They gave us another announcement: there was going to be a grace period. Registered members of Y5 Capital were going to be able to trade unlicensed up until October. The compliance department was working furiously on creating cheat sheets, as there was not yet any public study material available. Traders 25 years removed from their last university class were panicking whether they still had the study skills and the memory to pass this test.

I don’t do tests well. I hate studying. Goddamnit.

That’s my assigned mentor. He’s in his late 20’s and he hadn’t been taking tests for years. He didn’t get into prop trading to take stupid tests.

(continued from Management)

It’s the middle of August. We were all going live at this point and told to study for the 57 in our off-hours. Everyone was given a mentor, a more senior trader who would show us the ropes for the next six months. Some were given mentors with roughly a year of experience, a freshly-minted Junior Trader. Some were lucky enough to have Tuco as a mentor. I was assigned to Jimmy.

Here are some things you have to do as a mentor:

- Approve the mentee’s pre-market trading game plan

- Check the completeness of their end of day review (every day a mentee had to crunch numbers, write a summary of how the morning gameplan worked out, grade their execution, and create a power point file on a new trade called “Setup of the Day”)

- Have one-on-one Q&A sessions afterhours about your own trading day and your own trading process

- Write a report to management about your mentee’s monthly progress

- Bump a mentee up/down in trading size, maximum loss limit, total capital traded, and when you could trade NSDQ stocks (the default rule for a trainee was usually NYSE-only for the first 3 months). All of this is according to a guideline.

Jimmy didn’t do any of that.

He’d show up late and leave as soon as the bell rung, unless a manager told him that he had to stick around. He did bump up my size as rapidly as he could, guideline be damned, so that was cool. This isn’t to say he never taught me anything, it was just a bit more informal. Look at what I do and copy it if you want–that method of teaching.

Victor wanted a certain firm culture–he sought after college kids committed to trading and professionalism and studious work habits and uh… I wouldn’t describe Jimmy as the best fit for all that. MBC had a standard business casual dress code: slacks and a collared shirt. Bit more casual than most workplace’s business casual in actuality because we weren’t the kind of firm to openly reprimand someone for dress code violations. Jimmy ignored it anyway. He would always sport his lucky Yankees cap and a black Tiesto t-shirt. Jimmy had a special relationship with Avery, so maybe that’s why he felt he could just do whatever he wanted. Avery looked after Jimmy and would constantly stop by to offer him sage advice. Remember Jimmy what we talked about: you have to trade stocks that move. This was said in the context of Jimmy taking too many range plays looking for tight stop loss limits. His close mentorship of Jimmy was the only friendly relationship of any kind that I saw Avery have with any Junior Trader. There’d be these times he’d tap Jimmy’s shoulder, smile warmly, say whatever he came to say, then accidentally make eye contact with me, only to avert it immediately and abruptly walk away. I didn’t take it personally because he was like this with everyone–aloof and seemingly living in his own world. He would only have genuine interactions with Jimmy, despite both of them being a very odd fit, and we often joked he was Avery’s illegitimate son. I once asked Jimmy if he could understand any of Avery’s thousands of price levels and trendlines and he said he didn’t pay attention to morning meetings. Go figure.

Jimmy had a good knack for the micro of trading. He often didn’t care to have any big picture ideas or pay attention to the bigger timeframe price levels. He wasn’t super technical with his charts, he just looked at the relative range of one candle compared to the previous and quickly eyeball what he wanted to see. He just needed the intraday chart and he’d drill down into the 5 minute and 1 minute. There would be crazy mornings where everyone was all worked up into a frenzy from macro headlines and broad-market volatility.

European Debt Crisis!!! Trade European companies or distressed financials and listen to EU news for market cues!

USA Debt Ceiling Crisis!!! USA credit downgraded by S&P! Trade financials or high-beta stocks only! Listen to Obama, Fed, and congressional news for market cues!

…and Jimmy just ignores all of that. He’s scanning through charts of companies that do not have anything to do with the bigger themes (or maybe they do, he wouldn’t even know), looking for his favorite patterns. He’ll cook his own recipe in his own damn way.

