Do you remember this saga of mine that happened back in 2018? You might be wondering: why Pete, with your years of experience, did you decide to trade at this random bucket shop? Were you broke? Did you lose your mind?

Well, sometimes I’m just like anyone else. Its not enough to just make money but I want to look smart doing it. I wanted to prove a point.

I had this newb trader, underfunded and still in college, let’s call him Billy, chattering in my discord DMs about this new off-shore “broker” Tradebet. There’s always been a fringe business niche in the broker-dealer world for attracting aspiring day traders under PDT and Tradebet seemed like just another questionable upstart business in that world. Billy tells me he’s putting in $500 deposits and getting $8000 in buying power, no day trade restrictions–the usual PDT-workaround. Knowing how lousy the success rate was for most under-capitalized traders, I nodded my head–OK COOL, good luck, and all of that. Deep down I was wondering what the odds were that it was huge scam that would shut down overnight with everyone’s money.

Billy has a couple fringe positive months. He sends me screenshots of his Tradebet wire transfers from his fringe profitable months. Cool, great job I say. Then he tells me that Tradebet is “different” than other brokers because there’s unlimited liquidity. That you could hit instanteous size into positions without affecting any liquidity or enduring any price slippage.

Wait… what?

What does that mean? Billy tells me that Tradebet doesn’t trade in the regular market, they trade in something called CFDs — contracts for difference. It’s a synthetic instrument created on their back end to “mirror” the real stock market. It’s basically like paper trading. You could see 100 shares on the bid or offer and print either side for 100 shares, 1000 shares, or 10000 shares.

Wait… what?

I mean, if Billy isn’t talking out of his ass and he’s describing things right, then that’s basically paper trading. If you’ve ever paper traded and observed how it works, you’ll notice that you can exploit small movements without disrupting liquidity because you’re not actually part of the market. I mean, that’s for those of you actually paying attention. That’s why paper trading results aren’t taken seriously, especially if you’re scalping. But I mean, that can’t be right. Billy must be sorely mistaken. If this was Tradebet’s trading system, any decent scalper worth a salt could absolutely take these guys to the cleaners.

So I’m telling clueless Billy

Do you realize what you’re saying? That’s impossible. They would go broke against any pro trader. How do they hedge their risk properly?

He’s telling me he’s not mistaken. He takes some screenshots of his trades that prove the concept. Clueless Billy doesn’t really have any idea to grasp what I’m saying. What real opportunity lies beneath this sketchy-ass fake broker. He continues to trade his 50% win-rate directional strategy for a few hundred bucks a month. I’m telling him over and over again he has a license to print money. He doesn’t get what I’m talking about. I stop repeating myself to him. It’s obvious that Tradebet just thinks they can operate like this because their entire customer pool is underfunded newbies. For all I know, this magical unlimited liquidity feature probably entices the idiots to blow up even faster. A light bulb clicks for me.

You know… I am a pro trader. Why shouldn’t I get involved in this?

2013: Scalping the Uptick Rule

Do you know what the uptick rule or short sale restriction is? If you do, you can skip this part. Here’s the investopedia definition, which I am just copy and pasting out of laziness.

The Uptick Rule (also known as the “plus tick rule”) is a rule established by the Securities and Exchange Commission (SEC) that requires short sales to be conducted at a higher price than the previous trade.

Investors engage in short sales when they expect a securities price to fall. The tactic involves selling high and buying low. While short selling can improve market liquidity and pricing efficiency, it can also be used improperly to drive down the price of a security or to accelerate a market decline.

The 2010 alternative uptick rule (Rule 201) allows investors to exit long positions before short selling occurs. The rule is triggered when a stock price falls at least 10% in one day. At that point, short selling is permitted if the price is above the current best bid.1 This aims to preserve investor confidence and promote market stability during periods of stress and volatility.

The rule’s “duration of price test restriction” applies the rule for the remainder of the trading day and the following day. It generally applies to all equity securities listed on a national securities exchange.

