I used my most cartoonishly low-pitch sarcastic voice, like a boat horn that talks. I hear a few chuckles. Good. I felt supported.

I was done with these dumb trainee meetings. Why do we still have these anyway? It’s 9:25am. My anxiety near the open was getting worse. The lactose from the milk in my coffee was hitting like a sharp stab to the gut. Lousy anti-dairy Asian genes. My hands felt wet and my heart would start racing. I just wanted to feel ready at the market open and I didn’t want to fuck it up. I don’t want to hear about someone’s 7 different “inflection points” (the most used phrase ever on Avery’s morning casts) on a 12 (?) minute chart of $MON. I need my own time to get ready and I’m stuck in this conference room. Plus I really needed to take a dump. Terrance is trying to give us some meandering pep talk and it felt insulting he thought he was in a position to give one. It was time to heckle him off the stage. He stutters but tries to continue like he didn’t hear me.

(shrill voice) NOOooOOOooooOBODy CaaaaaREs!!!!

(pause)

(folksy voice) HuRRY uP alReaDY!!

I didn’t want to seem angry so I tried to play absurd. I’m ready to dummy shout at him all day like a lone voice actor playing a dozen different cartoon characters but I don’t have to.

Ok we’ll just… end it here. Good luck everyone!

I saw a trainee give me a wry smile, trying to contain his laughter. I don’t think they expected that from me at all. I throw my hands up and make a face-what is with this guy, am I right? On my way out, I glare at Terrance and do the “tap rapidly on your watch” gesture. Then I sped over to the bathroom.

Trainee meeting didn’t last as long after that. They finally ended after November.

(continued from Mentor)

By the end of the summer I had finally had my own place. I would share a 1-bedroom with a Chinese couple out in Battery Park. I could now walk to work instead of taking a 45 minute train ride. There’s this fake wall in the living room that creates a big white box that I will sleep in. There’s an outgoing roommate with a pre-existing history with the couple–they all attended University of Michigan together–and she handed me a letter on the day she moved out. It wasn’t particularly specific, just a warning that the girlfriend was hard to get along with and also quite untidy… and that I should be “careful” when dealing with her. That’s not great but it also just seems like normal roommate stuff… but at the time I should’ve seen it as a big red flag. Because why would someone go out of their way to write a warning letter to a total stranger about an ex-roommate?

We had all passed the 57 by the deadline. It really wasn’t all that tough. Compliance did a good job compiling the improptu cheat sheets. Even Jimmy had passed by a hair length. I actually ended up learning interesting tidbits about short-selling regulations and trade-reporting processes. I’m just glad it’s over so I could concentrate 100% on trading. I didn’t have a TV nor was I addicted to my phone back then. My weekend routine would generally be going to a coffee shop with my laptop and reviewing the training materials, my own recorded trading videos, and going through my numbers. I didn’t have a social life outside of just hanging out with other traders after market hours.

Jimmy’s consolidation setups were working fine but the ‘good ones’ weren’t always available. I remember focusing a lot on trading the open–the most volatile and active period of the trading day. Trading the Open was a big deal in the MBC training program. If you couldn’t trade the open, it was like you weren’t even a real day trader. Look at you, you knuckledragging bum–drifting your mouse cursor to the buy button in your Fidelity account and using only your index fingers to punch in the price–that’s all your capable of because you’re too goddamn slow to trade the open. Pathetic. I didn’t want that to be me. I didn’t want to just trade Jimmy’s slow consolidation plays. Those opportunities weren’t frequent as I needed them to be. I wanted to catch the big opening moves too.

MBC didn’t have any black and white strategies you could just hit the auto-follow button. It was more like a sandbox to create your own setups based on combining a bunch of (mostly technical) abstract concepts. I continued to model my trading after what was working for other traders. There’s this one trader who’s achieved “Top Junior Trader” (MBC would have these monthly PnLwards posted on a bulletin board) the first 3 months I was there: Eagle. That’s not even a nickname, it’s literally his name. He’d been trading for a year and was now demonstrating remarkable consistency. Victor started to push him into the spotlight as one of MBC’s next great trading prospect by featuring him in all our afterhours tradecasts. Eagle recorded his opens for about 30 minutes, they’d play it on the projection, and he’d break down his trading executions. The first thing that stood out to me with Eagle was his processing speed. His ideas were coherent and well thought out but what seemed special was the way he would do multiple things instinctively in response to what he saw on the tape at key price levels, often while trading 2-3 names at a time. The second thing that stood out to me was his volume. This guy was actively trading up to 50,000 shares a day while trading 500 share lot sizes. Just trading all day relentlessly. He was giving up a lot in commissions but you could see the method in his madness when trading… he maintained a low volatility equity curve by stacking up $25-50-$100 gains on the open with tightly-controlled micro level trading.

