness of keyboard equities prop in 2023. Back in 2010 the subsector was much bigger. Now I don’t think anyone cares anymore. There aren’t that many reputable firms left out there and most of them don’t really advertise their presence–MBC being the major exception to the rule. If you spoke to some TradFi suit and told them you’re a prop trader and to guess which firm, they might go through all the quant firms, banks, and multi-strat hedge funds (Jane, FNYS, Millenium, Schonfeld) before they just stop guessing entirely. Day trading is still seen as mostly a retail thing–picture a guy at home in his underwear, chit-chatting on the internet about the best stocks to buy.

For the most part, I tell people I’m a trader when they ask because I’m uncomfortable being dodgy about it. But I don’t want to talk about it all that much because too often I run into these two common reactions, neither of which I enjoy:

A. Person has pre-conceived notion that day trading is a scam and is very skeptical and opinionated on efficient market theory

B. Person is absolutely 100% into market speculation and starts asking for hot stock tips

I have a canned response to both. To person A) “Yeah you’re right. Market can’t be beat in the long run, I 100% agree.”5Younger Pete would argue passionately against Person A to prove his point and get super loud/fired up about itTo Person B) “I’m a bad trader, you don’t want to listen to a bum like me.”

7. What was the rough success/dropout rate of trainees at MBC when you were there?

1 out of 10 in any training class would go onto become a CPT at the firm. Maybe 25-33% of the class would linger for years as marginal traders who could make a small amount of money but would struggle if they pushed harder. If they don’t breakthrough after a couple years at that stage, they move on from the desk and would maybe pick up trading on their own in the future, hopefully become a retail CPT. The rest don’t even make it past a year to become Junior Trader6at MBC, it’s trainee(0-11 months), Junior Trader(1-5 years), Senior Trader (5+)–this denotes time at the firm, not money made.. There would be a few traders who fit into unusual categories, they weren’t CPTs but would fluke their way into a windfall during some unusual volatility-driven event. I remember being told one rookie trader made $1 million during 2015 volatility and never did anything noteworthy after that.

8. How do you feel about how trading is portrayed in the media?

This is a good time for me to share my takes on all trading-related cultural media. For one, I still do not think there has been a compelling and accurate portrayal of the modern trading experience in our media. I think Trading Places was a fun movie about the old way of trading in the pits but since then, almost all of the quality stuff has been about the institutional hedge funds–which is often a master-of-the-universe type in his office, sitting in his boss chair either rigging the machine or making godlike calls to beat the market. This was perfected in Wall Street and then re-mixed in one way or another in Billions, Margin Call, and The Big Short. I don’t know if there can ever be compelling media about a prop firm of traders or one guy trading in his own home. Where would the drama come from? It would have to be a super niche comedy, maybe a cheap web series at best.

Anyway, some takes.

Billions: Seasons 1-2: good schlock, mostly driven by Giamatti and Lewis performances, but still overrated and not worthy of prestige-TV label. Season 3 and on: Hot garbage. The further away the story deviated from standard hedge fund stuff, the worse it got. Everyone is a master of the universe type playing 3D chess and they will explain their every move and motivation to an underling with an exasperating pop-culture reference. I remember Bryan Connerty, one of the key US Attorney characters, asking another character “Did you ever watch the movie PI?” to which that character actually said oh yes, I totally did and know the exact point you’re trying to make. Come on, man. Pi made $3.2 million at the box office, nobody watched that shit. So hacky. 7I did actually watch Pi before Billions even filmed. I found the movie boring but you could chalk that up to watching the movie when I too young before my tastes matured.

Black Monday: Interesting concept but I checked out after about 5 episodes because It’s a comedy that didn’t make me laugh. I didn’t feel invested in the stock market plot either.

Wall Street: Still holds up as great after all these years. Let’s not talk about the sequel.

Margin Call: Excellent grounded and dialogue-driven movie. I just don’t know if the Sam Rogers character is actually rooted in reality–what did he want the bank to do exactly? Hold the bag? His altruistic motivations don’t feel real. Some great memes from this movie.