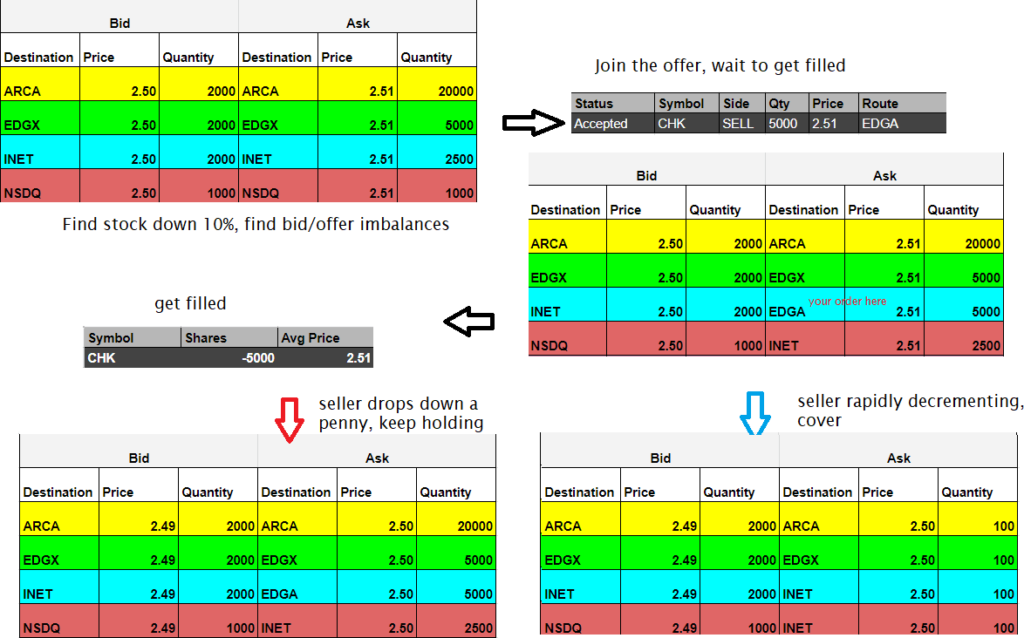

Well, the uptick rule (alternative uptick rule, rule 201) create some changes to how certain stocks would move on a granular level. Anytime you had a highly liquid stock down 10% that triggered uptick rule, you could find “moments” where level II where the offer had far more size than the bid (the offer being the short sellers trying to get into the stock but unable to hit the bid). The offer would creep down the stock in linear fashion, one tick at a time, with no uptick until the offer was entirely cleared. There wasn’t of noise to it. Just say, 100,000 shares on the offer going straight down from $2.50 to 2.30 on a stock until the offer finally cleared to 0 and then it would finally uptick back to 2.31 and however much further it wanted to go.

Being the piker I was in 2013, I observed some super low-risk scalpings strategies trading stocks on the uptick rule.

The general idea was this: find qualified stocks with weak consolidating charts, sneak into a short position and cover when the large seller is finally cleared through. Ideally you’re only risking one penny. The expectation is that the seller will walk down the stock potentially 5 to 10 cents (occasionally a LOT more) before being cleared through for an uptick.

Sometimes you could fill the midpoint during these momentary imbalances. The midpoint being the sub-penny price between the bid and the ask. Say it’s trading 2.34×2.35. You send in a bunch of orders through all the most obscure routes you can think of. Or you might use the anti-rebate routes like EDGA, where you actually lose money for adding liquidity (the purpose being these are the routes most likely to get filled because opposite traders on this route get paid for taking liquidity). Ideally, you shouldn’t get filled all at once, but instead slowly and infrequently. Why?

Theres’s an inherent information assymetry that existed in this strategy that greatly limited its scalability and efficacy: you wanted to get filled but you didn’t want to get filled too much. If you got filled too much and too quickly, that suggested that the stock was not as weak as it looked on the surface and there would be an imminent uptick. Conversely, the weakest stocks, the ones that would theoretically pay you off the most, would never give you the fill. So here’s a common scenario: you’ll see sellers walk down a stock with tons of size and no uptick, you’ll be begging the gods to get in while you rapidly hotkey your whole account in, then you get your fill near the bottom when the risk-reward is the absolute worst.

So here’s the nuts and bolts of it. Once you get your position, it’s simple. Just follow the seller. He keeps pushing the stock down, you stay in. He clears, you’re out. You’ll get a lot of one penny losses and break evens, some decent nickel and dime wins, and occasionally maybe if you found the magic stock and would forgo covering the first uptick if you could sense serious weakness, you could make a lot more. And of course, a ton of ECN fees and commissions racked up. It made a little bit of money, not a lot. It was mind-numbing work actually. You had to be reasonably confident you could get out to the exact penny if seller lifted and not lose a lot more due to slippage, which means constantly staring at the screen. Your wrists tense up on the mouse and keyboard. Your mind wanders. It’s so boring. Unexpected slippage can ruin an entire day’s worth of grinding, or more.

