I got settled in a bit and my dad had returned to California. I had found temporary refuge with a “cousin” of mine (her mom and my grandma had the same dad) out in Bushwick and she generously agreed to let me stay with her until August. In that same 2 bedroom apartment was her boyfriend, a roommate, the roommate’s girlfriend, and another cousin of mine, also staying as a guest, who had traveled out for a summer internship at a food publication. The two of us would share a pullout couch where the dog would often join in to sleep. It got hectic. I was spending a lot of my time on the “Roommates Wanted” page on Craigslist.

Continued from Part 3: Training Program

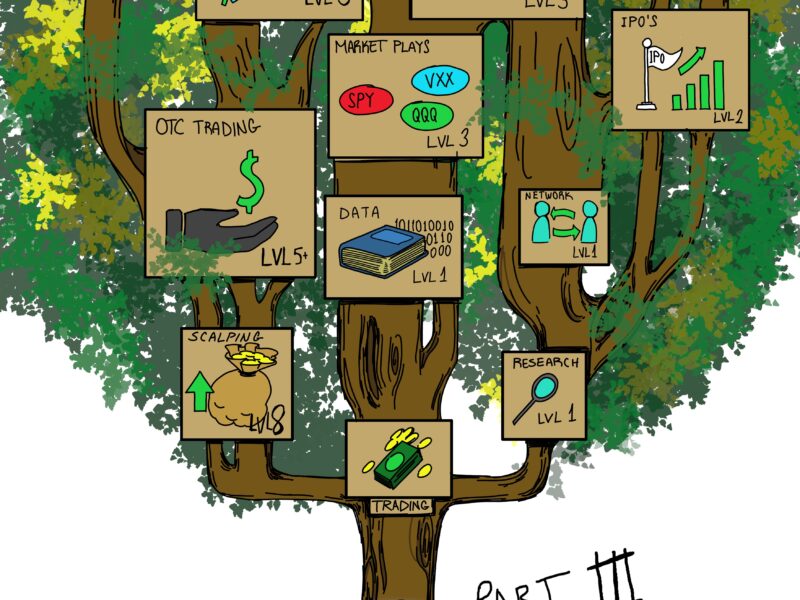

The training class ended after a month and we were about to go live. The next step of the process would be to register with our broker dealer, get assigned a desk spot, get assigned mentors who would review our work and show us the ropes, finetune my trading setup, and then I can finally start making some $–

–“EVERYONE GO TO THE MAIN ROOM.”

There’s a floor wide meeting being held by the principal owners of the umbrella broker dealer (who also double as a prop-trading firm and a trading education firm). Let’s call this firm… Y5 Capital. Y5 is telling everyone on the entire floor to meet in the main Y5 trading office, located on the nicer side where you can see the Statue of Liberty. The head of compliance steps on a chair and tells everyone there’s a new mandate: FINRA is requiring all members to take the newly issued Series 57 prop traders exam. No exceptions. So we’re going to have to cram for this completely new exam to get a “license” to trade and pass before we can start trading. I thought I was done with written exams for life but I guess not.

In the mean time, I had to sit through the trainee-only morning meetings. We would go into the conference room at 9am to discuss our morning ideas and price levels, even if we were still on demo. Guess who volunteered to run these meetings? Terrance. The dipshit had the most annoying way of stretching out the meeting as long as humanly possible. One of us would present an idea for a couple minutes or so and he would add another 5 minutes in questions and unsolicited commentary. We’d go off topic and he’d start talking about his fractions-based algo again. I had a little bit of anxiety before the 9:30 opening bell, I just wanted to be at my desk so I could self-focus and calm myself down from the morning jitters. And he’s just constantly stretching it way too close to the bell and adding zero value at all–he just parrots out what he thinks someone would say to sound legitimate. That’s an okay price level. That’s a good price level. That price level needs to be reviewed more. Huh??? Every meeting I’m thinking about how I should politely tell this guy to shut the fuck up.

Before I write about “going live”, let’s talk about what’s happening in the background. As I chatted with more people, I realized none of the young pro traders with fun nicknames from TGP were still there. In fact, there were no traders (excluding management) who’d been at MBC for greater than 2 years and the majority were under 1 year. I’d ask people who were part of the 2010 fall training class and the 2010 summer class–how many of you guys were still around? They’d say half or more had already dropped out. Even in my own short time there, it was common to just not see certain faces anymore. I’d ask some people: who were considered the good traders at this point? Tuco, the head trader and youngest managing partner, was the only one universally mentioned.