Overheard: I’m going to guess not a single one of you has seen this one. This is a Hong Kong movie about some cops who get a hot stock tip via police surveillance. It’s not exactly about trading, it’s more like a crime thriller that uses stock pump as a plot device. But it’s a fun movie and I’ll always remember the scene where the down-on-their-luck bucket shop losers are all cheering on the pumped stock.

Dumb Money: I’m never, ever watching this. I lived through it in real time, why do I need to see it again?

9. How do you feel about the topic of edge erosion lately? Should us traders be more careful of revealing information?

The last week or so, there has been a discourse in the small cap subsect of FinTwit about edge erosion.8I believe it started with some data-driven business offering traders the ability to backtest certain data and then some traders got all bitchy about it. And honestly, I find myself chuckling at all the people who are wringing their hands about it and begging others to not “leak so much edge”. I chuckle because I picture them reading a filing about some Junk Stock and observing that the chart shows the stock went up a lot and then all the way back down, so now they think they’ve discovered the last inefficient frontier in the entire market. I don’t mean to be overly dismissive because it can be a nuanced conversation because here’s a simple fact: stocks that go up a lot and then go back down have been a part of the market for over a hundred years. There are many ways to analyze it and many ways to trade it long and short. A lot of these methods are discussed out in the open by 7-figure (or more) Master Traders, if you look hard enough.

I remember someone on twitter citing the so-called “China liquidation plays” as an example of edge erosion. The point was basically this–“they were so good and easy to short all-in until everyone talked about them, then they became bad and blew up”. Zoom out and you will realize that these stocks are a super-niche play and they were always going to come and go, just like the 2009-2011 era OTC pump and dumps that also went down 90% in a day. They had their day and then they were gone. As a personal aside, I honestly do not care anymore to trade hyper-controlled stocks and try to figure out the manipulation. You don’t make a career out of that and one ZJYL event can end you. Trade too much of that stuff and your brain might just rot and start thinking everything is fake manipulation.

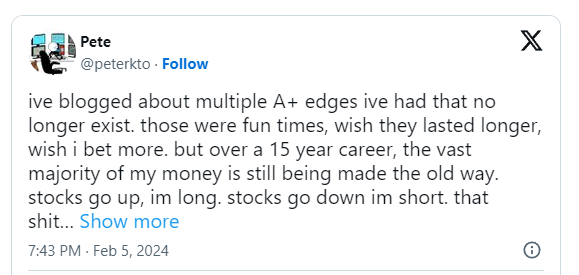

So that prompted me to tweet this:

Stocks move how they move and if you have understand basic principles to take advantage of human-driven phenomenons like trends, breakouts, range, and mean reversion, then you will be just fine. Some market cycles reward certain movements more than others. In good markets, you will crush. In dry markets, you will survive. That’s how it is and always will be. If you’re one of the lucky .001% to find something truly wild that should not last, then go ahead: bet big and stay silent. That’s just common sense.

10. Advice for quadrant 3 traders to maximise their strengths and minimise their weaknesses?

Ever watch Rounders? Remember the character Joey Knish? Q3 guys are basically the embodiment of Joey Knish. A real grinder’s grinder. Don’t roll up and take a shot for the big Vegas pipeline like a Mike McD (clearly a Q2 guy). Play within your means, don’t overextend yourself, and pay for rent, alimony, and child support. Put food on the table.

Anyway, my advice is kind of different depending on what stage of trader you’re at.

Rookie Trader: You have no idea what you even are yet, go explore a strategy and give yourself a year.

Marginal Trader: This is the hard one because you’re trying so hard to desperately make it and you feel like you’re close. Maybe you grind green 4/5 days but then you get carried away and wipe everything out in a day on tilt. Work on your psychology and double down on discipline and restraint. Create rules that keep yourself in check. In a completely difference case, maybe you grind with discipline but with inconsistent results because it seems like every play has questionable and random followthrough (similiar to our consolidation plays back in 2012). You have to be single minded and diligently take notes on your strategy, drill down on what works and what doesn’t. Focus on context and what moves stocks verus what is random or common.

