I felt too disgusted to review any of my worst losses. Too many of them fell under that famous Stan Drunkenmiller quote1context: while heading the Quantum Fund, Stan shorted the NASDAQ prematuirely in 2000, lost billions and covered, then he impulsively flipped long at the very top, lost even more billions. oh and he’s one of the best to ever lace ’em up:

You ask me what I learned? I learned nothing. I already knew that I wasn’t supposed to do that.

But hey, we’re here now and some of you don’t know any better. So let’s ask: what can we learn from that BBBY trade?

- Take away the right lesson. The lesson is not “you should not have covered the top“. For one, how am I supposed to know that was the top? How was I supposed to know there would have be an ATM issuance that would plummet the stock and totally bail out all short sellers, a couple hours later? The lesson for me is 1), I never should have taken the trade in the first place, 2) If I did, I should have stopped out over the pre-market spike highs of $4 and 3)

if I had no stop, just take the pain on a smaller position2nah, fuck that, don’t even go down that road–because if it works and you catch that bankruptcy after heroically holding through the squeeze, you’ll think you can handle more next time - Don’t try to be someone you’re not. I was too proud to admit it because I consider myself3delude myself? an independent thinker, but it did get in my head that a larger, profitable trader had this position on with a high level of confidence.

- Don’t add to your position when price doesn’t make sense with your expectation — rookie mistake. Even if you’re okay with taking incredible pain4I’m talking about letting a stock go against you 100% or more, which IMO–you should never, ever let happen, at least let it play out and try to figure out the range and what is happening first before taking action.

- Don’t actively trade volatile stocks on your phone, you numbnut

Like I said, I already knew not to do any of that. I’m just on massive tilt. When I snap out of it and I realize all the unneccesary damage I’ve done, I feel guilty. The negative thoughts start to swirl…

You really let yourself go, man. You don’t work hard, you don’t lock in. You make the same idiotic mistakes over and over. You are a million years away from just two years ago. You’re washed and comically bad at everything you do.

My tank was on empty so I just stopped trading.

I’m in unfamiliar territory at this point–red at the end of March. I’m never the biggest player with the most spectacular PnL numbers but I had decade of consistency and solid risk-adjusted returns. Unprofitable months were extremely rare and far apart. Now it just feels too easy to lose money. I held onto these shitty results like a scarlet letter–I constantly remind myself that they happened and because *I let it* happen, I only deserve pain.

I start to feel purpose slipping away. All of a sudden, I’m in this big multi-week long rut where I’m not really working or trying to improve myself. My mornings are just me trying to avoid any dreadful self-reflection with Twitter in one hand and TV remote in the other.

It felt like I was slowly sinking in a kind of depression that didn’t end, just deepened. I wasn’t trying to build anything or chase a goal—I just needed something, anything, to make the hours pass. That’s not the reason you want to start trading again but for me, that’s what it it was.

The Brink of Depression

Imagine yourself in the aftermath of an absolute calamity of a trade–not only was your directional bias super wrong, you tripled your loss just from revenge-fueled overtrading alone. You can’t accept it. Now you’re just spamming dead money into tickers you didn’t even pay attention to, thinking each one could be the lucky ticket you needed for a quick rebound. None of it works. You stink.

You question yourself: you’re not sure how much you longer you can do this. Depression is right around the corner.

I call it The Brink–it’s this “do or die” danger zone where either I get it right quickly or it ends badly but at least I know I can leave.5one of my secret super powers is that the “die” part of this equation is never actually a blow up or even close. I know my limits because I can physically feel them when I get close. This is why these losses always fall well short of hurting me financially. They simply create emotional fallout and I have to take time to clean that up. This seems very normal but some of the greatest traders and poker players of all time lack this essential self-control

The market is about to open. There’s this rotten feeling in the pit of my stomach. Time for pain. My only solace is that at least it’ll end soon.

Ding, ding ding. Market’s closed. Bunch of green numbers. Impeccable trading. I pull the rabbit out of the hat and make it back. Drawdown gone. Depression gone.

Pushing myself to brink and making it to the other side–it’s my magic formula to snap out of the slump. Some traders like to pretend that drawdown is no big deal. I go the other way. For me, drawdown is a massive dragon with a giant sword that can cut off my neck and trap my soul in hell for all eternity. I need to escape before I’m lost forever.

