(continued from Bitcoin II: The NO! Awakens)

Me: Some people don’t take it seriously enough. They’re not gonna make it.

Teddy: Oh yeah?

Me: Yeah. Your whole life has to be about trading. You have to suffer for it every single day. You have to be obsessed with finding ways to make money.

Morning commute. Think about stocks.

Lifting session at the gym. Think about stocks.

Evening dinner. Think about stocks.

No time for tourism or Tinder. Just trading.

Me: “If you’re not all-in, you’re not gonna make it. You’re gonna be another Imran. Another Billy. God help you, you’re gonna be another Terrance.”

Teddy: “Who are they?”

Me: “Exactly. They’re nobody. Now go over your trading ideas for tomorrow.”

I wanted to be a positive mentor. I didn’t want to posture and act like I’m some hard-ass who thinks of trading as a matter of life-and-death. But in the end, there wasn’t much to say aside from… motivation? Trying to be relatable? Ideally, the mentor/mentee trading relationship should unfold this like this: Consistently profitable trader lends new trader instructions of his strategy and new trader copies it. In a perfect world, the instructions would resemble an IKEA furniture assembly manual–you follow every step exactly as the instructions intend, with no discretionary input of your own. That would be the easiest path forward for a new trader and maybe he can tweak things later when he has both the money and experience. The exact opposite of IKEA manual would be sandbox mode–where you have to create everything on your own with just a few general principles to guide you. There’s levels to it but sandbox mode more aptly describes how I started my MBC career. We came in at a time where they weren’t any winning strategies to copy. Maybe for this new training class, it could be different.

I had jotted down all all my OTC setups and their execution procedures–the opening drive plays, the bounce plays, the parabolic shorts, how to find and select stocks to trade, and what to look for on the tape. Teddy could have the playbook and make money right away. But it was all for nothing.

Trainees were to trade strictly NYSE stocks for 3 months, then NASDAQ, then eligible for OTC only after 1+ year experience. Teddy and his training class were going through the same outdated training program that I had gone through 2 years ago. As a result, he was engaging in all the same mediocre trading that I had ditched a long time ago–finding random large cap stocks and drawing random lines on where to buy and sell. I guess in some ways I was glad MBC wasn’t letting everyone trade OTC and have all us all jockeying for the fills but it left me in a weird position as a mentor. So I just end up doing what most mentors do when they are unable to communicate a concrete strategy, I offered heartfelt general advice and wished him good luck. I suffered for my current success and I wanted him to know he probably will have to suffer too. Maybe there’s some “Happy Wanderer” out there who also succeeded as a professional trader and he enjoyed himself while living a balanced life but I wouldn’t know. I can only speak from my own experience–suffering and obsession.

Teddy: Pete, what do you think of this $328.42 level on AMZN?

Where do I even begin to answer that? The first question you have to ask is why is it a good idea to buy or sell AMZN today? Why would it have an outlier move from here? Am I even qualified to offer an answer on that statement when I don’t trade AMZN, ever? This is the murky world of discretionary trading–sorry bro, I have no clue what to tell you. I tried to re-direct the discussion to bigger picture themes and context–what makes a stock setup interesting in the first place, before you ever consider an entry (and thus start drawing your lines or whatever)? Conversely–why do some trades just end up being noise? Context is key.

This is especially true on the OTC where stocks alternate between completely dead and extremely alive. By December 2013, the OTC scans had died off and we very much needed a new catalyst for order flow.

The Year of the Junk Stock

Around Christmas, they were going to release the highly-anticipated The Wolf of Wall Street movie. Marty Scorsese and Leo DiCaprio making a film about the debauched world of selling penny stocks, should be great right? Well, I went to see it in theaters with my parents… and that was a mistake. They had some questions for me on the ride home.

No Mom and Dad, I’m not a broker lying to sell penny stocks to clients, I only trade the stocks. I don’t do drugs1adderall doesn’t count or hire hookers. I’m single guy living in a small apartment with 3 other people. I don’t go out much. I don’t stay out late. I don’t go on any dates. All I do is trade, all I want to do is trade. I think they believed me. They didn’t want to not believe me, I’m sure.

