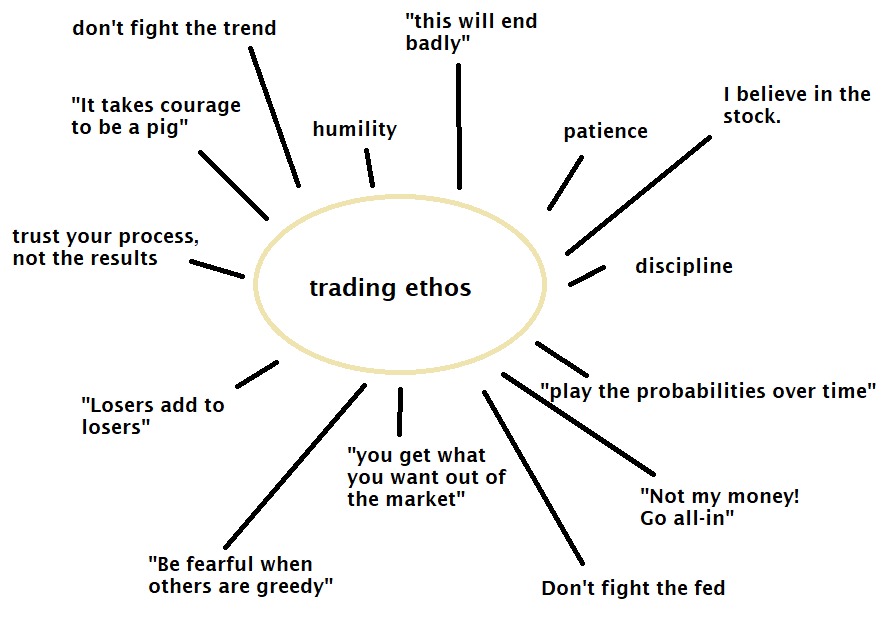

What is your trading ethos?

Your trading ethos is a set of beliefs and principles. For some traders, it centers around a trait like patience or humility. For a contrarian trader, it could come from a market-based mantra like “be fearful when others are greedy”. For a trend trader, it’s “don’t fight the trend”. Some traders adapt their ethos from books like Mark Douglas’ Trading in the Zone. For many, it’s a long list of rules on making sure to follow their time tested strategy and execute it perfectly. How many times have you written on some scratch paper something something about taking a loss or following your stop? This is a simply bare bones method of building an ethos around discipline. Many of the game’s legends like Livermore, Soros, PTJ, Druck, Dalio–they all have a very clear ethos if you ever listened to any of their interviews.

We see a lot of sports teams develop an identity and a culture from their head coaches or upper management. For years, Pat Riley and Erik Spoelstra fostered “Heat Culture”, a team identity that centers on selfless team-above-all mentality and blue collar effort. This identity was the backbone behind their exceptional player development and team chemistry, which culminated in an unexpected Finals appearance as a fifth seed in 2020. In 2015, Jurgen Klopp arrived at a woe-is-us Liverpool that hadn’t won the league in decades and had suffered numerous misfortunes in their pursuit. He transformed the culture to reflect his own personality–emotionally-driven, data-driven, high intensity, togetherness–and as a result, Liverpool flipped the script and won their first Premier League title in 2020.

For us independent traders, you are your own coach. You have to develop your own culture–your trading ethos. You have to have the vision that says “this is where I want to be”. You have to be the authoritative voice that says “this is what is going to happen today to get there”. You have to find a set of beliefs that guides you and your character development.

You want to lean on your trading ethos when opportunities are dry or when you encounter personal obstacles. Ideally it can be a source of faith and inspiration. Think Field of Dreams — “if you build it, they will come.” If you’re patient and you have a good strategy, the money will come. It should transcend a bad trade or a bad week or even a bad year. When you’re staring at shitty PnL on a rough day, you get through it because your ethos (or code or beliefs, you can call it whatever) has you believing it will. You miss a monster trading opportunity, your ethos is supposed to include some mantra about turning misses into future opportunities, giving you the fuel to study markets and spreadsheets into the wee hours of the night. You won’t miss that trade next time, no sir!

Here’s my confession to you… I’m actually struggling big time with my trading ethos. I don’t know if I have much of one anymore. It’s not that I lack awareness of the best principles and truisms. It’s that I have certain days where I just don’t believe in any of them. This is where trading nihlism comes in–something I tried to explain during my podcast with Aaron. Nihilism is basically the belief that nothing is meaningful. Character, value, culture, code, ethos–these things are just made up and pointless. You read a trading psychology book? That’s nice, here comes the market to totally fuck you up. You ever have that moment where you’re repeating something in your head while in a trade to guide yourself, maybe something like “be patient and hold your winners longer” and then the market reverses and stops you out? There’s a couple ways you can respond after this occurs.

“Disappointing but I followed my plan, it’s okay and it’ll work out in the long run.”

or

FUCK THIS BULLSHIT. NOT DOING THAT NEXT TIME.

