(continued from Consistently Profitable Trader, although more of a continuation from Bitcoin)

November 21st 2013, 3:00 AM EST

It’s going to go to 0. We’re gonna lose everything. I want to die.1play the sound above if you haven’t seen the movie. seriously. just fucking do it. i want that voice in your head.

I wake up in cold sweat and clutch my chest. I see price hasn’t budged–still $800. It was all in my head. I see our equity approaching $500,000–more money than I’ve ever managed in my life. Why is making more money more stressful? It’s because now I have more to lose. I want to sell it all before it inevitably collapses. I know you Bitcoin, I know how you operate.

Ok, relax. I’m struggling to handle my shit. I blame that stupid Bitcoinity alert. It triggers whenever bitcoin has a negative move. The alert is permanently set to the voice of Darth Vader screaming

It’s my wake-up alarm during periods of increased volatility and it’s the only sound alert I could find. It repeats until you close the notification on your browser. I am living through Anakin’s anguish. He lost the love of his life. I’ve lost my unrealized $USD profits. Same thing. His pain is my pain. I hate this.

Waking up abruptly out of deep sleep to see $100,000 in equity loss felt about as stressful as you could imagine but it isn’t even the worst part. The worst part is living in such a heightened state of anticipation that you *think* you hear the alert when it’s not actually happening. Half the time I heard it in my dreams, only to wake up and find out nothing had happened yet. Trading a 24/7 market is trading in Hardcore Mode–you’re never truly off-duty and it can start to screw with your head. Whatever I am doing–eating dinner, talking to friends, training at the gym–I can’t truly immerse myself because the price is always on the back of my mind. I’d carry my laptop everywhere and make these contingency plans to find the nearest Starbucks or McDonalds if I had to trade on the fly.

This Coin Fund is ruining my life quality but nonetheless I carry it like a badge of honor. I’m the guy doing my job, no matter how miserable it makes me feel. I’ve been a terrible sleeper for my entire life anyway, I’m used to it. I can do this. I can daytrade stocks too. I have to make money.

FOUR HOURS LATER.

Check price. Nothing. Just a dream again. I will never, ever get that sound out of my head. Might just be best to get up at this point. For breakfast, I have a cup of coffee with a side of adderall.

July 28th 2013 (THREE MONTHS AGO)

It’s the summer, which I hate because you’re shoulder-to-shoulder on the trains and the air sticks to you. My friend Tommy has a phone call with his cousin, Rivers, one of the top developers at a promising bitcoin startup called BitInstant.

Rivers: Hey Tommy, long time no chat. You’ve been a professional stock trader for a couple years now. I’m trying to start a bitcoin trading fund, is that something you’d be interested in?

Tommy, being less than 3 years into his professional trading career and not having ever traded bitcoin before, didn’t feel super confident in spearheading this venture on his own.

Tommy: Sure… but can I bring someone else on?

The next work day, we’re having lunch. I had an upsetting morning–made some bad trades that are still rankling at me. I’m scarfing down a greasy cheeseburger oozing with nasty sauce and grilled onions, each bite offering a moment of respite from my highly critical inner voice. And the humidity.

Tommy: P-To, my cousin is looking for traders for some sort of bitcoin fund. Want to meet him?

By this time, I had stopped actively trading bitcoin. There was an incident that pissed me off–the sole site-operator of Bitfinex, Raphael Nicolle, had cancelled one of my free-money ‘happy print’ trades simply because he could and he didn’t even notify me. That sneaky fuck. I don’t trust anyone or anything in crypto.

Me: Sure. Why not?

That weekend, we found ourselves at “Silicon Alley”, a cradle for tech startups out in the Flatiron District. Rivers gave us a tour of BitInstant and then introduced us to the company’s founder and CEO, Charlie.

Charlie: So where do you think bitcoin goes eventually? I say $100,000 at least.

He thinks this fake internet money is worth $100,000? GMAFB. That would bring it over the market cap of all of FAANG combined, despite no cash flow and no fundamentals. This guy is living in dreamworld. Too cocky. Just reinforcing my impression that bitcoin is a cult of fanatics and I don’t trust cult-like behavior in my markets.

Charlie: Let me know how the trading goes, I might be interested later on. I could talk to the Twins and see if they want to invest too.