Here’s a simple example: there would be buying pressure on a stock he’s trading, say, into a price level of $80. He’d wait for the buy pressure to just be on the verge of breaking through the level, when the last remaining size was about to cleared out. Then he would hit his sweep key (which is to buy through the top limit price plus one customized price interval, like an extra 9 cents, so you buy up to 80.09) a split second before price clearance, and then instantly the stock spreads out to 80.01×80.47, and he’d immediately offer (limit) out 1/2 his size on the offer for a per-share gain of +.47. Covered my risk! — he’d say this a lot, meaning the realized profit from the scalping lot would mitigate any potential reversal back to his stop on his remaining shares. Then he held the rest for further gains with a tight stop that he kept moving up. If the pattern repeated itself at a new level like $81, he’d repeat the same scalp trade even while still holding 1/2 the original buys at $80. It was like this hyper-optimized, ultra timing-sensitive style of trading that appealed to me given my propensity to risk small amounts. He made it look easy and I thought: if he could do it, why can’t I?

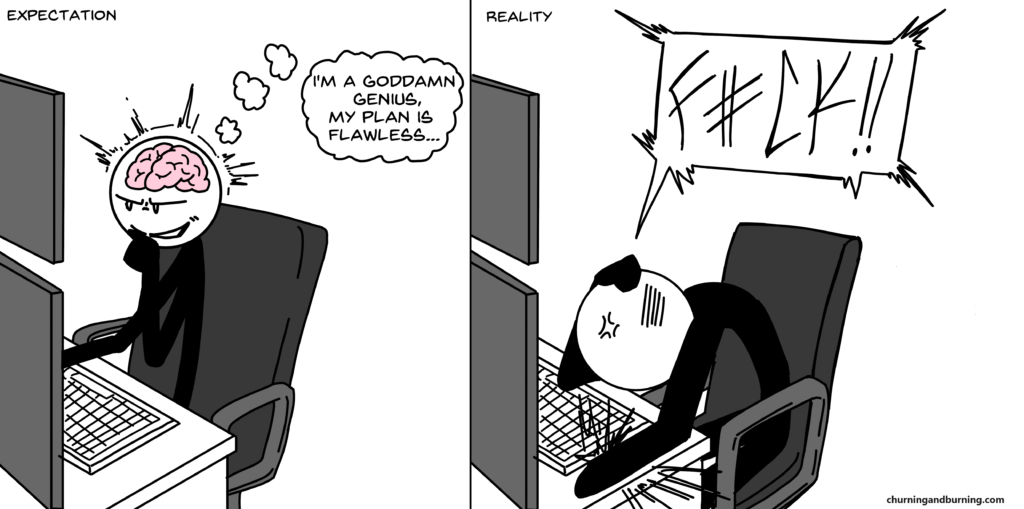

My impression of being a super trader making all the moves on the open was like a quarterback taking the snap and reading the defense. You’re just processing all the chaos until you see your opening and then you attack with either a 50 yard bomb or play it safe with a 5 yard checkdown. You take what’s given. You’d just be reading the entire market, get cues from huge institutional orders and technical indicators, and just know exactly when to get in to time the easiest momentum moves. I thought I would just be this calm and collected uber-trader at the open, processing everything with sound logic and experience. Then once the clock strikes noon, I’m just sipping on coffee and watching muPnL go up on your winners.

In reality, it wasn’t quite like that.

I didn’t have a real clue trading the open. I was all over the place.

There were times when I wanted to micro scalp and be flat so I didn’t have the stress of managing a position but I just took myself out of larger winners. Then there were times when I wanted to hold longer to catch the so-called “real move” and I should have just micro-scalped because the “real move” was fucking fake and I just gave back all my profits, GODDAMNIT. There were days where I had an idea on a particular stock that hadn’t played out and the desk was trading something else and catching the easiest move ever with zero drawdown. So then I’d switch to that stock, join in at the very top, it would reverse after everyone else sold, and then my own idea would play out without me, and now my blood is boiling and I’m squeezing all the white out of my knuckles and I want to scream bloody murder at whoever mentioned that stock. There were times where I’d take profit long and then try to be cute and flip short at a resistance level only to get run over and lose my initial profit and then some and that drove me absolutely nuts–WHY DID YOU DO THAT PETE? WHY? DUMBEST SHIT EVER, I’M GOING FOR A WALK, PEACE OUT EVERYONE. Inconsistency, inconsistency, inconsistency. And some self-loathing. My eyes are inches away from the screen trying to catch every single detail on the tape but I just get sucked into dumb bullshit trades and 50-50 decisions.

