The summer class of 2012 had arrived and they were eager to chat. What’s it like at MBC Securities? How much do the traders make?

We don’t make shit. Few hundred dollars a day, max. We are the last two traders from last year. Everyone else lost money and got fired. You guys will be like that too.

That’s Clockwork “initiating” the new trainees. He liked to paint the impression that successful daytrading was this impossible search for the holy grail that one shouldn’t bother pursuing. He’s usually smiling so maybe he’s joking… but maybe he’s right. Clockwork immigrated from Taiwan, graduated from the UC system, then moved to NYC to trade like I did. We actually got in contact out in California through sheer coincindence–my cousin, who played Dota with him, asked him about his post college plans and it turned out to be MBC. We would chat and he seemed so optimistic and hopeful about being a pro trader.

He was quickly building a reputation on the desk for being in everyone else’s idea and being able to sell for a small profit. Explosive breakout? He took a small profit. Huge rip for everyone on the desk? He took a small profit. Stock traded sideways? He sold on the ask to capture the spread, small profit. Hence the nickname I give him. He excelled at processing micro price action and executing with precision. If it were 2008, he’d be minting six figures easy. 2012, different story. His style of trading represented the old way of trading at MBC that Tuco wanted all of us to seperate from. He did not care. He just wanted green on the screen. I can’t really hate because we had very similar tendencies, him by intentionality and me due to my anxiety stemming from any variance in my equity curve. Now a year since starting, Clockwork’s optimism had disappeared, now replaced by a dark sense of humor about risk, failure, and loss.

Victor wanted us to chat with the trainees as he thought we best exemplified MBC’s work ethic and professional culture. But if he thought we would shower them with affirmations and cliches, he was wrong.

Trading is really hard. If you’re down a lot, just go all-in and hope for the best. That’s the only way to go out because it doesn’t matter anymore. Don’t frown, just double down!

(continued from Facebook IPO)

The average resume quality of an MBC applicant had significantly improved since their start as a rag-tag trading group back in 2005. Back then, they were interviewing rando’s off Craigslist and re-training leftovers from other firms. They were the Oakland A’s diving into the scrapheap while the Yankees signed the top tier free agents.

Then came a boon for MBC’s name presence: getting featured in Wall Street Masters in 2008. They got 4 episode appearances centered around “The Rookie”, a young woman1there’s a rumor that this young woman is actually a now famous actress but I have confirmed from a trusted source she’s a seperate and real person who tried to trade fresh out of college auditioning to be a day trader. This TV appearance put them on the map. Smart usage of social media pushed the envelop further and then Two Great Positions, published in 2010, wrapped the bow on top for MBC’s legitimization as a Wall Street Trading Firm™.

Two trainees from my class had Ivy League degrees, one in finance and another in mathematics–bonafide Grade A resumes. After one year, they were done. Does brand of education make a lick of difference in your success as a trader? No. But it does matter in job opportunity. These guys could easily find a quality six-figure position without the stress of trading to live. Imagine knowing you had options on the table, then you lost $400 in 2 minutes because some bullshit algo shook you out. Your negative balance continues to grow. The nagging voice in your head grows stronger–fuck it, it’s time to move on. Learning how to trade with no salary and living in NYC will always be an uphill battle that most are meant to lose.

Reid had enough too. He managed to connect with one of the top guys from MBC’s heydey in 2008, a trader nicknamed Maverick in TGP. Maverick had simply walked across the hallway to trade with Y5 Capital. Yikes. Maverick gave Reid the entire 411 from the previous era and why he soured on MBC. Reid reached peak disillusionment and decided to transfer. Guess where he went? Chimera.

The summer class of 2011 was down to two. Excluding the new class, it was just us two, the tiny Fall 2011 class (already half gone), and a handful of 2010 class traders who had survived since my first day.

Given our new seniority in the pecking order and our, ahem, “proven trading chops”, many of us would get integrated as cogs on the MBC Education Machine.