Then they had another question: do regular people actually buy these penny stocks? My parents grew up on a steady diet of mutual funds and blue chip stocks. Even that was considered “risky” by their generation’s standards because most immigrant families come from countries with unstable stock markets where buy and hold was emphatically NOT a thing. Trading, especially trading penny stocks, was like another 261 levels of gamble beyond their comprehension.

So I explained to them, that, yes, people actually buy these Junk Stocks and they aren’t traders like myself who adhere to Rule 12refresher on Rule 1: nothing is ever real on the OTC. They are actual investors who believe in the company and hold the stock. There usually aren’t enough of them to impact the stock price and absorb all the dilution and the Junk Stock usually finds itself in terminal decline where the investors will lose 90% or more of their investment.

It can change for a moment. Every dog can have its day when the right conditions come about. That’s when these stocks hit my scans and then I join in to trade the order flow. This is when context is key–understanding what can ignite stocks for bigger moves. These stocks just needed a little something, the equivalent of Ackman taking a stake in FNMA or the anti-trust news in AAMRQ. Something actually big, not just another empty promise in the form of a company-generated press release. It has to be a game-changer outside of the company’s control. I don’t even know what it will be because there are thousands of these of Junk Stocks and they all do different things in different sectors. Lithium mines. Biopharma. Oil and gas exploration. Nutritional supplements. Marijuana.

Marijuana…

This random shitco that made $258,000 in income last year called “Medbox” and their CEO somehow got an interview during Closing Bell. They NEVER put OTC stocks on CNBC. Could this potentially legitimize OTC pot stocks?

Game changer. All it takes is one.

A Bud-ding Opportunity

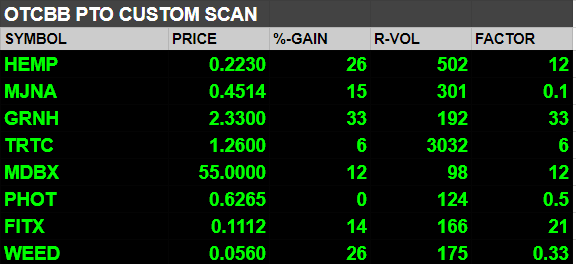

Let me give you a short timeline of the pot stocks on the OTC. 95% of them fall into category of Junk Stocks3the other 5% belong in the worse category: the Pump and Dump. Their ticker symbols would often be abbreviated relevant words like PHOT or MJNA or HEMP. They would run on favorable cannabis legalization news, which had become a prominent movement in America in the early 2010s. Governments wanted to decriminalize it and early speculators were looking for companies that would take advantage of the sector’s burgeoning free market. This was a good recipe for short-term stock hype. The only issue is that all these weed stocks had Tier-F fundamentals.4I mean, out of the 50 or so pot stocks on the OTC, not a single one was even a hidden gem with some promise. They were all terrible–here are some articles from the past on CBIS, MDBX, MJNA, and PHOT.

In 2012, Colorado and Washington were about to pass pro-cannabis amendments, which sent these stocks into hype-fueled gains. But it didn’t last and they quickly reverted back to their natural terminal-$0 state. State legislation was only a first step and most of regular society was still years away from a licensed store on the corner that sold them weed. In the meantime, these Junk Stocks would burn cash and dilute the shareholder with endless convertible debt. Some of these stocks had an outrageous amount of post-dilution shares–for example HEMP had 1.6 billion shares outstanding by Q4 of 2013.

In 2013, Vermont, New Hampshire, and Illinois joined the fray to legalize medical cannabis. Most of the weed stocks reacted positively for a day or two and then trickled back down as convertible shares increased supply. Sentiment appeared to be extremely negative and it seemed these junkers needed something even more than political currents to sustain longer trends.

Then Medbox happened and it seemed like everything changed overnight. MDBX went up tenfold in 8 days, peaking at a valuation of $1.5 billion. It was if this event signaled to all the dummy investors a green light to buy a lot more and not only that, invite all their friends to the Junk Stock buyer’s party.

So you had moves like these across the board on the “leading” pot names.