With the brink of depression… comes humility, fear, and the willingness to let go. Those are good things for a trader. It works. You can see my yearly equity curves and you would never know how often I sat on The Brink.

But this year and this particular downswing, I couldn’t bring that same urgency. After that BBBY disaster, I just listlessly churned shares and remained stuck in a holding pattern on my PnL curve. I was relying on positive results to create some kind of momentum but it went nowhere.

Now it’s late April. Let’s talk about another trade.

Chinese Scam Stocks

Do I really have to talk about these? For the longest time, I didn’t want to talk about this one. Too much shame.

Ugh, but here we are.

If you don’t know about this sub-class of stocks, good for you. Good for you for being normal and wanting to trade liquid names. For those of us in small cap land, we are all aware of a certain sub-class of equities called “Chinese scam stocks“. Although they had existed in a more traditional fashion for 15+ years6the good ol’ reverse merger Chinese fraud that would try to fake their fundamentals but still trade like a normal stock, like ONP or ABAT or SNOFF, these new age scam stocks with no pretense of being a real company started to become a thing after 2020. They are hyper-manipulated random number generators that no sane person should trade. They have two “known” patterns of pump: 1) IPO that trades to infinity. 2) The low-volume 5% creep up every day for a month and then decline 99% in a single candle on one random day.

So there’s this TOP Financial Group (TOP) — I don’t know who these people are or what the company does, I like to believe it’s a secret cabal of wealthy Chinese businessmen meeting in a dark conference room at the top of an ultra-tall Mordor-like skyscraper, all of them twiddling their fingers like Mr. Burns, as they hatch yet another convulated trading scheme to snatch money away from foolish traders. TOP initially debuted in 2022, going from $20 to $50 during the initial IPO period and then declining to $5 by the start of 2023. It had this one unusual “liquidation” day on October 14th 2022 where it traded from $29 to a low of $5.3.

So we’re now several months removed from that madness. This TOP, now well off the old highs, pops up on the momentum scanners because it’s up 200%+ during market hours on zero news. I trade it cautiously. Like scalping a few hundred shares to make a few thousand bucks. I think this type of trading is very risky but I’m not going overboard and the results are ok. I thought I had enough of these names after my roller coaster ride on HKD earlier in the year, but I’m just that desperate to make money so I indulge…

In the afternoon, the stock seems to settle down. I actually took a nap during this entire time and woke up 15 minutes before closing bell.

Moment of Madness

Most of the time, when I have a calamity of a trade, it follows a familiar script.

- After hours of battling a stock that doesn’t trade within my expectations, I’m fatigued and on tilt

- Lots of PnL swings, possibly reaching the edges of what I’m normally accustomed to

- I’m revenge trading to make back overtrading losses

- I get fixated on this end outcome that has to happen, I just have to outlast the current price action, which is obviously 100% bullshit

Nearing the end of the day, none of those boxes had been checked. It’s an ordinary day–Pete trading some volatile piece of garbage and it’s whatever, you know? My positions were just scalps. I made a little money on it. I didn’t really care to have a more ambitious trade outlook. No risk heading into the close.

What happened next is a series of events that I still don’t 100% understand7(I might have blacked out some parts from memory as a response to trauma) but I’m going to try to explain it to you.

I had a moment.

Let me explain what that means. I have a lot of hyper specific thoughts go through my head when trading a stock but I almost never try to plan a trade around these hyper specific thoughts. It’s not a robust way to trade–where you outline an ultra-specific pattern and you try to execute thinking it has to happen that way. It’s just a half-baked thought and maybe, at best, it’s some instictive thing to be aware of.8I’m a big proponent of proven, discretionary traders listening to their instincts to create positive moments, provided they’re not on tilt. Another subject for another time maybe