I made a little diagram below:

When you don’t have a clue what direction markets really go in to make the bigger money, grinding out $200 with piker risk felt fine, I guess. But eventually I ditched this stuff unless it was in combination with some relevant factors that made me think the stock would spiral lower even after the first uptick. The edge was just too marginal. Too much of an attention hog, more risk than it seemed, too hard to find the right stocks, lot of tricky algos to deal with. But at the time I was doing stuff like this, I always had to wonder… what if I could be the guy who could hit the bid? Then I could find stocks that were extremely tight on the offer, where nobody could fill the uptick, seller completely piling into the stock with panic selling… and I would get the fill on these weak stocks without having to deal with the problem of assymetry. It would be free money.

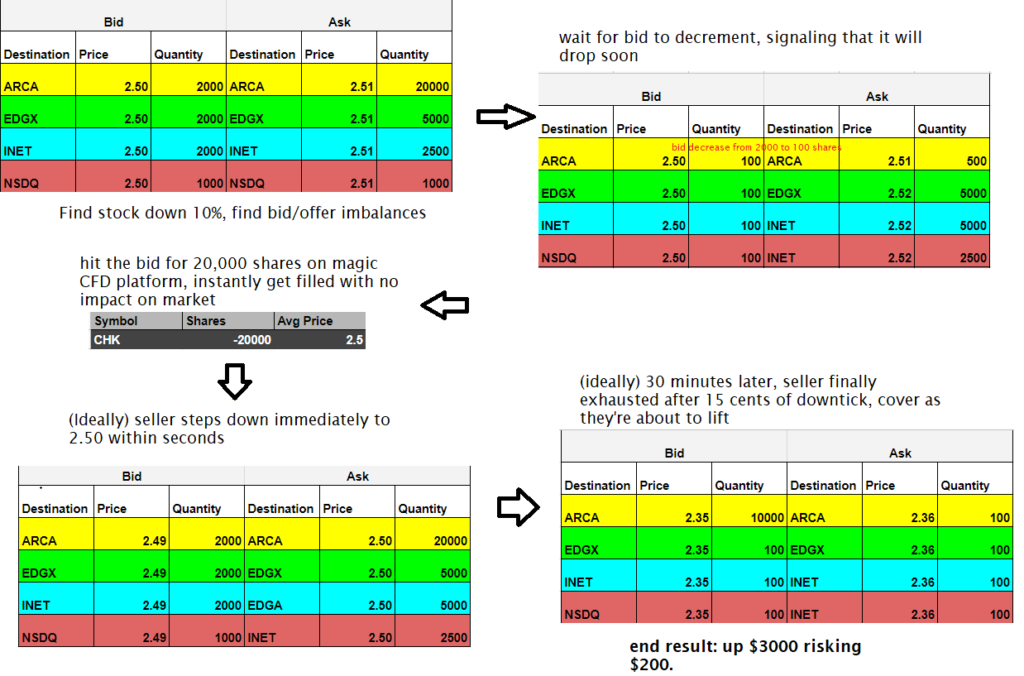

Shorting without the Uptick Rule on Tradebet (the One Cent Risk trade): A Breakdown

So, as I was saying: trading on Tradebet CFDs was basically like paper trading and any pro trader worth his salt could make the kind of money that would eventually bankrupt their company. Fine, I guess I’ll do it.

I signed up for their highest educational package. I think it was a $9000 package for $100,000 in buying power. They gave me access to their magical CFD platform. The short sale restriction didn’t exist on this synthetic platform that wasn’t subject to US financial market regulations. I immediately found a stock down 10% to see if I could hit the bid. It did work and now it’s time to go to work.

Every day, I look to find stocks gapping down under 10% with weak consolidation patterns. I filter out the thinner names that don’t have slow, controlled downticks with thick selling on the tape. I want stocks that will likely trade over 10 million shares by day’s end. Then I look for my pattern on the tape and then I execute.

This isn’t real trading. This is fake trading, except I actually get paid. It’s incredible. Sometimes I am making $3000 off a 7 cent move and I giggle to myself. How is this real? I am sweeping out 20,000 shares when the real market offer is at 100 shares. These people don’t know what they’re doing. They don’t know who they’re dealing with. I am on a mission to take these bums to the cleaners. I am not a trader, I am a bandit. Hands up mother fuckers, this is a robbery.

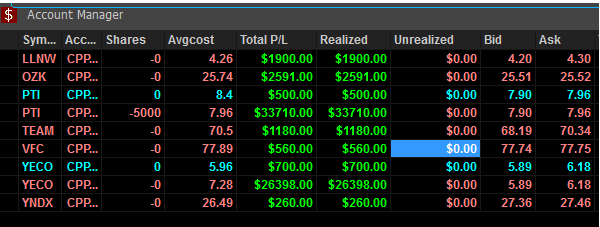

August and September I am honing my strategy. There’s some trial and error as I try to pick up the pieces from a strategy I hadn’t traded in over 5 years. I do make a little bit of money and I do get my wire transfer of the profits.