Keep in mind these stocks had hundreds of millions of shares in the float being traded with tight spreads. That allowed skilled OTC tape readers like myself to find all kinds of layup scalps with good size.

Every day the first thing I would do is look at my OTC scan looking for volume, tight spreads, and gaps.

Then I’d just buy the opening print on the strongest stocks with the best volume and ride the opening drive for the first 30 minutes. The rest of the day was spent on managing my positions and making sure I didn’t give back profits on an unexpected rug pull.

Then I’d look at the OTC scan on the close and buy 5-6 different stocks closing strong expecting a gap up the next day.

February 2014 was my first six-figure month ever. I had one red day that month. Overall, I made $222,168 in the first 2 months of 2014. And honestly… every close I would review my work and think to myself… I should have made so much more.

Soon after, everyone else wanted in the OTC game. At least ten other traders opened Knight Direct accounts. One veteran trader flew from Austin to NYC, going directly to me to talk about how to trade the pot stocks. We had a daily stock report e-mail after the close, summarizing the most traded stocks on the desk. In the past the most active names would be the major tech names, the most active %-gainers of the day, and some random imbalance names. Almost everything over $5. During these two months, you’d open the stock report and you’d often see so many junk pot stocks–HEMP, PHOT, CBIS, MDBX, NVLX, PLPL, GRNH, DEWM, ERBB, FITX, ELTP, TRTC, just to name a few. Guys I’d never met were trading them.

I had my old mentor Jimmy in my ear all the time asking me my opinion on whatever shitco he was enamored with. For whatever reason, I could sense Jimmy didn’t want to grind anymore. His WTG account was firmly in the negative and he wanted a big play that could wipe the slate clean. I’d show him the easy money I made just by scalping the leading stocks that already went up 200-500% but he’d be preoccupied with finding stocks that had no volume or momentum yet, trying to anticipate the initial breakout. He bought millions of shares of this illiquid pot stock at 2 cents and paid thousands in commissions due to our per-share cost structure. I shook my head. At this point, the roles had reversed completely–the student had now become the teacher.

Jimmy you’re being an idiot. Why would you pay those commissions to buy a super cheap stock like that? Why not at least buy that position in your personal account and pay a flat rate?

He tried to convince me it would go to $1. Too many late-comers creating new OTC account and now I see Jimmy super bullish after so many stocks had already flown up 10x. At this point, I knew the hype cycle was close to being over and I started looking for short opportunities. I caught some nice moves and made $25k short in a week when most weed stocks experienced parabolic correction. I remember thinking how I was way too cautious with my risk.

Our success was not without some unexpected resistance.

Toxic Order Flow

“They’re shutting you down. They don’t want your trades.”

That’s our Director of Trading Operations, managing the relationship between WTG and Knight Direct. He just told me and Clockwork that our accounts were being terminated because Knight didn’t want any of our “toxic order flow”.

Toxic order flow? Are you fucking kidding me?

Here’s the thing: we didn’t trade OTC like the average retail trader where they just buy breakouts for multi-day swing trades. That’s what you do with penny stocks right, you buy at .1 and sell for 5-10x? Yeah, we did that too but we also wanted to juice the order flow like we did on FNMA. We wanted to buy a million shares and sell it for the incremental .01-.10 moves. This usually meant at the time when order flow was most chaotic, like volatile dips or opening prints, we would jump in and snipe the last orders before the price turned. We’d jam the order blook with 20 different orders, and then cancel them all when the price took off because we didn’t want to backfill anything if the momentum died off. Then when the micro swing had ended, we’do the same thing and unload all our shares onto the bid to take out profit, again jamming in with 20 orders. We didn’t know it at the time but this style of trading got under the skin of the market makers. It wasn’t a problem on FNMA/AAMRQ months earlier but the market makers handling the shitco names like HEMP and MJNA were apparently far less equipped to handle it.5Read: they were bad at their jobs.So they went to Knight Direct to bitch about it and shut off our accounts. They actually used the word “abuse” to describe our trading. We are like the card counters being thrown out by the angry casino because they don’t like it when you win.