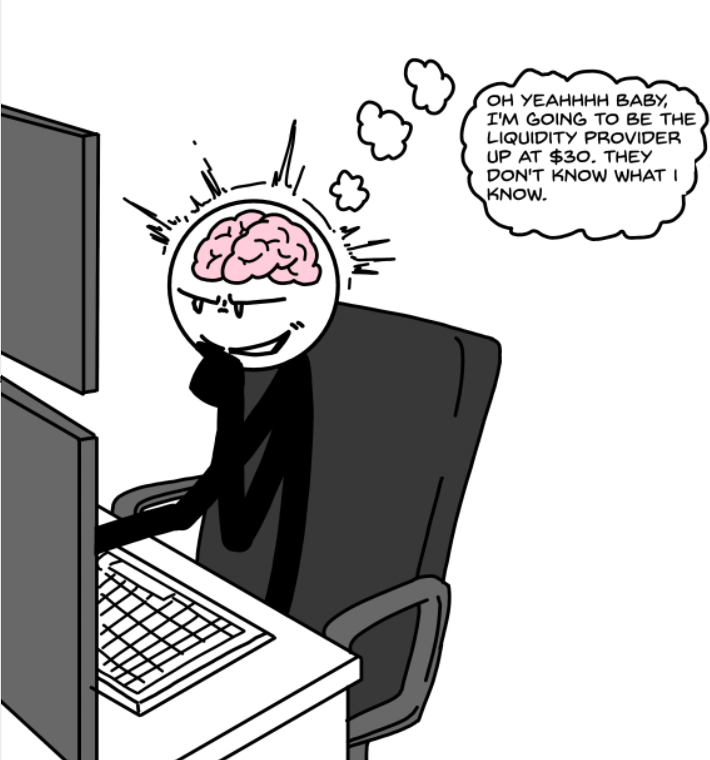

So here’s the 1000 IQ thought — earlier in the day, I had a quick thought that TOP would find $30 in a bee-line and then it would just implode after ticking that. It would go through that high from the October 2022 liquidation day and then THAT’S ALL FOLKS after everyone chases the false breakout. I put this thought away when it peaked at $24 and then struggled to hold $20. Or at least I thought I put it away…

So I’m there watching the close of TOP. There’s a bit of strength over $20 to end the day. Interesting.

Then it skips quickly. Gets to $25 in no-time. Woah, people are really panicking out. That fleeting thought from many hours ago… came back.

I shorted 8000 shares in this candle, average 27.

It started with 1000. Then 2000. Then I just kept clicking away. 8000 shares. I didn’t even wait for it to tick $30. What the heck? I never even once thought about my exit plan or my dollar amount at risk… I was just acting on instinct. When I’m trading well, this works for me.9(almost always because price is in my favor, NOT when it’s an adverse move or quick spike) It’s like I can just sense opportunity and it’s better to execute quickly rather than think it over.

That’s the moment. Pete’s trading.exe thought it detected some kind of 1000-IQ genius opportunity and acted very quickly without mulling over his actions.10I just want to say this for the record: I NEVER MAKE MONEY LIKE THIS. I don’t short power candles in the afterhours and just magically declare that I’m the top! I *KNOW* that! That’s why it’s so hard to understand why I did this! Hope his brain isn’t glitching out.

Within minutes, it skips to $40 and uh-oh, I realize I don’t want this position anymore.

The tape was so thin, I couldn’t stomach puking it out and causing a significant amount of slippage. I’m already at peak depression and taking another six figure loss in 5 minutes… I just can’t, man. But I’ll negiotiate! I’ll work a bid and ease my way out.

Luckily, while I was stuck in paralysis not knowing what to do, there was a downtick and TOP trades back under $30. Maybe that’s the worst of it. I might even be right and it collapses later but it’s okay, let’s just ease off. I bid mid-$27s to take a small loss. It’s so close. Market gods, can you please just be kind and let me off the hook? Like, pretty please?

It prints as low as $28 on the pullback. Then it starts to get away from me and drift back to $40–where I am now down a little over $100,000. There’s no way they came within pennies of my bid and will never come back… right? I can’t chase it up… especially when the book is so goddamn sensitive, it sees a 1k $32 bid it’ll uptick a point just to freak you out. I can’t give in. Just when I thought I was too desensitized for my own good, my heart is now pounding faster than it has in a very long time. Now I really am on The Brink.