CPT: This one is interesting. You’re already making a good living but you want to push your comfort zone a little bit and make that career-high, life-changing money don’t you? But you pike around too much, you weak-hand what should have been year-making winners, and you just check yourself way too much rather than letting it rip. I get it, I’ve been there.

I had the privledge to sit next to an extreme Q3 trader who didn’t want to take any pain at one point but later developed into an 8-figure trader a decade later. So I asked him directly:

Clockwork: “Make 1k/day for 5 years. Get 300-500k in bank savings (or whatever number has you feeling financially comfortable for 5 years). Then just go YOLO for a chance to be a millionaire. Take a leap of faith on your best trades to do it.”

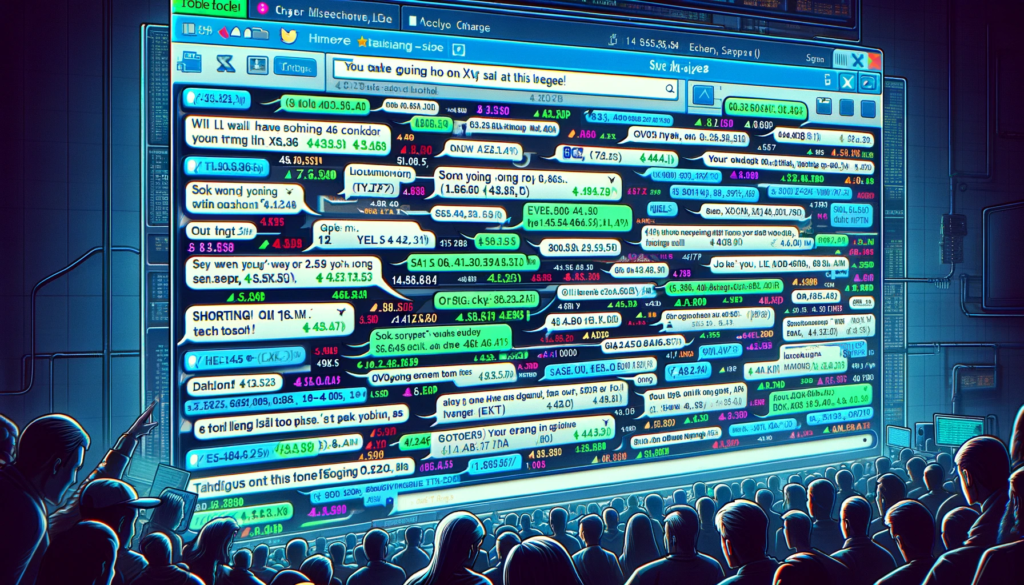

11. How do you feel about (whatever trading chatroom insert here)

I got a lot of questions about: what is up with this [insert paid chatroom here]? Is it legit? Is it helpful? I can’t answer them all because I don’t subscribe to every single one of them.

Paid chatrooms are kind of a charged topic to talk about in the current trading discourse. You either love them or you hate them. I’m going to try to keep this professional where anytime you ask me about a chatroom, I’m going to evaluate it purely as a trader product and try to remove emotion out of it.9this means assuming good faith from people running it

So one chatroom I was a part of from 2011 to 2015 was the Investors Underground chatroom. During this time, I learned a lot about OTC trading and how penny stocks moved. That alone made it worth the money and it’s what gave me the leg up on trading these stocks while I was at MBC. Here’s the caveat: nobody broke it down step-by-step the way I did talking about held bids in the Fannie Mae chapter. It was more like you’d observe several comments akin to “looking to play FNMA bounce“… and then the play unfolded and then soon after, everyone celebrated and called out where they would sell. So it was a lot of saying something without explaining all of it. Then when you’d ask more questions, you’d get responses like “if you see it, you see it, if you don’t see it, don’t trade it” This was annoying but I sort of understand where it comes from. Not everyone is a great communicator–some good traders see the pattern but they can’t break it down into nuts and bolts for the layman. And then I understand not wanting to feel responsible for a new trader getting himself stuck by saying anything too concrete like “just buy it when I buy it.” Nonetheless, this became a recurring pattern–you feel like you’d be onto something real but not enough to make it more systematic or repeatable.