Rivers shows us out, says he’ll get in touch. A few months pass and price remains stagnant around $100. I don’t think much about it until I see that the largest exchange, Mt. Gox, had suspended withdrawals and then admits to incurring “significant losses” due to crediting uncleared deposits–massive red flag #1. Then later on, Silk Road gets shut down and bitcoin drops 30% in a day–massive red flag #2. I contemplate whether bitcoin is just a fad that will fade away due to all the trust issues and the lack of a regulatory safety net.

October 15th 2013

The leaves have turned and it’s now autumn. Bitcoin survives waves of negative news and rallies back over $150. Rivers reaches out for another meeting. He’s no longer at BitInstant. Charlie is out of the picture because he’s got “bigger stuff to deal with”–whatever that means2I would later learn that he got indicted for money laundering and conspiracy charges. He’d get convicted and have to serve a year in federal prison. Rivers is now starting a new multi-project venture called Coin.Go. He has some serious backers: an heir to a centuries-old Manhattan bank, a guy named MM, and the CEO of the leading ASIC miner company, a guy named Zuo. Rivers wants us to start trading as a “proof of concept” for a future crypto hedge fund.

We had a meeting. Basic agreement was this: we would take 20% of the profits since that was the hedge fund industry standard, starting from today. There was no paperwork. Rivers asked for our wallet address and transfered over 400 bitcoins, which at the time was around $70,000. He left strategy and fund objectives entirely up to us–just do whatever we think will make money. We don’t really have a strategy other than “beta with leverage”: hold the core of 400 coins and ride the existing market move, use leverage to trade around it and enhance returns. Our primary goal was to create a track record that would beat buy and hold returns. We didn’t have any well-defined strategies, we’re just going to make it all up on the fly. We didn’t have an official name but we informally called this venture The Coin Fund.

November 5th 2013

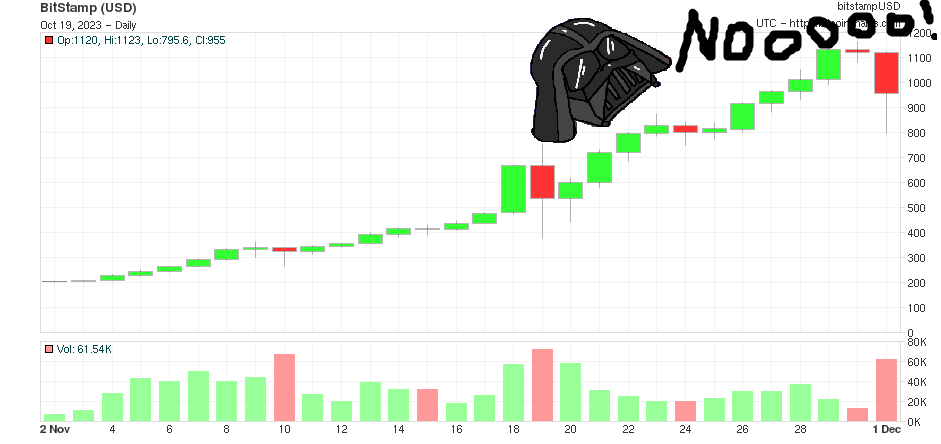

It’s starting to get interesting as price marches past $200 for the first time since March. Shortly after that, BTC-China and Huobi break out to new highs while the U.S. exchanges lag behind. We make a plan to go 200% long when Bitstamp breaks new highs, thinking U.S. markets have to catch up. $250 is the key number. We decide to help break it out ourselves and see what kind of momentum we could get.

There’s a large order block at $250 slowly being cleared out. I monitor the moment when it’s close to decrementing to 0 and I buy another 400 coins, doubling our fund’s position and going 200% long. You know that intense feeling of gusto that hits you right when you size into a position? It hit us hard. Suddenly you want *the move* that much more. COME ON, GIVE US THAT MASSIVE BREAKOUT CANDLE TO $275.

It trades to $251 and then it’s back under. Some idiot traders stack the $250 offer again. They’re not seeing what we’re seeing, that this should go MUCH MUCH higher.

An hour later, it drops to $230 on volume. Oops. Got ahead of ourselves.

Is it a fake breakout? It’s hard to tell. We have daytrader brain–meaning if breakouts don’t go right away, we just hit out of the size quickly. The proper stop level is $200 but that’s too large a loss to stomach. We decide to play it safe and take off the levered long for a paper cut.

24 HOURS LATER.

Bitcoinity has a different price alert sound for when the price goes up.

It’s the sound of the Road Runner–the one from the Looney Toons.

