(continued from Crush / Roommmate)

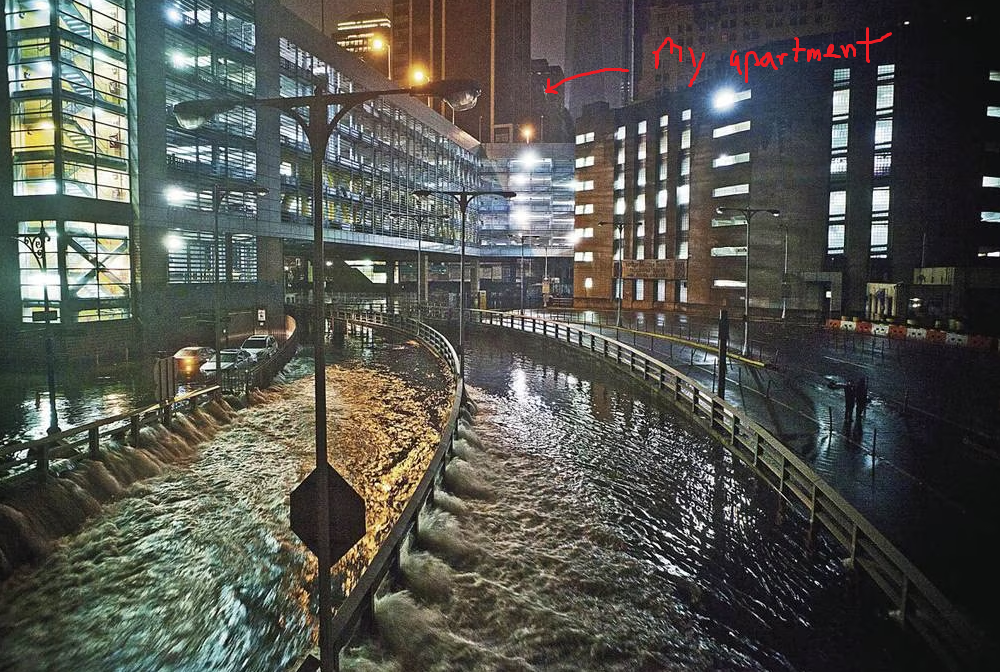

The media was warning us that Sandy would be a 100 year flood kind of event. I just shrugged it off because they did the same thing last year when they were fear-hyping Irene. Most of the day, I just see something resembling a heavy rainy day. But around 8pm, the high tide was starting to get a little spooky. Walk out on the street and the water would be well above your ankles. I’ve never seen this kind of weather in my life.

I’m window watching a car camped on an intersection at the West Street highway right below our living room view. The flood was rapidly rising and the driver was frozen in a state of panic. Once the flood went from “heavy rainy day” levels to 3 feet of water, I think he knew how fucked he was going to be. He got out of his car and just starting scrambling–where he went, I have no idea. 30 minutes later, the surge hit a peak and I saw his car nearly submerged under the rising water. Lower Manhattan briefly became Waterworld.

The power goes out in the building… and then the rest of the neighborhood. The elevators ceased to function and I walked through a stairway lit only by glowsticks. I got downstairs to see the lobby flooded to waist-high levels. This is bad. I go back upstairs and my roommates and I discuss what the hell any of us are supposed to do. My Blackberry runs out of batteries and I spend most of my night watching a river flow through the West Street highway… absolutely surreal.

In the morning, our building concierge informs all of us that we have to leave the building until further notice–there was no power, no internet, and no running water or gas. We were being forced out of own homes. Just a couple days they said, until it was “safe” again. Once the storm subsides, they start pumping water out of the lobby and we make our preparations as refugees of the storm.

My first look outside and I see the situation at the Brooklyn-Battery tunnel. Not good.

There are no taxi’s around and all nearby subway trains are down but luckily my roommate’s brother offers me a ride. I pack some essentials and take a ride to my cousin’s place in Bushwick. When I arrive, I charge my phone and check my e-mails. This is from our floor manager CJ:

MARKET CLOSED. DON’T GO TO THE OFFICE UNTIL FURTHER NOTICE. NO POWER. BE SAFE.

Sun Allied Capital

Both my apartment building and my office building were deemed uninhabitable–too much damage from the storm. The entire financial district got rocked, with damages estimated to be in the tens of billions. We have no clue when things could be up and running again; it might be weeks or months. After a few days of trading remotely, we secure a temporary space in the Trump Building on 40 Wall Street. We could all be a team again and maybe that would help us all feel normal during this unusual time.

We arrive to the poorly lit trading floor of a firm I had never heard of: Sun Allied Capital Partners. There were about 5 rows of computer setups, all unoccupied and all looking like outdated tech by at least 5 years. This would be our temporary trading setup. Tuco and CJ told everyone to keep to ourselves but we didn’t see any “regular traders” at Sun Allied, just random people being toured around by the man who ran the place, Morrie.

Morrie reminds of the character of the same name from the movie Goodfellas. He wouldn’t stop talking and he looked like a used car saleman with a cheap suit. He claims he was once a NYSE specialist back in ’85.