IT’S NOT MY FAULT THEY’RE TOO SLOW!

That’s Clockwork, incredulous, when the situation was explained to him. Of course we would cancel our orders that didn’t fill. Why would we want to take the losing fills when it went back down?

Our Ops Director went hat in hand to Knight Direct on our behalf and we managed to get off with warning. Don’t cancel any orders or we’ll end you. This also seemed absurd. So we needed a conversation and then more people got involved–Victor and Avery, multiple operations guys, and even Mr. West. No one wants to kill the golden goose.

For a good 2 weeks, there was all this back and forth negotiation on the “correct procedure”. They’d propose solutions like we could only cancel 10 orders in a day. Or we had to wait 90 seconds to cancel our orders. Or we had to enter orders in one large bulk order rather than layering it. Or we had to trade on ARCA and pay a lot more in ECN fees. Meanwhile on my retail trading provider, I had zero pushback trading the exact same way I always did. Being a so-called “professional trader” sometimes seems like it has more negatives than positives.

Toxic State of Mind

Let’s get something straight–OTC market makers are not the good guys. They screw traders all the time when panics happen; I know because it’s happened to me plenty. They just didn’t like the tables being turned. It resolved itself but it’s something that pissed me off. We also had issues with Goldman Sachs changing the trading fees on ARCA and retroactively passing through the cost to us–that sucked too because if we knew the true cost we wouldn’t have been so aggressive on certain trades.

I found myself aggravated all the time. Maybe it was the poor sleep I was getting. Maybe it was how much energy I burned while staring at quotes non-stop from 8am until 4pm. Maybe it was the anxiety of trading around other people on a desk, which hadn’t really gone away even after newfound success. I took such a conservative approach to all my trades, meanwhile in all this pot stock fervor, I was hearing about other traders holding huge positions for doubles and triples. And I could get so tense while anticipating an entry on a big play.

One time, I had this trade where I was looking for a bounce on one of the pot stocks that over-corrected. I’m watching it tick by tick, doing everything in my power to not give into temptation and buy it too early. I only wanted to see my signal to make a trade. There’s a discipline to the process. And then I hear–

Hey Pete, where are you buying this stock?

This fucking idiot. What did he just say?????????

Then I turned around. Just glared at him. Like come on dude! I don’t know until I know! This trainee newb behind me who’s trading 500 shares max and not even involved in this play is interrupting my mental process and dude COME ON, that’s not how it works, OK??? Please just STFU.

Then I felt bad five minutes later. It was not neccesary to lash out like that. I get all self-conscious that everyone can see what a raging lunatic I am–an all too familiar feeling. Everything’s going so well, why am I so angry anyway?

We have another great week and Victor gets pizza and beer for all of us. Everyone’s all happy but I’m tired AF. I need a breather from all the newb trainees pestering me with the same old questions so I got up and went to pace around in our lobby area.

I started thinking to myself… everything that’s happened has happened because of me. That Fannie Mae trade almost a year ago, it started everything. Everyone trading OTC after that. Eagle and Clockwork following a higher pnl trajectory and making monthly top-10s–that’s all because of me. None of it happens without me.

And what do I get for it? These newbs interrupting me. Other traders competing for my fills and crowding me out of bigger positions. Market makers threatening to take away the Knight Platform because they don’t want our order flow. I’m always feeling like shit because I’m in the rat race, looking at the leaderboard every day. On top of all that, I have to give up 50% of my PnL for this.

Sometimes I just want trade alone all by myself. The prop trading model is for the quants and the cowboys, and I don’t trade anything like them because I’m a wimp who wants to take ZERO drawdown–and this eliminates the best part of trading at WTG, which is to take reckless shots and get a piece of the upside. I have the money at this point. I ought to just leave. I’ll run the bitcoin fund and trade on retail and keep it all. I’m sick of this shit. I DON’T EVEN LIKE NEW YORK.

Teddy: Damn Pete, I didn’t know you feel that way. You sound stressed.

Me: I’m just venting… I’m not actually going to leave.

(to be continued in Risk Limit Exceeded)

Cant wait for the next blog post omg