I felt this especially more true when it came to learning how to trade NSDQ/NYSE stocks, where I couldn’t lean on the crutch of clean tape patterns the way I did on FNMA and the pot stocks. There were too many vague comments. Watch this level, watch that level. Well, what am I supposed to watch for? Lots of trader slang like “gearing, perking, stuffing” There’s a lot of chaos and sometimes you don’t know where certain traders are coming from. You cannot contextualize the one trade they’re making within a greater strategy. It’s all condensed into a short comment–“Short TSLA here at 190.” “Long NVDA there at 502.” Why is he choosing to trade this stock? Why at this level? One guy exits within seconds. Another guy exits and you wonder when he even posted his entry. Then another 5 random traders make their own 5 callouts, some even going long the stock at the level someone is short. It became its own skill to have to process all this information and turn it into actionable trading.

It was good for news alerts and good for more eyes on stocks at a time when real-time scanners weren’t as ubuiqtious as they are now. This is valuable for the CPT who knows how to make money already but most people aren’t CPTs, they can’t extract value from alerts yet. They need instruction and the instruction style of the room was just not my cup of tea. You’d get general concepts but it wasn’t dialed enough into details.

There were definitely good traders in the chat but you had to really dig into them via DM to pick their brain. Me being stubborn as a mule, I usually wanted to go my own way and not have to be all buddy-buddy with everyone to get all the answers. I didn’t want to feel like the 100th guy to ask the same question.

Sometimes you just don’t vibe with a room anymore and that’s okay. There were bad days–inevitable in trading, maybe I got stopped out a lot and overtraded and I’m red–and my mind is so strained by the very end of it. Then I’d peek at the chat at close and this is what I’d see:

Moderator: “Great job everybody! We banked today!”

20 different newbs: “OMG thank you! Made money today bc of your calls!”

It reminded me of my prop experience with the MBC blotter where I felt like shit to be negative when everyone else was green. That feeling of “everyone else made money today cept’ me huh?” That shit can make you jaded. Sometimes I’d find myself taking note of some newb taking a questionable side of a trade. Then when he posts his stop loss, I’d think to myself “HA, I knew that idiot didn’t know shit.” This was a complete waste of brain power and attention span.

Now, it couldn’t be true that *everyone* made money in a large room like that but obviously there’s a survivorship bias at play: people who struggled often deal with it quietly while the newbs who made $100 for the first time get excited and the people who run the business want to keep it positive–I get that. I just didn’t want that on my screen anymore unless I was getting tremendous value elsewhere, which I wasn’t once I had my OTC setups on lockdown. I’ll concede that this is mostly a “me”-problem, but even so, that’s my honest experience.

Anyway, that’s my review of a chatroom experience from almost a decade ago. I don’t know what it’s like to be in there now, maybe they changed a lot of things for the better (or worse). What you should take away from it isn’t whether I am endorsing or bashing this certain room, but how I am evaluating it. What am I getting out of it for myself? Is it this something I want as a part of my daily trading experience? Don’t get too bogged down into wasteful and gossipy conversations like how much does trader X in this chatroom make or lose. Transparency is important but that’s a can of worms I don’t want to get into yet. The next chatroom I subscribed to ended up having the complete opposite problems as IU did (but it was still also useful and worth the money)–maybe I’ll write about that another time.

