So this is a question that I receive a lot, which I briefly addressed in my FAQ, and deserves its own lengthy treatment.

This is a guide addressing the pro’s and con’s of trading on your own vs. trading for a firm. This is NOT a guide on how to get a job at a top notch prop firm (the answer to that is easy: A) develop a track record, B) if you are a student, get a degree in quantitative sciences) or on what every individual firm offers. I’ll update it periodically.

First, you have to think of trading as your career and each firm as an individual company that has its benefits and drawbacks. You have to start with a self-evaluation–asking the right questions.

|

| If only you could adjust those sliders with a button click like in Madden |

You have to consider your own starting point:

- Are you out of college or working in another job while considering trading full-time?

- Do you have savings or can you get staked by someone else to establish a trading bankroll?

- Do you have enough savings or earnings power to sustain the costs of living while learning on the job?

- What is your experience level? Not just whether you trade or not, but how well do you even understand the industry? Do you know for certain what your desired asset class, timeframe, and strategy would be?

- What other skills do you have? i.e. coding/programming

Trading has opportunity costs. Developing a skill takes time and capital. Most traders lose money when they start out–and the less you know, the more you will lose. Reducing the “tuition costs” of trading is a good thing. What is your plan for doing it on your own? Is it to join one of the plethora of trading education sites out there that teach you a momentum-based strategy? Is that even the trading style that best fits your personality and temperament?

If you’re a student who wants to trade but has trouble raising cash, it might make more sense to find a firm that can back you and see where it leads. Your mindset should focused on your development and your future. Are there good people there to help you get to where you want to go?

If you’re an experienced trader with an established track record or an independent guy who makes consistent income, your mindset should be that you’re the guy interviewing the firm and not the other way around. What are they offering you that you otherwise can’t get somewhere else?

What can a prop firm offer you?

- Fully-backed risk. In my opinion, this is the absolute minimum you must have when you are deciding to trade prop. It’s the essence of being a prop trader, otherwise what is the point? Why not stay at home and just use a regular broker? There are some firms that will give you a 95/5 split if you put up a deposit, but there is practically zero difference between doing this and trading as a DIY retail guy.

- Salary or salary draw. Some firms offer a salary to new traders. These firms are usually not equity prop firms looking for discretionary traders who trade their own ideas or their own system. The firms that pay a salary usually have some kind of structural edge–for example, they spent millions investing in technology that gives them a speed advantage as market makers.

- Structural edge. There are firms where 90% of the pieces are in place and you just have to teach the trader to execute. They built some kind of technology and system where you basically buy the bid and sell the offer (if not exactly that, then playing some kind of niche role in the market that facilitates order flow or exploits price inefficiencies), minimize risk, collect a pay check, and go home. There is far less discretion on what you can do, you are told to do XYZ with very little variation. This might be a drawback for traders who are more apt for directional/idea-based discretionary trading rather than being a cog for a firm-wide strategy.

- Proprietary technology. Some firms have a proprietary platform or can offer an additional tweak to whatever you’re already doing. For example, you look for certain statistical arb patterns and the firm has technology that can help you data-mine the information more efficiently. Or you trade breakout patterns and you can build an algorithm or gray box to automate your execution.

- More capital. This can matter in a couple ways: 1) those with higher risk tolerance can take larger bigger position sizes 2) helps traders that have a strategy that requiring high buying power maintenance, such as long-term portfolio/basket trading or spread trading against futures

- Different asset classes and styles. You don’t learn a whole lot about automated trading, pairs trading, statistical arbitrage, news-based trading through the current trading books or education sites out there. Most of the well-known prop shops in Chicago specialize in this kind of stuff. We all have different strengths, we can’t all be chart reading short-term technical traders.

- Lower cost. Lower than retail obviously. At my firm, I was charged a rock bottom per-share base cost (the commission, excluding ecn and regulatory fees) that was less than half of what I’m charged on my current retail brokers. It should be a red flag if a firm cannot provide a cost lower than the average retail margin. Sadly, I know a burn-and-churn shop that I live a few blocks away from in the financial district that’s actually charging ABOVE retail rates to ignorant college kids who have no idea what they’re doing. They make money off commissions and push their traders towards ineffective high volume/low margin trading strategies.

- Professional mentoring/training program. Help you develop as a trader.

- Idea-sharing and building a network. Being around like-minded professionals to share trade ideas.

- Friends. There’s something to be said about forging a bond while in the trenches with other traders. The traders who manage to stick around “get it”–the uncertainty of the job, the up’s and down’s, the never-ending learning curve, the desire to push, the same aha moments. They end up being great guys to enjoy a beer with for the rest of your life.

Potential disadvantages of prop-trading

- Profit split. Obviously, there’s going to have to be a tradeoff for anything you receive from above.

- Exam requirements. Having to spend time on acquiring Series 7, Series 55/56 license, etc.