I met Tuco over the phone in one of my first interviews and I also read about his story in TGP: he was negative every month for his entire first year and wanted to quit but was convinced not to, then he eventually turned it around to become one of the top guys, arguably *the* top guy, of the entire firm. But you didn’t truly know the real him until you were on the trading desk. Tuco had a fiery Latin American temper–hate to be stereotypical but it fits too well, think Tuco Salamanca from Breaking Bad (thankfully, the victims of his anger were just inanimate objects). Low key, I loved that about him. His anger reflected his intensity and competitiveness. He fucking cared, maybe he borderline cared too much. Sometimes I think I’m an angry asshole who can’t stand losing and then I think about Tuco’s moments on the desk and I realize that nasty explosive anger is normal in prop trading. Traders just get uncontrollably mad, let it loose on their keyboard or their monitor or their phone or a trash bin– and then everyone would stare for a couple seconds, we’d process it, and then we just all move on like nothing happened. Tuco had his triggers that would make him absolutely lose his shit. One was when the market made a runaway move but his beta-neutral portfolio would lose money–my longs go down, my short don’t do shit, what the fuck is this market? Another trigger would be when an algo was frustrating his sense of how a stock should move. There would just be a ton of volume pouring into the direction of his bias and a seller would absorb it all rather than letting the pressure release. “Just let it go already” he’d say. He once said there should be a universal chatter box for everyone trading a particular stock so that we can yell at a stubborn buyer/seller to GTFO. I still think that’s a genius idea. He’d call the market maker a clown. “NSDQ you clown! Let it go already! He’d call them a cockroach. He’d call them worse words that start with a “C” that I shouldn’t repeat in 2023. He also felt strongly about internal communication on the desk. Call out your fucking trades! You did not want to be in his crosshairs if you were top of the pnl leaderboard and didn’t make a peep about any of your trades. He’d let you know about it.

Tuco was also a very prolific trader with experience in every arena–algo’s, forex, portfolio-style trading, scalping, swing trading, you name it. He had a curiosity about all markets and never limited himself to one way of trading–he always felt he was up to the task if he put his mind to it. Tuco kept it real and he loved to hang out and catch drinks and shoot the shit about trading markets, even though we were a bunch of know-nothing shitheads. You could ask him whatever and he didn’t bullshit you.

“Tuco, can I ask you something? What happened to all the profitable guys in TGP that Victor wrote about? Like Mister Momentum and Maverick? “

“Yeahhhhhhh they’re all gone.”

Tuco explained to us that all those guys left. Some had transitioned to other trading firms. A couple of them had started their own hedge fund. Some had even moved on from prop trading entirely. Tuco divulged that all of them, including himself, peaked in 2008 when stocks were extremely volatile, and then they all just ran into a much tougher market in 2009 and onward. You could no longer just slam into a distressed financial stock, get in the money right away with a tight stop, and make insane 10-1 risk-reward trades. They went from making $5k a day to struggling to make anything at all. The firm had to make major adjustments to the current market conditions. Nowadays, you have to take pain. He repeated that phrase a lot. It means you have to trade with the appropriate risk and accept drawdowns to know when your trade is clearly wrong. It fucking sucks, bro. He said that a lot too. Then he said that’s just what you have to do to make money–you do whatever it takes or you exit the business.

At that moment, it was starting to dawn on all of us: it sure sounded like we read a book about a trading firm’s fleeting glory days and had decided to join said firm after the glory days ended. Some shrugged it off and some got pessimistic. Reid, the other guy who didn’t have to put up his own capital, felt especially wronged. He was the one doing most of the sleuthing, via word-of-mouth and online forums, and sharing it with the rest of us–who was making what money during what time period, when did they stop making it, when they did they leave, how much money was made on education vs. trading, etc. Reid had offers from many firms and he felt he got sold a bill of goods to join MBC. It started to affect his trading mindset. He would get stopped on a trade that seemed to be a textbook reflection of MBC’s strategic concepts and then throw up his arms and exclaim “this is kinda bullshit, isn’t it!? I could understand where he was coming from but I had my own attitude: doubling down on my own sense of exceptionalism. Fuck it. I’m going to make it work. And I still sorta believed in MBC’s strategy. Okay, it’s not RenTech-tier edge, but maybe it’s a skill thing where 90% would fail and 10% could do it and I’ll just be in the 10%.

MBC had a routine. They wanted you to be prepared as a trader and that began with writing down trading ideas and going through charts at 8am. I routinely arrived at 7. I didn’t do it because I wanted to show everyone how hard I worked, I was legitimately obsessed with trading to the point where I wanted to not just write down 20 different trading ideas, 20 different summaries of the news driving them, 20 different price levels, and 20 different trading plans… I also wanted to watch more videos, do more reading, and even do a small amount of research/prep for my IB account–the “OTC bandit” trader version of me. There was just so much to do and I figured ok, maybe MBC didn’t have all the secrets, then I’d have to invest in other available strategies too.