He had TVs all over the floor playing his Youtube commercials. Men and women monotonously offering 5-10 second testimonials about how Sun Allied change your life and supercharge your trading. They have the best platform out there to trade. It looked like software from Windows 95. Morrie will teach you how to trade and you can ask questions, great for beginners. Cut to Morrie at a conference table authoritatively pointing to the camera saying things like I WILL TEACH YOU EVERYTHING YOU NEED TO KNOW. Then these huge blue arrow graphics enter the screen like ‘NO CREDIT CARD NEEDED’ and ‘FREE TRIAL’, accompanied with generic royalty free jazz. These commercials would just play all day in the background non-stop while we traded.

Morrie led live tours around the floor–a mixed assortmen of men mixed with some attractive European women. At the risk of sounding sexist, I wondered if these women were just being hired to build a good vibe around the prospective male customers. He had these same types of women offering testimonials in the aforementioned cheesy commercials. Or maybe Y5 and MBC had done a poor job recruiting the attractive European women demographic and it distorted my world view.

I remember Morrie putting his hands on a young woman’s shoulders and asking her to close her eyes and to imagine trading Netflix, at the time a super rangey, highly shorted $80 stock with lots of sharp moves.1This was when Netflix’s pivot to streaming was still a controversial and hotly debated move. Most of us wouldn’t touch NFLX or we would trade it with 200-500 shares most. Morrie told this woman to visualize trading 1000 shares of Netflix… then 5000 shares… and then 10,000 shares.

He’d say all she needed was a 1 point move and she’d be up 10 grand. Anyone suggesting to trade reckless size just to catch small moves is waving a lot of red flags. I don’t know if that woman even knew what a bid/ask was. It felt so sleazy.

Part of me wanted to talk to some of the prospective hirees/customers and tell them to leave for their own good but I decided against it. If it weren’t going to be them, it would be someone else tomorrow, what difference does it make? Being at Sun Allied gave me the “privilege” to see the very worst the prop industry had to offer. If I had ended up at this slop shop, I’d probably end up swearing off trading entirely. Maybe MBC wasn’t what I thought it would be so far but it was leagues better than this. Luckily we didn’t have to trade there longer than a few days. I wasn’t the only one who felt the same way.

Bro, I never want to hear that clown talking again. I think it’s time to go.

Trading at Sun Allied and having to listen to Morrie’s commercials was unacceptable for Tuco. We later moved to trading at the headquarters of our platform provider, Lightspeed. It took two weeks before I could return to my apartment and I was one of the lucky ones. Many residents never came back to Financial District and just had to completely abandon everything they owned.

Low Morale (redux)

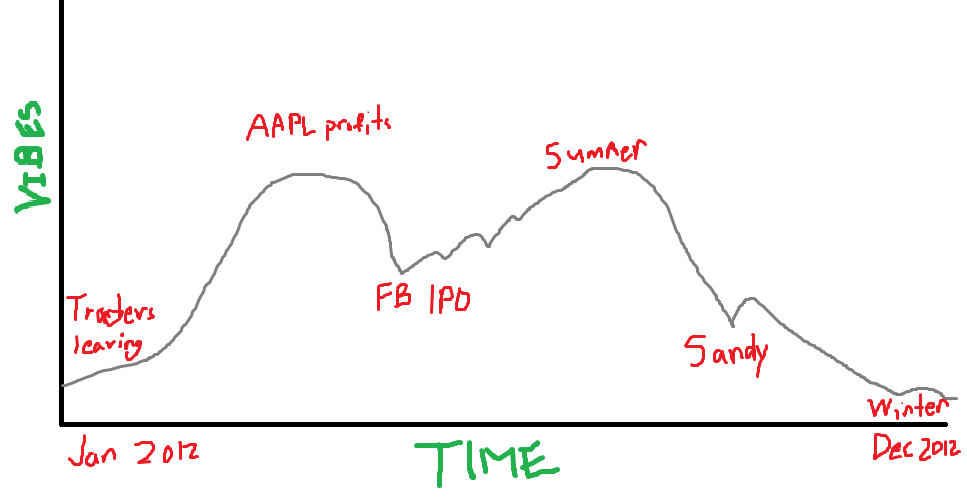

The Y5 trading floor was deemed safe to return in late November. The only issue was the heating didn’t work. It was 40 degrees outside so this sucked ass. CJ suspended the dress code so we were all wearing our big heavy winter coats inside. The trading floor was at maybe 25% capacity because who the hell wants to commute to work just to trade in the cold? It felt like a ghost town. Many of us just went through the motions. I had a trip booked to Orange County for Thanksgiving week and I couldn’t wait to go home. The vibes were bad again.