- MBC Education started going international. Victor was flying all over the world to countries such as Singapore and South Africa. He would do the rounds with their prop firms and convince them to trade US equities under MBC’s training–just for a small fee of course. By his side was the charismatic Anton, one of the core traders who traded AAPL well in the spring and specialized trading the rangey high beta stocks. He got assigned to speak to Russian and Ukrainian traders given his bilingualism.

- Some of my pals took side gigs to help pay the bills. Tommy took an HR role and would screen resumes for the next training class. “Fresh meat” he’d call them. Coulsen was in charge of correspondance for commercial trading classes like the $1500 “Reading the Tape” course. Even the new intern Frenchy, a friend I knew in college, got assigned to help develop the MBC Options program.

- I became a remote mentor to a transitioning professional, Ramit, who bought the MBC Foundation package for $3000. This paid me a few hundred bucks. Honestly, I felt a bit fraudulent. I trade all day and grind in and out of the tape just to make paltry sums after fees and split. Who was I to mentor anyone? Nonetheless I always gave a full effort in answering every question. Ramit would ask me why I darted in and out so often and I had to break down all my scalps. It would feel embarassing to break down trades that went several points while I darted in and out for a few nickels, but I did it anyway.

- MBC created a new product: their own Virtual Trading Floor (VTF) that would broadcast traders’ live positions in real-time. Y5 Capital’s VTF would feature 15 year trading vets like Spark Merling and Scoot “The Browndog” Browner. Our VTF was mostly guys with 1-2 years under their belt, struggling to make $1k a day like Eagle, Jimmy, and Anton. $200 a month.