- Higher data fees. Ever looked at the fee structure for data feeds? Notice how it’s two-tiered structure for “professionals” and “non professionals”, with the professional tier being charged a lot more. This annoyed me quite a bit. Once you’re at a prop firm, you’re a “professional” and some equity prop firms pass on data subscription costs by subtracting it from your overall balance.

- Less control. Since it’s not your money, you will likely not have final say on risk and capital allocation. This might not be a bad thing for less experienced traders.

Going through the pro’s and con’s: why I decided to leave*

*I was going to leave irrespective of that FNMA loss

Simple. I weighed the benefits against the costs,mainly the opportunity cost of giving up 50% of my profits, and decided it wasn’t worth the trade-off. I felt it was easier to earn $500,000 by generating $500,000 in profits on my own, rather than earning $500,000 by generating $1,000,000 in profits at my firm.

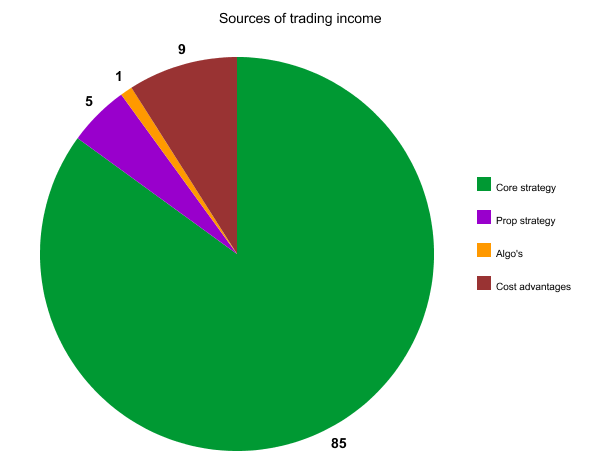

I visualized a mental pie chart of where my money came from…. this is all in my head with no real math involved.

Core strategy = money made on idea-based price action trading

Prop strategy = money made on strategies that could not be traded outside the firm due to lack of access or proper technology

Algo’s = money made through use of algorithms created by the firm’s proprietary software

Cost advantage = the lower marginal cost of trading by trading at the firm vs. trading retail

Some of the other successful traders at the firm would have a different pie chart with more weighting in the “prop strategy” or “algos” section, and it made sense why they stayed as long as they did rather than leaving to trade their own money. There were traders who were making six figure sums in the last 15 minutes of the day by taking positions in stocks in the Russell 3000 on the day the entire index was being re-balanced. I won’t go into the exact details but they needed the platform and the buying power that the firm provided to execute this esoteric strategy. For some of the guys, I could definitely see it being easier to make $500,000 by making $1,000,000 trading these “prop strategies” at the firm.

Were these areas future growth opportunities? Absolutely. But I decided the best growth strategy would be to learn to scale up on what I did best and could do by myself–idea-based price action trading. I wanted to build on my strengths rather than expand horizontally into areas where I felt less competent. It’s all just a business decision.

Exta-curricular reading:

Future posts:

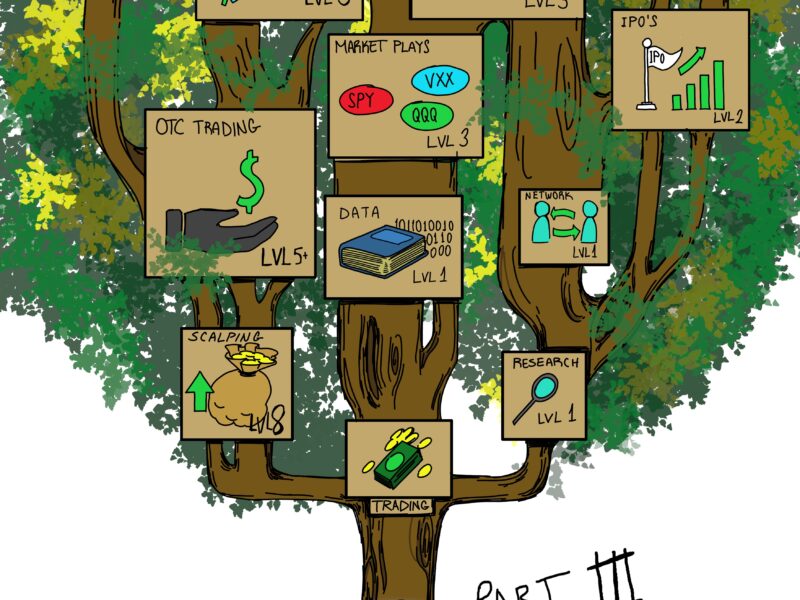

Different types of firms

Temp-trading at the worst prop firm ever during Hurricane Sandy

Equity prop trading in the 1990s — the golden age that will never come back

Hey Pete,

unfortunately they removed the article “Interview with Co-Presidents of First NY Securities: Inner Workings of a Prop Shop” and through a quick google search it is nowhere to be found.

The only news popping up is regarding the resignment of Joe Schenk.

Hm that’s too bad. I can’t find it anymore either