Our first chance to show some kind of value add as “pro traders” and we piked it. Goddamnit. While watching price climb to $300, I was beside myself.

The Coin Fund initially doesn’t have well-defined roles but one starts to develop: I am the head trader and Tommy is basically my therapist. We have phone calls to discuss “strategy” aka “me bitching about my feelings”.

November 10th 2013

I’m itching for a trading opportunity because I know the Coin Fund needs to show relative performance. I don’t want to look like a useless idiot. And then while watching late night NBA games… I hear it.

Price drops nearly $100, from $362 to $269. It’s time to get to work and buy those dips. I race to my laptop and buy 200 BTC in the $270-$280s and get us back to 150% long.

A day later, price recovers to $350. I scale out and reinvest the USD profit into the BTC stack.

This is it. This is the strategy. I can’t be the uber-trader who gets 500% long and holds it all to the moon but I can be the scalper who trades the dip, minimizes his holding periods, and add 5-10% increments. There’s nothing wrong with that. Our stack increases from 400 BTC to 500 BTC using the margin trading profits.

November 14th 2013

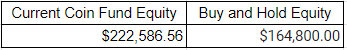

There’s a bi-weekly Coin.Go meeting where we discuss our performance. Tommy has a spreadsheet print-out comparing our current equity to that of a theoretical buy and hold account3basically where our account would be, mark to market, if we just sat on our asses and held the original 400 coins.

The numbers show that we’re adding alpha even though we know it’s just beta with leverage. Rivers, MM, and Zuo are pleased. They’re all getting crazy rich off their own personal holdings too. Everyone’s happy. Then the conversation meanders into something else because these bitcoin-obsessed technocratic futurists need to share their strange new ideas–something about an unmanned yogurt shop run by robots that operate payments through the blockchain, which was supposedly an example for a real-life use case of bitcoin.

I’m jacked up on adderall and I can barely listen as I stare at the Bitcoinity website, watching every tick. Meanwhile, Tommy is getting sucked into the bitcoin cult. He loves this yogurt shop idea. He’s been telling his own parents to invest into bitcoin. He’s compromising his objectivity by drinking the Kool-Aid. We’re short-term traders, we’re supposed to be agnostic about long-term future prices because nobody knows what will happen that far out. I’m concerned.

November 18th 2013

Every $100 move in btc that happens, I lie in bed anticipating another big dip. And then I could scalp it again. But there are no dips. Bitcoin is now approaching $700. Our equity is now close to $400,000. It’s hard not to look back with regret that I didn’t hold my margin longs from $280. Or $250.

We’re at the MBC desk at 7pm and everyone else has left. I’m glued to my seat while watching the chart and market depth. I tell Tommy to stick around because my spidey-sense is tingling. The trend is speeding up and that usually means another huge pullback coming. We order Chinese food for delivery. We wait. It rips through $700 and touches $750. Way too frothy.

Half hour later. They start to machine-gun the bids. It begins.

It’s my Pavlov’s bell for pain. I felt pained seeing our USD equity drop but the best way to cope with it was to delve deeper into short-term trading mode and make some nice scalps off the volatility. The next 36 hours, I traded my ass off.

Our stack increases from 500 to 600 coins when the dust settles.

I don’t remember when exactly it happened–it might’ve been this day in the office, might’ve been the next day or day after that, it’s all a blur–but an intense conversation happened. We faced a tough decision and our emotions had reached a boiling point. Or at least *my* emotions did.

Tommy attempts to reason with me while I foam at the mouth. He calmly replies he has not, in fact, drank any Kool-Aid. He reiterates the plan–hold a core of 400 coins no matter what, the original amount that Rivers gave us. He asks me what will feel worse–giving back some profits or missing the next 100% move because I panic sold?

I don’t respond right away. I take a deep breath and pace around for a bit. I do a little gut check.

Fuck, he’s right. We can’t sell it yet. I’m just not sure enough the top is actually in.

We agree to hold 400 coins until further notice. The next few days are restless. What if that move was the top and it just has a death candle out of nowhere any second now? This is when it got really bad. I’d lie in bed awake for hours and then drift into this hyper-surreal dream state and hear that horrible

Then I have these nightmares: I’m at my screen and I’m seeing bitcoin trade near $1 after some kind of horrific infinity dump. Every exchange has gotten GOX’d, you can’t even load the page, it’s so bad. Bitcoin was revealed to be a scam all along and somehow, I slept through all of it. Now our equity is at $0. Devastation.