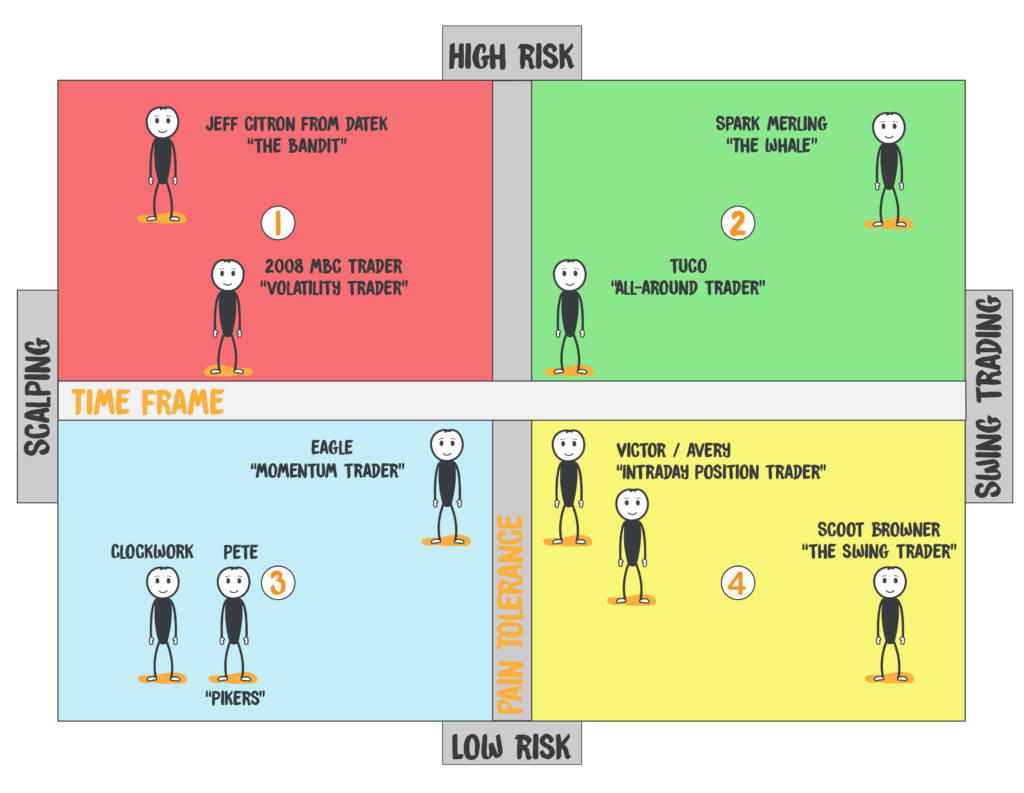

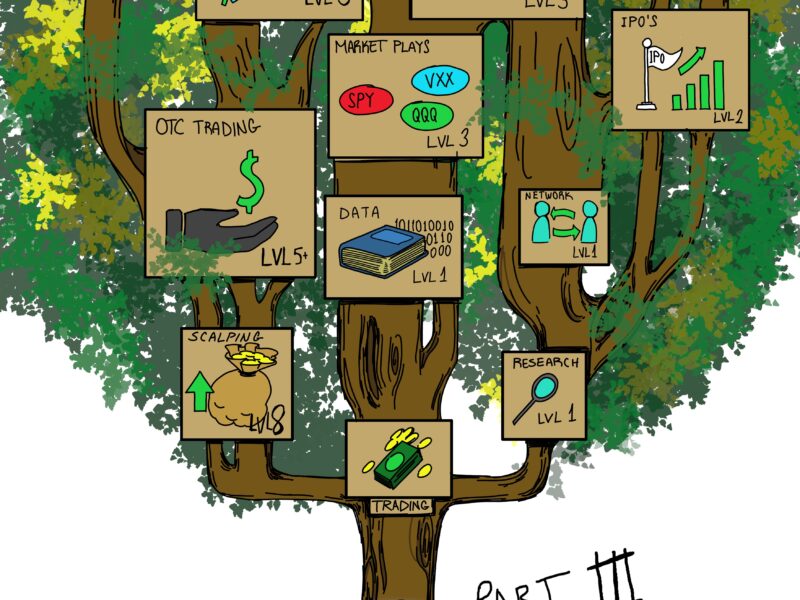

The Pain/Time Matrix

Speaking of the VTF… since we got the Y5 VTF for free, I learned a lot about different types of traders that existed. MBC had this problem of everyone being trained under the same hivemind–tight risk, trade the tape, catch clean intraday moves. We lacked trader diversity. In contrast, many of Y5’s top guys relied almost entirely on daily & weekly technical analysis and held positions far longer. They’d hold mixed portfolios of 5, 10, even 20 positions. Some specialized in options or traded off algo’s. They had perma-bulls and perma-bears while most of us were directionally agnostic. They had some day traders too but overall were far more diverse. Zoom out far enough and the stylistic difference between me and say, Eagle, would be microscopic compared to the difference between any one of us and Y5’s top trader Spark Merling. Spark took far more risk and far more pain, and he didn’t care about every tick on the tape or 1-min chart.

I created a little matrix below to capture the differences between traders. There could be a dozen axes to describe traders (asset class, discretionary vs. mechanical, fundamental vs. technical) but for simplicity sake, I only have two: pain tolerance and trading timeframe. I call it The Pain/Time Matrix.

Quadrant 1: High risk/Scalper. Somewhat of a rarity because scalpers tend to be risk averse. This quadrant is reserved for news/event scalpers, scalpers who move markets with their size, scalpers who fade sharp moves, and scalpers who seek massive volatility. Jeff Citron, head trader at Datek who made millions off the SOES strategy is the best example. The top MBC traders from the 2008 period belong here, just closer to center on the Pain Tolerance axis. Liquidity and market conditions are critical for Quad 1’s.

Quadrant 2: High risk/Swing. These are the whales making the huge bets. They hold positions with utmost conviction and become pain sponges during drawdown. Spark Merling, a perma-bull who dip-buys leading stocks, made huge sums of money in the bull market but not without some occasional red-eye sessions in the Y5 bathroom where he questioned his own survival. The legendary compounders and blow-up artists often belong here.