I find myself reacting the second way. I always feel like I’m talking to someone too. Like someone wiser is telling me that this is part of the process and to trust it, and I’m telling them–no, fuck off. When things just don’t work out the way they should, my mind defaults to nihilistic thoughts. The market just does whatever the fuck it wants, it doesn’t make sense, and who even cares anymore. The 16 year old me who consumed the Theory of Poker in days and learned to deeply believe in probabilistic thinking, about how the math will end up right in the long-run–he’s long gone. A bitter, jaded 32 year old has replaced him. The habits of acting in my own interest and still making positive expected value decisions–that’s still there, which is why I still win. But the mindset is gone. Being rooted in a strong ethos, that’s gone. I’m in the very thick of a slow descent into madness and meaninglessness and I’m unsure how to pull myself out. I don’t particularly care for trading beyond it being just being a job and a means to make money. I don’t care about doing the right things, process-wise, as much I used to (honestly, it depends on the day and what side of the bed I woke up on). Younger traders approach me with their work, they say they’re working on their trading rules or they like this chart or they’re backtesting all this data–whereas I used to encourage them, I now just ignore it because at the end of the day, you either make money or you don’t. You tell me–why should I give a fuck about having some kind of process, some kind of positive culture, or having some stupid trading rules? What does it all add up to?

I think I have seen too much. You’re not supposed to chase garbage like Gamestop or Dogecoin and make 10x your money, but some people did exactly that. You’re not supposed to add to losers when shorting a parabolic squeeze but some do exactly that and make it out to the other side and their twitter followers talk about what big balls they have. Some of you may chime in and tell me “yeah but they’ll learn their lesson later and give it back” and that’s an ethos partially based on how the markets are fair and just, but I have a secret to tell you–they aren’t. Some people actually keep their lucky gains with a fraction of the work you put in and they do get to buy their lambos. I remember when it seemed like discipline and calculated risk management were the “must have” principles for professional traders–up until meeting prop traders who go all-in based on feel with very little discipline ethos at all making millions of dollars. I’m not even mad at any of that anymore, because what is the point? They give me easy reference points to know that ultimately, trading is a meaningless and vapid endeavor. Trying too hard and feeling pain and disappointment because you’re overly invested in succeeding as a trader, nah man, that’s not worth it. Click your buttons, make your money (or lose, quit, and do something else–that’s a win), and leave. Feel what you gotta feel to make your money but don’t try to make any sense of it, you’re better off. Maybe that’s my ethos at this point (again it depends on the day you talk to me).

You can have an ethos about learning and listening to others as well. I don’t! Let me tell you a story about a mentor figure I met online a few years ago. He traded a little longer than I have and I learned a bit from him–details will be left intentionally vague here. He had a very strong trading ethos built around trusting his strategy and being patient. After years of rote discussion, I’ve grown tired of his cliches and constant riddles. A more humble person might be messaging him to have a positive discussion on how to change their mindset. Me, I have completely tuned him out and my eyes can’t roll fast enough whenever I scroll through his cliche “a loss is a learning opportunity”-spirited comments, after a trade not working out. Shut the fuck up already old man. I barely talk to anyone about trading these days and I don’t care to change that. I rarely feel interested.

I had to ask myself the question… what are my trading principles? Or maybe more precisely, what are the closest things I can grasp at, when I need to? I had to dig deep to really fish out what I believe in, what I don’t, what I sorta believe in on my good days, and what really drives the actions behind my day to day trading. I also had to think about the negatives of certain beliefs. Not everything I write below is some perfect optimal belief, a good rule of thumb is to never ever emulate me.

- Risk it for the biscuit — you’re not trading to make a salary. You have to make it worth the bullshit. When opportunities arrive, trade big and hold for larger moves. This has helped me become a more aggressive trader. It has helped channel my focus from a risk-focused trader to an opportunities focused trader. I don’t think about how much I’m going to lose because that’s not a pleasant thought. I focus on how much I deserve to win. I’m very entitled when I’m in a winning trade, what I can say?

- It’s not worth fighting losers — this is more a survivor’s instinct of mine that I had from the very beginning, rather than a learned belief. I may fight something a little bit but never too long. It’s not worth it, it just isn’t.

- I’ll always make money — a very egocentric, problematic thought. I don’t think you want trading principles that lean too much on your ego and identity. But as I said, when times get rough, you have to have faith to keep yourself afloat, and I have faith in myself. At least eventually I do, after I bitch and wallow for a little bit. I’ve made money since I was 16, I’ll figure it out.

Here are some notable things I don’t believe in:

- “I hate weekends I just want it to be Monday” or any hustle porn — I don’t live to trade, sorry. The grind is just a means to an end.

- Being a winning trader or having a large PnL means you have any character or higher intelligence at all. It doesn’t, sorry, I’ve seen too much.

- Anyone can make big money as long as they have a winning strategy and work hard and do things the right way. I wish I could believe this but I think there’s an intangible talent and risk-tolerance factor in the equation. If you don’t have the talent gene or that killer instinct or just flat out have lady luck on yours side, you’re not just going to make it for real money. It’ll always be a grind at most. Again, I’ve seen too many people fall in the category.

Anyway, welcome back to my blog. Yeah there’s a new domain and layout, no I don’t know if this means I’ll actually write more. As always I’m trying. Good luck to you guys.