I will add one last thing: in today’s trading environment with the thousands of telegrams and discord channels everywhere… if you are a hard-working, likeable and social person willing to add value and share information–you can work your way into private chatrooms with awesome traders without having to pay anything. It’s called having friends and it removes the problem of having to contextualize what & how every random stranger is trading and commenting on because you’ll have a better grasp of how your friends trade. I currently don’t pay for any chatrooms, I’m only in private channels with people who I vibe with.

12. How do you think trading has impacted your sense of empathy/sympathy? We deal with so much bullshit and so many head in hands moments, it makes it hard to listen to other peoples problems and extend a sense of sympathy, at least for me. Have you experienced the same thing and do you think that’s typical of most traders?

I think I go the other way… I don’t even give myself any slack for my own issues. Traders are just parasites. That’s all we are. We do not have real problems and everything is self-imposed. Whatever you’re upset about, mad about–just remember–it is always your fault and your fault alone.

I have to remind myself every single day. I do not have the worst problems in the world–not even close. People are out there at war, or they’re starving, or they’re unsafe in their environment. There’s all kind of horrible things happening to the silent and unseen masses.

Since the inception of this blog, I’ve occasionally had the urge just to let it all out in one long, incoherent “fuck the market and fuck me!” type of rant. I have had all kinds of dumb, trivial trading events that have triggered me into a near psychotic break–big losses, small win/losses where I feel I piked out right before a gigantic move, medium wins where I feel I didn’t size enough and I had the misfortune to be aware of someone who did, orders that missed me by fractional pennies, or just some jackass spouting nonsense on twitter getting too many likes. Just anything that set me off–I wanted to set it on fire. Further than that, I wanted to dispell any notion that trading was at all fulfilling like all the other content suggests that it is. It’s ThE mOsT cHaLlEnGiNg GaMe In ThE uNiVeRsE aNd YoU gEt To Be YoUr OwN bOsS–oh shut the fuck up, will you? Damn, there I go again–just thinking about it puts me in the mood.

Then I remind myself: who wants to read this? Okay it’s probably funny the first time. And there’s definitely a dark allurement to it–like watching a car wreck–if I was actually blowing up money left and right. But I am just a regular-ass consistent trader who’s up in his feelings. I have a good life. It’s unbecoming to lack gratitude when blessed with a good life. I neither want anyone to feel sorry for me nor do I want this type of content to represent me.

So if I’m up in my feelings, I write down all kinds of terrible shit in a draft… and then I erase it. Just flush it down. No “Fuck the Market, Fuck Everyone!” post today, although you can see it leak out here and there on some posts I am sure.

13. What do you think of Auction Market Theory?

I read Steidlmayer’s book a long time ago–he’s the guy who popularized Market Profile, which was a popular charting technique for futures traders from way back in the day and supposedly based off Auction Market Theory. I don’t remember a lot about it but I think it made sense. I don’t really apply it to my trading but I know people who do and have been successful.

Just understanding market structure through one particular analysis mode–whether it be AMT or Wyckoff or Dow Theory or market breadth–and sticking with it for a long time (I mean decades, although you can speed up the learning curve through historical charting) can be very powerful in shaping how your ability to see big picture moves unfold in real time.

Remember Paul Tudor Jones in the documentary Trader? It documented his fund being position short on the 1987 Black Monday crash, having forecasted the move via Elliot Wave Theory–a popular market cycle indicator invented by Robert Prechter. Prechter has since been exposed as nothing more than a hacky permabear and I don’t know a single trader successfully using Elliot Wave to make money. I highly doubt PTJ himself uses it anymore to guide his decision making. My point is this: the best traders see the big picture changes, and they do it by studying markets over time through whatever method it is that makes sense to them. The method itself doesn’t matter. They’re just good at trading, that’s the key.

14. What do you like to cook in the morning?

My current breakfast rotation, where I either make it at 8:45am if I’m not busy pre or 11am if I have time:

- Eggs over easy + Trader Joes frozen roasted potatoes (basically home fries) + adding cooked bacon/sausage (I like chorizo lately)

- Eggs over easy over a flour tortilla with salsa (basically a quick huevos rancheros)

- Egg scramble with peppers, onions, cheese, bacon bits and a lot of hot sauce

If lacking time: microwave a burrito or eat yogurt with some granola and fruit jam mixed in it.