Quadrant 3: Low risk/Scalper. The majority of scalpers belong here because low risk and low timeframe often go hand and hand. Clockwork and I are deep in Quad 3 because our natural inclination was to find tight consolidation plays and clean tape moves with minimal risk. We didn’t like excessive volatility or liquidity issues, we liked stacking small gains to build consistent, stable equity curves. Someone like Eagle or Anton who trade slightly faster stocks would float closer to center, better labeled as momentum traders than true scalpers. The losers in this quadrant, like those who trade here, will slowly bleed out rather than blow up in spectacular fashion.

Quadrant 4: Low risk/Swing. The classic technicians usually belong here. They will lean heavily on their charts to find low-risk entries to join trends and occasionally trend reversals. They let the market play out rather than relying on speed like a day trader. Scoot Browner, Chief Technical Officer of Y5, would belong here. Scoot was the corporate face of Y5 and he portrayed this milquetoast everyman image. Husband, father, trader. Always follow your rules! He preached his moving average system and if price broke under all his MA’s, he’d stop out, no additional pain neccesary. Older MBC guys like Victor and Avery preferred to hold for hours until closing bell, thus they’re closer to center on the Timeframe axis.

Some notes:

- There’s a spot on the matrix that reflects your natural personality, but you can move yourself in any given direction if you make the effort to change. Early Jesse Livermore trading at bucket shops was somewhere on the scalper axis, quad 1 or 3, but in his later years, he firmly positioned himself in quadrant 2 (and then blew up multiple times and took his life).

- Some traders are a bit more complex, mixing both scalping and swing strategies at various risk levels, like Tuco. I put him close to the middle.

- Almost every single MBC trader at this time belongs in quadrant 3. Those who weren’t were quadrant 3-adjacent along the middle. MBC was a firm with a true daytrader’s DNA.

- Just from my experience talking to algo traders, they’re usually in the low risk quadrants (3/4). They don’t take the huge risks intentionally (system error is another story). I would also think option traders (not to be confused with option buyers) are in the risk-averse quadrants because they have to be intimately familiar with exotic hedging, volatility, and tail risks. Feel free to correct me in the comments.

- Anyone in any quadrant can win/lose small/large amounts and have superior/subpar risk-adjusted returns. To me, this is about competency/skill, which is not being graphed. You could argue someone like Warren Buffet is a Q4 type and Jim Simons a Q3 type, implication being you don’t need high risk for high return. Which leads to my last point…

- This is something I made for fun to categorize the traders you meet at prop firms and is not meant to be a hyper technical discussion of risk. Excessive risk is generally bad no matter what.2There’s some good academic discussion out there that more risk does not equal more return. Variance (and one’s stomach for it) might be a better word descriptor than risk.