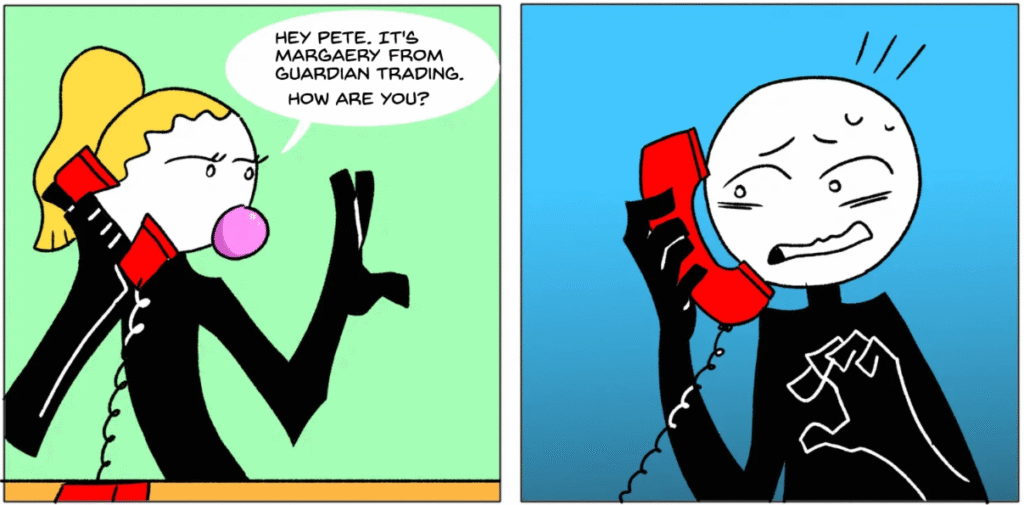

The Dreaded Tap on the Shoulder

Ring ring. Phone call.

Fuck me. Up to this point, I had never experienced this as a retail trader. This call is for all the idiots who don’t have a clue on how to properly manage risk–the ones who pop up with a GoFundMe 2 weeks later, to pay back a debt to their broker. Not Pete. Not with his steady hand and his conservative risk-averse personality and the ironclad lessons he’s learned from his FNMA debacle and his decade of experience shorting high fliers while never coming close to blowing up. He doesn’t get phone calls like that. He has common sense for god sakes. IT MUST ALL BE A BAD DREAM.

It’s not.

Margin-Call Marge, kindly, tells me that I need to post more money or else I will be at risk of being auto-liquidated due to firm risk management.11BTW I met Marge at the same brokerage party that I met Ralph at. She told me what her unique role was and then she told me that it’s a good thing that she had never heard of my name before. My reply: “yeah well, I’m not stupid like most people you deal with.”

The first thing that comes out of my mouth is an apology. I can’t believe I’m even in this position and I’m sorry she has to call to me like this. I sound pathetic. She tells me it’s okay, it happens–she’s clearly seasoned in dealing with these situations.

I ask her what’s my call price, she says around $50, they will start by liquidating half the position. I tell her to hang on. I got the money. I decide that I’m going to have to outlast this. There’s no way this manipulated squeeze can last that much longer. If I just wait until the opening bell tomorrow, I bet it cools off.12there’s this story that Ralph told me about him shorting 2000 shares of ATXG and it went from $20 to $300… and he survived it because he wired in a million bucks or something. and I wish he never told me that.

I start filling out a wire form. The head of compliance sends me multiple e-mails about reducing my position immediately. I go back and forth with him. Bro, just wait, I’m going to send in enough money to double my account equity–just chill out, okay?

I’m nervous that I’m going to be forced to take this huge loss and that just seems so unfair while I’m in the midst of the worst trading year of my life.

I keep watching the TOP like a hawk. It refuses to go down. Even though it traded 35 million shares intraday and seemed reasonably liquid, now it’s all nothing but 100 share skeleton orders spread out points apart. I have no idea what happened to even cause this–I don’t see any news, any filings. It seems nonsensical—until you recall: these are Chinese scam stocks. The randomness is the system. Just as it’s in a scorpion’s nature to sting, it’s in theirs to trade like broken slot machines.

I start to imagine that cabal of wealthy Chinese businessmen during their secret meeting at the top of Mordor. They’re probably (somehow) watching all our real-time positions and having a big laugh while instructing their lackey broker to buy another 100,000 shares, no price limit.

“PETE… WHAT ARE YOU DOING???”

The same voice that told me to fold shop on BBBY starts to kick in and get louder. Because this isn’t what you do. It’s just not. I think about what is going to be required if I take drastic measures–I’ll be watching this stock for the next three hours and then I have to wake up at 4am the next day, finger on the button to panic cover every single moment. I realize that I can’t handle that because every second will feel like the heat death of the universe. Enough is enough. I decide not to wire in any more money. I decide that over $50, I’m going to personally take myself out. I’m not going to let them do it. For such a terrible position, this is the only way I can re-take any control.

I’m literally praying at this point. Please. I’m on The Brink and taking this loss might mean I never trade again for a million years.