At 9AM, MBC had their main meeting for the pro traders. There were some days where we skipped the trainee meeting and actually got to listen to it. Avery, the second managing partner, was tasked to run these meetings. He had been trading with Victor since the 90’s, all the way back to the days of Datek Securities and the SOES bandits. If Tuco was the heart and soul of MBC’s desk as the fiery head trader, Avery was more like MBC’s intellectual backbone–he was the grizzled, street-wise veteran trader who could give you the cold, hard-hitting analysis you needed. The meetings primarily focused on macro direction and… Avery would draws charts like this every single day:

When you zoom out on them, they’d look like this:

Avery had the gift of having the most minimalist of technical charts, comprising of only simple straight lines, yet he still managed to be just as confusing and complicated as someone who used fibonaccis, pitchforks, Gann angles, or Elliot Wave. If this line at 310 holds here, then you get long with a target of 312 then flip short at 313 with an expectation of a retest of 310, which if that fails could lead to a move to 308... There were so many price levels!

TGP built up Avery as MBC’s ultimate trading guru. It was written that, back in the 90’s, he once made more than Phil Mickelson in a year (look at the PGA money list and you’ll see Phil Mickelson never made less than $1.5 million in any year from 1996 until 2020). Avery’s the guy who would lead you into war on days where the market was getting obliterated. Avery’s the guy who would start a day down six figures only to fight back and finish green, at least so the legends were told. I’m probably just a foolish rookie who doesn’t get it yet. I’m sure Avery’s analysis will click with me once I get more experience.

And last, we have to talk about the guy you already met and the third managing partner–Victor. Let me just first begin by saying this: Victor always had my back. He genuinely believed that I would succeed and never wavered. There were times he held me up as the poster boy of MBC’s values in front of the other trainees. Pete works hard. He competes. He gets trading and he gives a fuck about being good at it. Be like him! Would I feel really awkward about these moments? Yes. Did I see as it as sincere praise that reflected his actual opinion of me? Yes. I did not want to let Victor down. I wanted to be the trader he thought I could be.

At the same time… Victor played favorites and I just happened to be one of them. Did he have everyone’s back, thinking every single one of his trainees would succeed? Probably not. In fancying himself as the firm’s trading coach, he would engage in “sports coach” type tactics. One of them was to use weaker traders as verbal punching bags in an effort to teach the team lessons. Some trader wouldn’t take stop out as planned and then take a larger loss than normal. Happens right? Well, Victor might just make an example out of him in front of the whole desk.

He’d go on his little tirade and then we’d chat about baseball a minute later. I don’t know if it was a bit or a calculated act or if the emotion was so real that he couldn’t help but unload on some poor sap. Nobody really took offense after awhile, we were more amused than anything. It’s just Victor being Victor, the Trading Coach™ of MBC Securities. He cared about having a profitable, successful proprietary trading desk–it was clearly a source of pride for him.

At the same time… I was seeing the real driver behind MBC’s revenue and what allowed them to pay rent during their troubled times. Victor doubled as the front man for the firm’s marketing and they had a strong social media presence. They would film TV documentaries and have Avery do CNBC interviews. Victor would tour college campuses as a guest speaker at university finance clubs. They would get traders to do presentations, record and edit it, wrap a nice bow around it and include it in a $2000 “trading videos” package. They even asked me to start writing a few blog posts. They marketed themselves more aggressively than other trading firms to A) sell trading education products and B) attract talented traders for the desk. The priority was in that order. In TGP, he claims he hates doing all this marketing and recruiting… he just wants to trade and he wants to coach elite traders. That other stuff is just a chore of neccesity. Regardless of how he truly felt about it, he was quite good at it. MBC was viewed quite favorably in the old 2010’s era Stocktwits circle. OG fintwit guys like Brian Shannon and Dr. Steenbarger championed their teachings. They were really the only name prop firm in that circle and it gave them some cache. The brand was basically: learn from actual pro traders on a Wall Street trading desk. (as opposed to say… a guy in his underwear running a chatroom) That’s how they got on my radar and everyone else had the same story–I learned about them on Twitter. There were thousands of applications every year and people were BEGGING to learn from us. When comparing their profitability, the MBC prop trading desk was an absolute joke compared to the MBC Education Machine.

(to be continued… in Mentor)

Super interesting. I’ve been in the prop world myself and getting your perspective is fascinating.

Brilliant! Write some more posts in this series please…

lol at the charts I still go wtf every time he posts one of those up on twitter

still waiting to meet one person who finds his charts actionable for any trading

Is [redacted] as big a dbag in real life that he seems to be in all his videos?

Ha those charts look very familiar!

Just catching up on all the old posts, great read so far

Wait… is “Victor” Mike Bellafiore? And MBC is SMB capital?

was thinking the same thing LOL

“Two Great Positions” is a metaphor for “One Good Trade” written by Michael, and Pete actually quotes someone like Dr.Momentum who is also in that book lol. Just fantastic writing.