Quadrant 3 Trader

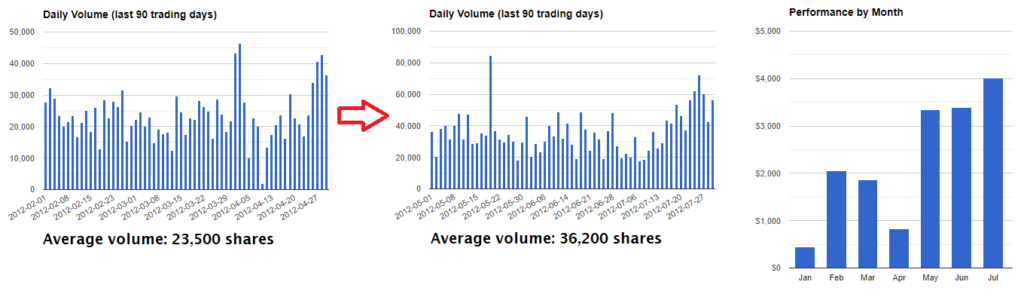

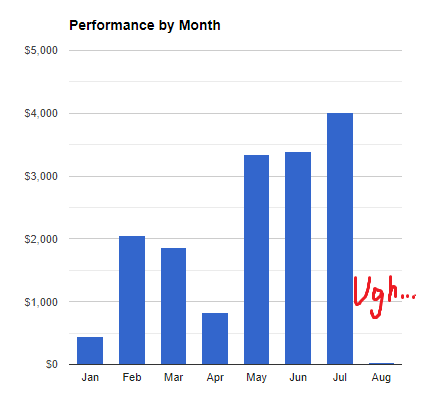

Perhaps I can give some insight into what goes on in the mind of an extreme quadrant 3 trader. That summer, my PnL started to pick up slightly but my average daily volume went up a ton as well.

Ever since the Facebook IPO, I started to hyper-scalp more frequently. Even if I tried to position trade, my approach would be to use tight stops and give myself multiple entry tries, hoping the real move covers the paper cut losses. With so little experience, it was hard to see the big picture and let stocks play out. I wanted a sense of control on every trade. I was strung up so tight every single day, often trading my PnL and my emotional state. While a perfectly calm and rational trader spends his energy on “where is the market going and how do I take proper risk to capture the move”, I would spend energy on thoughts like “what will tilt me and cause me most pain?. Trading itself just became a reflex of both my skill and my unconscious thought. I churned so many shares in response to unavoidable annoyances, like drawdown from entry or giving back unrealized profit. I often found myself not thinking about making money but saving money by extracting every little penny. I’d wait for exact levels to the penny to buy, rather than spread my orders. I’d sell into any initial burst and try to re-buy it lower to improve my cost. I’d see pressure against my position on the tape and I’d proactively front run my stops. I’d enter trades with a cynical outlook where I was prepared to lose and I figured I should lose as little as possible. The algo will tag me out anyway, might as well save the margin and possible slippage. I was the trading equivalent of The Princess and The Pea–a delicate little flower feeling every increment of pain on every tick. These little sensitivities actually made me a good defensive trader but it was an exhaustive experience.

Cognitive dissonance tore my mind apart when I would have to simultaneously think about where a stock would go and how it would get there. For your own sanity, you should probably trade one or the other but I tried to trade both. I’d constantly question every breakout, skeptical that the initial move would give me enough carry to my price target. If price teetered around too long, I’d quickly lose belief and hit out. Then 15 minutes later, the algo would resume buying towards my next level and make me question why I hit out. All the churning and overthinking was why I existed deep in the bottom left of quadrant 3. I couldn’t just let it go.

I remember trading a lot of biotech this summer and having to deal with these creeping thoughts about how I just knew where these stocks would go. Mixed results ensued.

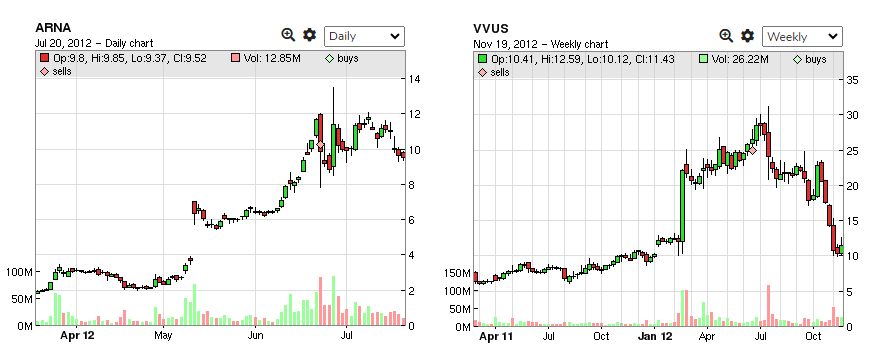

First, there was the fat pill craze of 2012. The two most talked about stocks that summer within retail trading cicles were these small-cap biotechs that both promised a miracle weight loss pill: ARNA with Belviq and VVUS with Qsymia.3also a third bio, OREX with Contrave but that stock was a dog. There was a lot of controversy behind these drugs, how safe they were and whether they worked at all. It led to a lot of polarized discussions between uber-bears who were skeptical of the data and the perma-bulls who believed in the market potential. Riding promising data and panel committees, VVUS and ARNA ran up huge into their FDA approval dates. Polarizing stocks with strong catalysts often create parabolic charts.