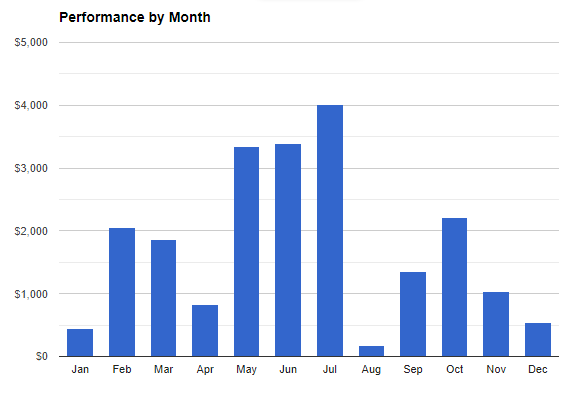

There wasn’t any one single event but just a series of things that slowly brought the MBC desk back into a winter malaise. Some that I can recall:

We lost one of our most promising young traders, a trader named Saxon. Saxon had one of the higher risk appetites on the desk and was just waiting to unleash it. He had his breakout trading AAPL in the spring and he decided to take it to the next level–trading the 4-digit monsters like GOOG, AMZN, and PCLN. Saxon was one of the most vocal and brash young traders on the desk, calling out his levels on each one and buying with confidence. He wanted to trade like Spark Merling and on days where he’d smash the leaderboard, we all found ourselves rooting for him. Come on Sax, be the guy who shows everyone how it’s done! Unfortunately it did not last. Saxon alternated good days with very very bad days, outpacing the entire desk in daily max loss triggers. He had a certain sticktoitiveness about his attitude that made us think he would keep fighting but out of nowhere, he informed everyone of his last day in October. He was pivoting to run his family business and trade retail on the side.

My mentor Jimmy’s trading results started to spiral into the red. When I had first started in the summer of 2011, Jimmy appeared to be a rising star who would routinely place near the top of the leaderboard on the most active days. A year later, it seemed like he was fighting for a green day on a regular basis. He had all kinds of overtrading issues, gunning through 10-20 stocks a day and never finding his footing on any of them. It didn’t end at the bell either, as during earnings season, he tried to trade announcement spikes afterhours to try to recoup his losses. That worked as well as you would expect. I could see the anguish on his face.

I remember one day Tuco made one of his boldest conviction calls. FB had their first positive earnings quarter with a large afterhours spike and immediately, Tuco told everyone this could be the starting point of a huge run as many institutions were still sidelined and waiting. Initially, we loaded up more shares than I could ever remember us doing from afterhours earnings context in the 20-21 range. FB grinded up just a little more and we sold it around 22 near 8pm, as the volume leveled off. It was ok but far from the most explosive move. Tuco took his entire position off and said he felt tired. Most of us followed suit. I remember Anton asking outloud “am I the only one taking this over for the next day’s move?” I think many of us still had this lingering skepticism and negativity after the IPO. The LFG! attitude we should have had on the trade kind of petered out into a Yeah… whatever. When that happens, traders just want to take profits. The next day, FB opened at $25. Whereas in the past, maybe Tuco would have a meeting to discuss how we could do better with our commitment levels, here we just kind of accepted that were pikers who sell early and move on.

I wasn’t doing any better than subsistence earning. Neither were my friends. My PnL leveled off from their summer highs and I was just fighting to survive. I started to withdraw money from my retail broker accounts to help pay the rent and now it felt like a clock was ticking. I’m maybe a year away from being just another sad statistic in the prop trading industry.

Victor spent all year trying to hype us up as big deals who were about to take the leap towards six figure PnL but nobody really got there. The year ended on a whimper and I felt resigned to the narrative in my head that moving to NYC to be a prop trader was just a dead-end idea destined for failure.

Oh and I have to tell you about this one crazy day where Clockwork and I were trading this one stupid stock and–

YOU!

Woah. There’s this man charging through the door and pointing very aggressively towards me.

Wait. That’s Spark Merling! And he’s not shouting at me… but at Clockwork!

Clockwork: What?

Spark Merling: You pissed on the floor! You shit on the floor! You’re disgusting!

Clockwork: I don’t know what you’re talking about!

Spark Merling: I saw you! You know what you did!

The biggest whale on the entire floor just accused my buddy of pissing and shitting on the bathroom floor. What on earth is going on? It went back and forth like that for a few moments. Spark with his wild accusations and Clockwork denying it all. The whole desk sat silently watching this unfold, not knowing what to say. Even Tuco was speechless. Victor got up to ask Spark to confer in his office and thankfully he left. We spent maybe 30 seconds acknowledging how weird and uncomfortable it was to witness that and then we went back to trading.

I was wondering myself… would he come back? Would Victor explain to us what occurred? All of his goofiness aside, Clockwork was one of the most respectful traders at the firm so these allegations seemed preposterous.

A few days later, my buddy Tommy did a little investigation and found Clockwork’s doppelganger on another desk (one of the shitty ones that recruits anyone) and concluded it was a case of mistaken identity. It was that other dude who pissed/shat on the floor. We received zero follow-up or apology on this matter.

Clockwork: He’s racist! He thinks we all look alike!

Y5 Trading Group was a cursed place to be at. We had to get the fuck out.

(to be continued Bitcoin)