The longest fifteen minutes of my life pass by.

Flat. -$208,000 loss. Largest of my life, just barely surpassing that bad one from ten years ago that I wrote about.

HOW?

I try to process it: Just a small moment. A glitchy thought in the brain. A few clicks. So much damage.

I just sat there, soaking it all in for a moment. I didn’t even have time to get angry like I normally do–where I throw shit at the wall and pound the table and scream obscenities. Instead, something broke quietly inside me. And then I start sobbing… loud enough to pick up in another room.

Out rushes my wife from her home office, currently 6-months pregnant and working remotely, to alarmedly ask:

WHAT’S WRONG???

She must have thought someone died. I don’t know how to explain it to her right away. Even during peak emotional discombobulation, it’s still in my nature to pause and edit my spoken words so I can explain things properly. So we’re hugging, she’s trying to comfort me, she tells me to drink some water… and then, maybe three minutes later, it all just spills out in this ridiculous hyper-fast shouting.

I LOST 200 GRAND… (pause, turning my hands over cartoonishly over and over) I’M NOT SUPPOSED TO BE THE GUY WHO TAKES THIS LOSS. I DON’T KNOW WHAT THE FUCK HAPPENED, I JUST SNAPPED AND DID SOMETHING SO FUCKING STUPID. I HATE THIS CHINESE GARBAGE, WHAT THE FUCK AM I THINKING???? I’M LIVING IN SOME FUCKED UP UNIVERSE AND THIS IS ALL A BAD DREAM. I NEVER WANT TO DO THIS AGAIN. I SWEAR TO GOD. JUST WARNING YOU I’M GOING TO SCREAM NOW.

(to be continued with lessons and aftermath in next post, tons of credit to Jacob for the illustrations)

OMG WOW. Love to hear what your wife thinks about all this. Did she know what she was getting into marrying a trader? Takes a lot man, this was an impeccable article. I am so sorry you had to experience this.

Inspirational stuff… putting words to an adventurous life, fully experienced

I experienced a similar blissfully ignorant moment after waking from a nap. It’s usually the adrenaline gods that take me to bad places, but like you described, this was different.

Calmly and blankly slamming size, with no plan, until reality set-in. Like you, I needed to own the loss.

This was after 15 years trading.

Since breaking my self-trust, I’ve switched to a cash account, restricted trading hours and began supplementing Taurine, mostly for anxiety, but it has notably moderated overthinking and calmed me down significantly.

Either you’re in control or you’re not. There is nothing more frightening than going off-rail without any way to rationalize it afterward.

Thx for sharing

So much respect. And so much relating. Thank you for sharing, Pete.

i couldnt stop reading , a great read and man i really hope things pick back up for you!

As soon as i read “Chinese scam stocks,” I fully understood my summer of 2024… long TSM, SMCI, NVDA, whatever… long *tech* and *bitcoin* and ravaged out of nowhere *because* “some random CFO [whom you’ve never heard of nor will ever hear of] randomly resigned out of nowhere…”

Somehow my lame 3-month position scaling in/out on NG futures magically propped up my loss on “scam stocks” later in the year, but fawk it sucks when some CFO resigns and the stock tanks -70% overnight, gapping *way* down while lame-o’s talk about “2% going against [their] position and cutting it.” Thankfully enough, I was L/S Portfolio shares while daytrading/scalping options, and so didn’t “lose” as much PnL as might initially be conceived. (It just totally sucked, and reminded me of why daytrading/hedging/scalping is The Way…)

My advice?

Trade “Chinese scam stocks” like you would TSLA options, and know when to stay *out*

The “trend is your friend” and all that, but [Two Good Positions, by Viktor] essentially admits it:

A “market first” rationale; stocks in play, hot off a fresh catalyst; and, keep your risk managed….

Even when *adding*, never forget to cut your losses *FAST*

With that said? Understand unconditionally what “scam stocks” actually are. (Level 2 won’t help, and neither will “live market data” actually help.)

Do *not* “swing trade” them for any reason.

And don’t fawk with S&P 500 or any of its derivatives for any reason. (Never!, for *any* reason.)

Scope for stocks in play, but understand the market first….

appreciate the post. TOP still remains my biggest loser ever and taught me some hard lessons, mainly it doesn’t need to make sense. I rember that feeling like you describe the next morning, it wasn’t anger it was an emptiness… win or learn, right? just wish the learn didnt have to cost so much!