I had more of a bear’s slant. As ARNA climbed higher, I was convinced they would just yank it for a huge correction, just like DNDN back in 2009. That’s what happens on these polarizing biotechs with parabolic charts, they’ll have these “bear-raid” moves out of nowhere. I’d be on gchat ranting about ARNA’s potential bear-raid to my pals–dude once they pull the rug, the drop will be unreal. The more I talked about it, the more personally invested I felt in catching the move… because how bad would it reflect on me to miss the one thing I’m obsessing over? I didn’t want to live up to this anti-narrative I had floating in my head that I was just a huge wimp all along.

Day after day I’d attack the first sign of weakness and every single time they would support the dip and grind it higher, forcing me to take a paper cut. They make it so fucking hard. After many agonizing misfires, I wrote in my journal that I’m only going to wait for the best setup rather than impulsively hit every downtick. I want it to consolidate and hold lower like one of Jimmy’s consolidation plays. If ARNA didn’t setup perfectly and allow me an obvious entry, I would abstain from shorting it. This is good trading, I’m disciplined and I have a plan. The next day arrives.

Pre-market, it’s at $13. Seems juicy but it fades into the bell and opens around $12. They’re going to hold it, the gap isn’t big enough anymore. Just wait.

First 5 minutes, it slides to 11.50. Of course they’re going to support it here, it’s the prior day close. Just wait.

3 minutes later, it’s under 11. It’s way too early. Now I’d be chasing a full point. Let it show it can hold lower. Just wait.

30 seconds later… there are no fucking bids at all, all the way down to 7.76. I have no position and I’m just a helpless spectator.

I didn’t see my setup. I was trying to be a disciplined trader following a detailed trading plan and it was hard go outside the game plan and pile into something so abruptly. I did the right thing. Right.

Right?

RIGHT???

After the close, Jimmy shared with me a bit of gossip from the Y5 trading floor. One of their larger traders shorted a 5-figure amount of shares in ARNA at the open and was audibly screaming at Spark Merling, griping that Y5 couldn’t locate the size he wanted. Quad 2 traders man…

Later on, there was the AMRN “sell the news” trade that I learned from a popular retail biotech trader, twitter handle @johnwelshtrades. I had seen him call out the trade numerous times as a college retail trader and the sell-offs I witnessed on ARNA/VVUS after they secured approval further seared the idea in my brain. While I still struggled with holding positions and trading high range stocks, one thing I truly internalized from Tuco’s meeting in February was understanding the psychology and the “why did this happen” reason underneath the trading setups. If I had that part down, I had the confidence to transcend my piker nature for at least that trade. The idea behind the “sell the news” trade was simple: any biotech trending into approval usually had the approval priced in, and thus a sell-off would occur on the actual day of news. Early accumulators would take profits, not wanting to carry additional risk as the next big question arises about commercialization. Buy the rumor, sell the news.

I had a nice trade and I got featured in the MBC Tradecast again. I think I had one of the best presentations yet, as I broke down every component of the trade and why market psychology and prior historical events had given me a reliable edge. Victor subsequently chose to put my trade in his new book.

Overall, my performance showed modest improvement. Risk-averse quadrant 3 traders live on consistent and incremental gains. Overall profits were far from being able to sustain an NYC lifestyle but any improvement is key for one’s confidence, especially my fragile brand of confidence.

Then August came around.

(to be continued in Sandy)

Great post!

Dude, I got sucked into this wonderful story, couldn’t stop reading – and now I’m starting at an abyss! Where’s the rest of it?

where is the next one bro