I remember the first setup he taught me. He would love to find consolidating stock charts with “tightened price action”. For example: stocks that initially traded with a 50c range the first hour, a 20c range the second hour, and had narrowed to a sub-ten cent range in the last 30 minutes. Ideally, it might even be a 1 cent range for the last 10 minutes. The stock had been slowing to a crawl, possibly at the edge of either the high of day or the low of day. Then it drop would out and start a very controlled, slow downtrend. It was easy to manage due to the lack of volatility. You would just keep moving your stop down as it trends. Here are a couple I saved:

Notice how it moves penny by penny? It just trickles down. On the level II, it’s just as friendly. There’s liquidity and it doesn’t spread out. Think of all the small cap bullshit you see that just trades into a volatility halt in seconds… this was the complete opposite of that.

Jimmy would find these setups, then I’d see it then I would pass it along to Clockwork on my immediate right. We gravitated towards these setups because they were safe. You never felt like you were chasing. You never felt you had to give it a ton of room and then sit through massive drawdown and whipsaw. You had a sense of control over the trade–maybe too high a sense of control than you actually had. The flip side was that you usually didn’t catch huge moves either. But these small moves would add up.

Also keep in mind–we had such ultra tight risk parameters to start off our careers. Our first month we couldn’t lose more than $200 or we’d get stopped out for the day. We could only trade 400 shares until our mentors bumped us up. Trading GOOG or AMZN where the spread could open up a point and you could be marked -$200 right away just on a 100 share lot? Off-limits until you’re a Junior Trader. Scouting for low-risk, low-volatility trading setups became a neccesity.

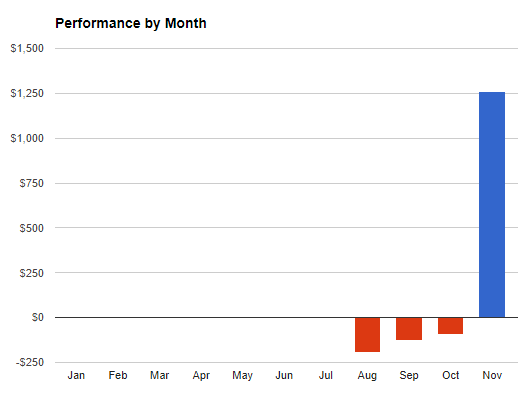

This type of trading set the tone for the next several months. We didn’t short nuclear small caps that shot up 500%. We didn’t trade a portfolio of high-beta $100+ stocks like FAANG. We didn’t find the biggest spike on breaking news and try to jump in on it. We found news flow stocks (usually gap up or down +/- 5%) with a reason to move, with a steady controlled tape, and found consolidation (or range) patterns to play continuation or reversal. We set super tight stops to lose as little as possible when these plays didn’t work out. Sometimes the algo’s would run the stop by a few pennies and then re-establish itself on the prior range, forcing us to get back in (and that’s super fucking annoying and will be addressed in later chapters). The vast majority (90%+) of our per-share gains and losses were between the .05-.50 margin. We did have to trade a lot of volume to make it work… and boy did that benefit Y5 Capital. But all-in-all, I had a good knack for these moves and I was the first of the summer ’11 training class to post a positive month in November. How much did I make?

$1200. It doesn’t seem very impressive just typing it out now, 12 years later. It wasn’t even that impressive then, because I had already doubled up a $25k IB account while trading in college–OTC-bandit Pete had made $1200 in a single trade many times. But this was different–now the “pro trader” Pete was making money on scalable, everyday-opportunity NYSE stocks. It wasn’t some gimmick that could be shut down by future regulation or market structural changes. I had this sense that maybe a year from now with hard work and diligent refinement, my intrady timing could be so good I didn’t have to take excessive risk to make significant money. Victor told me the next step was just to get bigger and go from 400 shares to eventually 4000 shares and eventually 40,000 shares. He encouraged me to keep pushing.

Things felt… promising.

(to be continued in Anxiety)

Excellent! Can’t wait for the next part. Thanks for sharing, Pete.

Loving the daily posts. Can’t wait for the next one.

MORE!

The new content is great! Excited for more stories.