15. Do you bet more on A+ setups compared to a B? Or your bets generally are equal?

I have always been more of a “bet bigger on A-setups” discretionary guy versus a “all bets equal” systems guy. I know solid traders exist on both sides of this debate but that’s just how we were taught to do it in the prop trading world. A trader might grind a stock for $5000 daily and then when the market has an insane move, he bets all his BP (an 8-figure amount) and puts his career on the line. That’s an extreme that I don’t support obviously but it can be done thoughtfully with measured risk controls.

To borrow an American football term, I refer to these bigger bets (when they work) as “chunk gains”. Most of the time you need to move the chains with your 3-5 yard runs and some quick passes (book a green week during a slow market), but sometimes you gotta be greedy and chuck it deep. Go get that big chunk gain in your PnL curve.

“No risk it, no biscuit.” — Bruce Arians, Super Bowl-winning head coach known for his vertical passing offenses

16. What’s the secret to not bleeding away profits for in a tough market cycle?

Having a deep playbook where you can make money in all markets. How to do that exactly probably requires a much longer answer than I’m prepared to give. The more niche your trading is, the more vulnerable you’ll be to tough cycles (maybe this is the edge erosion boogeyman coming for you, hard to say). If you lack structural market understanding e.g. being a sloppy trader who buys without great risk mgmt in bull cycles, you’ll also be extremely vulnerable to tough market cycles.

17. Do you trade any alt coins?

The vast, vast majority of my crypto profits have been in bitcoin. Like 90%. I am not the guy to talk to about altcoins or ICOs. I think I just trust things that last and have a lot of other people also trusting it. Another factor is I don’t think I have the mental bandwidth to be tracking so many positions on 24-7 crypto markets. Letting go and managing a position by only looking at a chart’s closing price is a skill I need to work on to have my swing trading game reach the next level. I definitely feel like I have missed some amazing opportunities over the last few years.

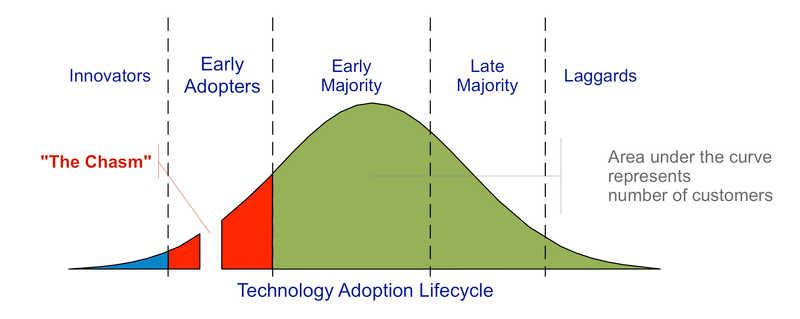

I look back at my start in crypto in 2013 and I can’t but think that in retrospect, I was so far ahead of most people in traditional finance with my start but I don’t think I really maximized it. It’s difficult (not impossible) to know that in real time though. I’m not even talking about futures prices because of course we can’t know that but I am talking about “the moment”–just knowing that you’re super early in something that will grow exponentially larger. If you can just sense it and believe… you can go a long way. This relates to the previous answer I had about bigger pictures cycles–the tech adoption cycle is its own thing to understand.

18. How do you deal with tilt?

You have to resolve what is causing it.

There’s always little hacks out there to help you out. Bet smaller. Wiring out money to reduce account size. Getting up for a cigarette break. Taking a deep breath. Ending your day at your PnL benchmark by noon rather than giving back any money. Watching funny youtube videos to have a laugh. Eating your way into a lunch coma with a greasy double cheeseburger. These are little easy hacks to temporarily reduce the pressure of the moment or to reduce your real-time anger and frustration but they aren’t permanent resolutions. If you are a person like me, trying to push yourself all the time and get the most out of yourself and take on the most intense situations, there will be periods where the little hacks just aren’t enough.