Then I wake up again. It’s fine. It’s actually at $100,000. Just like Charlie had told me all those months ago. We’re mega-millionaires.

And then I realize *that* was also a dream and then I wake up again. I am experiencing pure delirium. I don’t know what’s real anymore.

The say in bull markets, the market climbs a wall of worry. I didn’t get what that meant until now.

November 23rd 2013

$800. New all-time highs and trend still in tact. Stop worrying, try to get some sleep.

Day after day, I’d talk through my “worries” with Tommy. He should just buy a long chair for me to lie on and start billing me for his time. He’d assure me: bitcoin is the greatest thing ever. It’s going to go higher. Does he really believe that? Or is he a bitcoin tourist posturing for the sake of maximizing profits? I don’t know anything anymore.

November 30th 2013

Trend speeds up again and the bitcoin community is too happy and full of themselves. I don’t like it.

I know what usually happens next. It’s time to embrace the dark side of the force.

December 1st 2013

Back to $800. Our equity peaks near $700,000 and swings back near $600,000 on this pullback. We are day traders who hate losing more than $1000 in a day and we were now experiencing 6-figure equity swings. It can be a shock to the system. But at this point, my nerves have been forged in the fire. I’m handling my shit a little better. Deep breaths, Pete. You got this.

I go 200% long in the low $800s and flip it for a quick scalp when it bounces back over $1000.

December 5th 2013

After that $800 test, it starts grinding back up to the highs at $1100 within a few days, just like all the other pullbacks.

It’s just consolidating into a high and tight flag right under $1150 for hours and hours and hours. You know what happens when you see that kind of price action–another breakout is imminent. I’ll hear the BEEP BEEP! any moment now.

It’s 4AM. I hear something.

It’s not a dream. It’s real. It’s back in the mid $800s, even though I was sure it would go higher. This doesn’t seem right. It has not yanked twice at the same level like that. I forgo buying the dip this time and I wait instead. It’s different this time, I can feel it in my bones. I know what to do now.

Tommy. We’re selling it. If I’m not right about this being the top, we can just re-buy back over $1150.

He doesn’t respond. I’m spamming his Gchat while he sleeps. I make the unilateral decision to dump all our bitcoin on the micro-bounce to $1000. Better to ask for forgiveness, not permission. I actually hope I’m wrong and bitcoin reverses back up. It’ll force us to buy it back higher and we keep making money on the uptrend. That’s a better scenario than the bull cycle being over for months, possibly years, or possibly forever.

It doesn’t hold $1000. Later on it breaks under $800 with conviction and the flood gates open.

It’s over. It doesn’t make new highs for the rest of the year.

December 17th 2013

It feels good to lock it in and hold cash while $1000 acts as resistance. I feel an entire load taken off my mind. I take a week off from the graveyard hours and have Tommy scalp the dips instead. Let him deal with Darth Vader. Even with bitcoin trading back to $700, 40% off the highs, our equity eventually surpasses new highs with nimble and adept dip-scalping.

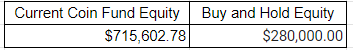

We have our last Coin Fund meeting before I travel back home to California for Christmas vacation. We show them the current spreadsheet.

I almost want to take a bow in front of all the Coin.Go partners–“You’re welcome!” This experience started my dependency on stimulants and probably took years off my life but yeah, you’re welcome.

But I didn’t want to come across as ungrateful. I wanted the conversation focused on new ways to make money because I had a good one.

Rivers: Great job guys. So if you think bitcoin has peaked, what’s the plan now?

Me: There’s a cash lending feature on Bitfinex. It’s a P2P lending platform where you lend USD to other traders who need it for the margin. Rates are crazy at the moment–you can make 1% a day lending at peak demand. Forget trading, lending is free money!

(to be continued in The Pot Stocks, thank you to all my readers!)

The P2P lending platform comment made me laugh, because back in in 2018 I had a heated argument with one of my friends about how I believed P2P lending was essentially a house of cards that would fall once the price of the coin they were paying you in (usually their own) was diluted. I was right, but he made money, so who was the real idiot here?

Love this!

Read every post in this series and now I’m all caught up. Looking forward to the next one!

Wonderful blog Pete! How do you feel now when BTC is trading at 100k? Do you still have the same view over BTC or crypto overall?

I own it and I like it. Not sure what else to say that hasn’t been said by others.