I was clicking buttons… to borrow a poker term. Clicking buttons describes a period of play where you’re just guessing with very little or zero foundational theory behind any of your decision making. Eh sure, I’ll call here, why not? (because I feel like it) Then he turns over the nuts. I don’t even know why I called. That’s me trading the open. Too often I felt like I couldn’t keep up. It was just beyond my grasp.

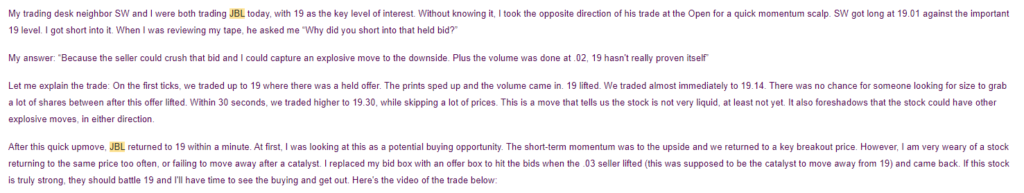

I found myself scared to lose money. It was difficult to commit to trades. I developed a severe overtrading habit, I didn’t want to take the proper risk on trades, and I had trouble holding positions for any significant duration. I’d want to know by the penny how a stock would go to where I thought it would go and when I saw any evidence to the contrary, like the buyer on my stock getting wiped out at a level, I’d just want to get out and re-evaluate. It got way too micro. It wasn’t as if I couldn’t read the tape and see buyers/sellers, it was just so easy to overthink everything when you’re scared of losing. Say there’s a buyer at $20. Buyer = get long right? Maybe, maybe not. What happens if $20 is holding forever but when buying pressure tries to find the next level, it creates several upside wicks that immediately come back to $20… that creates a potential bottleneck where $20 can drop out and it spreads out to 19.80 (or worse) immediately, so you take slippage. If you want to take it to the next level, what if you short $20 when it drops so you can catch the stop orders of all the trapped traders who all got long at $20 for a cute little scalp? So what’s the right move? It depends — psh it always fucking depends… does this all sound ridiculous? Well it’s a real trade. Here’s an internal e-mail where I summarized some random $100 trade I made because Victor needed more blog content:

These micro mind games and the hyper awareness of my surroundings constantly gave me anxiety and I spent a ton of my energy just not freaking the fuck out at prices hopping all over the place. Also there was another shitty feeling I had: Insecurity. Jimmy took this trade and I didn’t and now he’s up. Clockwork got the shares faster than I did and now I’m chasing 25 cents higher. Eagle is at the top of the leaderboard again and I’m nowhere to be found. The whole world must be making money off all these easy trades and I’m just fumbling the bag. Was it perception or reality? The desk didn’t have a good year at all in 2011. But it doesn’t matter, perception is reality when you get into your own head.

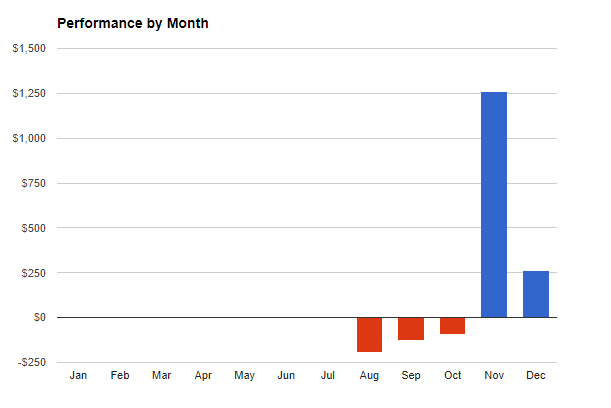

I ended December just barely positive, making a little over $250 after all fees. By the way, I took home 70%, after profit split, of that $250…oh yeah and there was platform and data exchange fees (levied at the ‘professional’ rate) too so it was probably more like 70% of $50. My overall win rate was below 40% because I took so many $5-20 losses on the open, paper cutting myself to death.

Nonetheless, I felt optimistic going into 2012. Everyone predicted the market to crash in 2012 and traders were excited about the potential of a Facebook IPO. Every weekend I put in more work and I felt like a breakthrough was just around the corner.

(to be continued in Low Morale)

I hope you continue this prop trading series. Very interesting/entertaining to read. Thank you

Great stuff!

– Bella Mikafiore

This is such a great read. The insecurity and hyperawareness really hit home, especially being a new trader who’s current engineering career is all about considering tons of variables and risk mitigation. It’s so easy to get paralyzed by all the ‘what-ifs’.

Can’t wait to read more.