What is resolution? Let’s take a simple example through poker–if getting “unlucky” on the river tilts you, you have to resolve that in the long-run that by rewiring your thinking. You have to accept that bad luck and low probability scenarios will inevitably happen and they are part of the game. Then in the long run, the magic happens when nothing happens. The old trigger that causes you to snap happens and then BOOM… you don’t feel anything.

Do I know how to do this? To resolve and re-wire? No, not yet. I think previously, I had accepted the fact that I’m just a very flawed, tilty and emotional trader who just happens to be good enough to power through it most of the time. I had my little hacks to get it out of my system. I went through therapy sessions to reduce the impact of trading tilt on my overall well-being in life. But I never truly resolved the cause of it. I don’t even know if that’s possible but I think at some point, I gave up on even the idea that it could be achieved. I think that led to a mental backslide that I call trading nihilism–a state of mind where I just find myself unable to believe in anything other than make $ = good and lose $ = bad. And now I am where I am–I’m in a mental place where trading very actively makes me fundamentally unhappy. I have to question this core belief that “I can’t solve tilt” and maybe I can’t solve it right away but at least believing I can and trying is probably half the battle at least. We’ll see I guess.

Anyway, we can end it there. Thanks to all my readers! Again, feel free to send questions to churning.burning.blog@gmail.com and I’ll save them for the next one.

Lotta good stuff here (long read)

Been in the game since the SOES days, so I know

In case anyone has doubts, this shit has changed 2000% in the last 30 years. J H Krist, has it been that long ?

Stuff goes on daily that by rights, the SEC and the FEDS should be looking into , but clearly they are not interested. Maybe Citadel and friends are making so much money off it, they prefer it that way.

Hi Pete

Very nice blog, I have a few questions.

1. you mention a lot of pnl in the blogs, when I see salaries and bonuses of traders and PMs on like Glassdoor or Reddit those numbers are not that high and don’t seem to work for bigger firms. I feel a disconnect, can you explain if I’m missing something? I know not everyone makes money but it still doesn’t make sense.

2. Also Im a new graduate with a CS degree and im trying to get into either discretionary or quant trading. Can you give me an idea of compensation at different firms and capital allocation between shops? and from your knowledge do the big firms have the same structure of allocations and risk as the smaller firms?

Thanks

Hi Rahim,

1. I can’t give the most comprehensive answer but I’ll try. Every subset of trading has their own economy and different “standard” numbers… Day trader firms are on the low end of the totem pole and they move less nominal ($) amounts than all the others. In general, day traders get paid from their PnL in the market with minimal salary and bonus, if any. Banks, quant firms, and energy firms are moving a lot more money so they have higher upside at the highest level. However, the threshold for entry into those positions is significantly higher. It demands higher qualification and experience. You may not trade your own book for years. Also another factor: You can be a top level day trader in your own home but you can’t solo a prop desk position at Goldman Sachs.

2. I’d have to do much more research to give you an accurate answer here. My suggestion is that you follow your heart and do what you like, then let the chips fall. If thinking like a quant is what you do, apply to a quant firm. If you want to be in the market all the time and manually trade, do that.

Thanks Pete , I also had similar questions and Im also in the same boat. Can you do a post in the future about compensation and allocation from all aspect of trading algo and manual that would be really helpful. Given the years you spent in the industry Im sure you have seen different types and ranges of pnl. I am about to finish school and start the application process so your insight would be really helpful.

Mark Manson the tilt part…

“The desire for more positive experience is itself a negative experience. And, paradoxically, the acceptance of one’s negative experience is itself a positive experience.”

You are not your thoughts, you are not your emotions.

This should be printed out and stuck on a wall somewhere:

“the best traders see the big picture changes, and they do it by studying markets over time through whatever method it is that makes sense to them. The method itself doesn’t matter. They’re just good at trading, that’s the key.”