Then October rolls around. I am picking it up a bit. It’s prime earnings season where negative reports send stocks down 10% and more. Some days it’s a grind to make $1-2k. Some days there aren’t any suitable stocks. Some days I make over $10,000. I start getting addicted. It’s effortless.

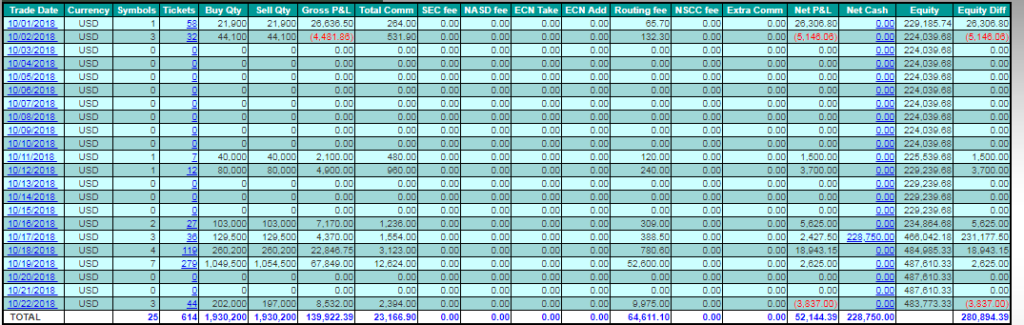

It’s easy to get caught up in the tape and try to make perfect moves. I am not showing any restraint by waiting for the best opportunities. On slower days I challenge myself to make money on very small incremental moves and I don’t give up on the poor stocks with weird algorithms (usually ADRs, for some reason). When I churn through some losses, I convince myself to make it back. Little mind games where I lose 3 cents so the next trade I try to make 4 cents. Many days I would finish with hundreds of thousands of shares traded. In hindsight, this unusually high activity trading probably got me flagged down too quickly.

It’s October 19th. I am having a moment. I am a money printing artist and I am painting my Starry Night. I cannot lose. I am up $67,849 in gross profits, trading only the uptick rule strategy.

That would be the end of it. Without any warning, they levy me with a ton of arbitrary “routing fees” to completely claw back my profits (see the picture below). The next day they switch my platform from CFD trading to real trading, rendering the “hit-the-bid on the uptick rule” strategy completely obsolete. I make a post on this blog to attack and damage their reputation and we make a backroom deal so I can get my profits back (as long as I take the post down). They politely inform me that they will also be closing my account from hereon after. All good. I made my point.

They shut off the spigot. If I had just kept myself in check, I probably could’ve taken them for a lot more in the long run. I’m like those blackjack cheats in the movie Casino, minus the broken hand.

I got too fucking greedy. I went way overboard. Or maybe someone else would’ve exploited this much earlier and they would’ve got on all of us before I could have hit some big pay days against them, we will never know. I had multiple people reach out to me claiming that they were doing the same thing, one guy even labeled it “the O.C.S. strategy”–one-cent-risk. Many of them traded far less before getting switched away from the magical CFD platform. The crackdown was happening. It was too good to last.

A couple years later, the SEC charged “Tradebet” for unregistered swap transactions. None of that magical CFD stuff was legal. Who knew?

Hey Pete,

very interesting bit you dropped there about EDGA, always wondered why someone would use that route and brokers that service us retail schmucks, for all they care of course, won’t give out any substantial information about the performance of the routes they offer.

So how does one find out about this type of information?

Is it prop trading knowledge accumulated over the years from guys who know their shit about the plumbing or some internal route performance evaluation?

Keep those posts coming!

All the best to your family and congrats on your newborn daughter!

You can always look up ECN rebate tables, ask for the most current one from your broker. The lowest fee ECN for taking liquidity will usually get filled first, it’s a trade off between price and priority.

Wow, this was a super interesting read.

I assume they patched this “exploit”?

Yes they did, by taking me off “CFD trading” and back onto “normal market trading” where liquidity matters again.

I’m blown Away!

To really be a good trader you need to know how to read the tape.

What do you think of tools like bookmap, or footprint charts in general?

When you where starting out you didn’t have access to such tools,

you think it would make a huge edge back then if you would have access?

I don’t think you need to know how to read the tape to be a great trader. It’s just one method of many. As far as those platforms–I don’t use those and wouldn’t know how to apply them to be honest.