I need to to free-write. Write without worrying about creating a narrative, drawing, editing, or simplifying in-the-know concepts to outsiders. I need to let myself spew words and create a habit of updating this blog, otherwise I’ll go on radio silence for another half-year. Maybe this becomes a weekly thing.

The Value of Confidence

One intangible value to being at a (good) prop firm is being able to tailgate on the confidence of other skilled traders. On the surface, this goes against the conventional wisdom in trading that you can’t blindly follow the trades of another pro trader or guru, but it’s a gray area. I think 2 things need to be true before one can benefit from the conviction of others.

1) You’re already a consistently profitable trader

2) You believe in the trade idea and intuitively/intellectually understand the edge (ask yourself: would you make the trade yourself if you were trading all alone?)

And perhaps the only shortcoming is a lack of real-time situational experience. Corrections greater than 5% don’t happen all too often. There’s a very tight window to put on the risk, you can’t just sit there doing mental calculations and then all of a sudden you reach the tipping point for your decision. Okay, now I will finally decide exactly what to do and how to do it. It doesn’t work like that.

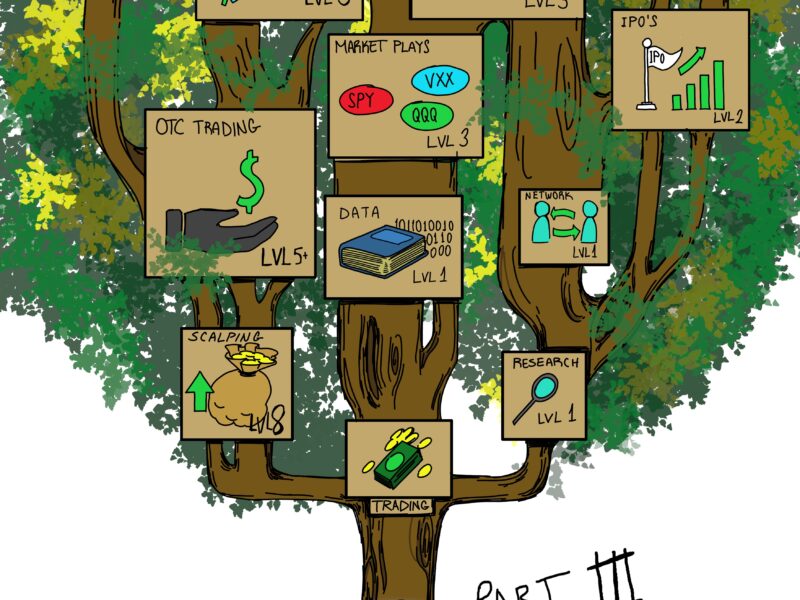

A few of my friends (with 4-5 years of trading experience, like myself) who had their career days had never aggressively traded a steep market pullback (or “crash”, however you want to define it). But they were able to follow the lead of some of the older guys of 10+ years of experience, several of whom had traded the flash crash. Seeing those guys execute in real-time can take the pressure off. There’s also other trades to express the same big picture trade, like buying the most beaten down NYSE large caps on the open (CVS in the low 80’s??? low hanging fruit there). I think it’s more psychologically daunting to try to take on the “bounce trade” by only trying to time the big ETF’s like buying 20k SPY and shorting 50k VXX–at least it would be for me.

I gotta say, as much as I pride myself in being an independent thinker who hates getting into risk just because everyone else is doing it, I really could have used that spark on Monday. That sense of that there was unusual opportunity for the day and it was time to lay out serious rope.

On the flip side, there are drawbacks… like group think and highly correlated/concentrated risk. It’s not all happy endings.

Mispricings

I think the stock is mispriced so I bought it.

“Mispriced” — I love hearing that word. To me, it makes you sound like you know what you’re doing. Replace that word with other words in the trading lexicon or just think of the many common reasons people buy stocks.

I think the stock is oversold so I bought it.

I think the stock is undervalued so I bought it.

I think the stock had good news so I bought it.

I think the stock is a good company so I bought it.

I think the stock is technically strong so I bought it.

I think the stock is poised for a breakout so I bought it.

Now, I’m not saying I make snap judgments off people who tweet stuff like that but there’s good chance they’re just some dilettante trading off what they hear on CNBC’s Fast Money.

After listening to stories from a dozen veteran prop/institutional guys about all the strange, esoteric ways* they’ve made money, I always interpret mispriced as “something I don’t know” or “the market is very, obviously wrong here.”

*like, really weird shit. shit nobody ever touches, BRK.A shares or thinly traded warrants/preferred stock

What does it mean to buy a stock that’s down a lot and you sense that it shouldn’t be? Is it catching a fall knife or buying a mispriced stock? The only honest answer is “it depends”. I think a key component is why the stock is down and how quickly the market can correct itself. Here are 2 different situations–just a thought exercise.

A) ABCD is former high flying tech stock. The sector has fallen out of favor. The stock is down 50% from 6-month highs and closing red for the fifth day in a row.

B) WXYZ is a large cap down 9% intraday and trading well below the 6-month trading range. It is one of a handful of stocks, all uncorrelated in sector/industry, trading erratically for the day, with wide spreads and peculiar price jumps that have no rhyme or reason to them. There is no news on the stock and the broad market indices are near unchanged.

Situation A is likely a momentum situation–one side is getting beaten and their pain drives the stock lower. It can keep going. We see that all the time; it’s too common to be an anomaly. The second situation… could be different. Nobody is going to write a book or record a DVD about it.

Just something to think about.

Trying Too Hard

I tried way too hard this week. I traded 4-5x the volume this week that I had the previous 2 weeks. I pressed it.

End result: I made less money (roughly the same ballpark, but less when counting to the penny). Figures.

It takes a toll mentally too. I spend every the next 2 hours after the close in zombie mode, just sitting on my computer chair doing nothing.

Motivation can come from the wrong place. I think that’s exactly what’s happening to me right now.

Feels like I am catching up your “this is a real, could be sport I play through ‘retirement’, but still suffer from imposter syndrome” stage. Mean while, I grow through my “scale up size vs scale up target” should-be-obvious stage. Uberconfident-non-imposter syndrome says my plays tend to go… widen that TP. Smart money says size up & feck off. Fun to read something about another’s growth stages.