On Sept. 24th…

…the CCP announces an economic stimulus package to bolster financial markets.

I don’t know what I was doing at that time. Probably dicking around with my fantasy football lineup while struggling to write anything or do anything remotely productive. I couldn’t tell you anything about the details–how much rates were lowered, the total dollar (yuan) amounts being injected, who said what, what impacts what–absolutely nothing. I just know FXI, my proxy ETF for China’s stock performance, closes up 10% on the day. Good for them.

Just for background Chinese equities have underperformed for a good 3 years. FXI was down a staggering 60% from its 2021 highs at the YTD lows. There are many reasons for this but I’ll keep it short. 1) government-driven regulatory crackdowns have made it a poor shareholder environment, 2) bad economy–there’s been a real-estate bubble pop and a recession. Throw in some bad covid policy and boom, that’s why China has been a depressed stock market for some time. Being a Chinese equities investor must have a truly awful experience. It’s probably what killed Charlie Munger.1that and being 99 years oldHow can a stock market suck so bad against such amazing GDP growth–that’s what people smarter than me were probably asking.

So anyway. That’s that. Chinese government announces big money package thing and Chinese stock go up. I really don’t care anymore because I’m a retired trader.

On October 2nd

It’s a random Wednesday morning. I don’t really care about trading, please believe me. I’m out in the park doing a meditation. I’m closing my eyes and “reflecting” on everything that is wrong with me. My attention span is garbage. I don’t sleep. I’m too online. I open my eyes hoping to feel better but I’m pretty sure the concept of meditation is a scam to get you to pay for therapy or subscribe to mindfulness apps.

I get back to my computer and I look up how stocks are doing because I want to waste my morning bean counting my long-term portfolio gains at S&P 500 highs.

Then I notice FXI is up to $35. That’s kind of wild.

One of the fleeting thoughts I sometimes have about my own trading is that maybe I can be an infrequent trader. In order to stave off the possibility of needing to acquire a real job, I only have to make a couple hundred thousand dollars a year. For a good experienced trader, that’s not a big deal. I don’t have to show up every day or even most days anymore. I just need to identify, via my 15 years of market experience, the top-10 opportunities of the year, in real time, within my competency circle–which is usually ‘sell the news’ plays or parabolic extension shorts. Or in this case, both.

This China move is starting to look a little extended and it might be a top-10 opp. I don’t really think much about it, I just see some opening range weakness early on and I smash some keys and now I’m short China. I am aware that the mainland Chinese market doesn’t open until October 7th and that there will be some kind of news conference on that day as well. I am aware that when it comes to ‘sell the news’ plays, you need to be as close as possible to *that specific date* to avoid pain and whiplash. I’m kind of a moron though so, despite “being aware” of this, I pound away thinking it could fade early because the daily chart is super extended.

So I’m short JD, FUTU, TIGR and I get long YANG–a triple leveraged ETF in my 401k. Another fleeting thought I sometimes have is that I should be a tax efficient trader. If I have any “top-10” opportunity to short in a 401k (via puts or an inverse ETF), I should take advantage of it so I can defer taxes on all my profits until I’m an old geezer2(yes I am aware the ultimate tax advantage would have been to do this in a ROTH but that ship sailed a long time ago and starting with a tiny contribution in a ROTH isn’t worth it right now). So I’m long 150,000 shares of YANG at $3.08 because it seems like a genius move on multiple fronts.

There’s a small correction. FXI makes an intraday low to 34.50 (YANG goes to 3.19 highs) and I’m thinking it could fade all day until the closing bell and maybe gap down.

It does not do that. For about 3 hours it chops around and creates a range below the highs. I kinda know my position isn’t going to work but I haven’t made any decisions. I’m just stuck and agonizing over it. I’m completely unpreprared for the mental challenge of trading. I debate between holding the bag until next week (for when mainland re-opens) versus the other choice: covering for a small loss and trying again later, hoping for a higher price.

FXI makes a new high in the last hour before close. I flatten all positions and lose $13,000 total. I feel like an asshole and now I’m mad. Not because of the money, I’ve lost that amount of money a million times. I’ve lost ten times that amount a handful of times. I think I’m just mad because I feel washed and stupid and depressed. And I keep telling myself: just stop trading. And yet here I am, I trade and I get mad–what else did you think would happen? You’re supposed to sort out these inner conflicts before you put money at risk, dum-dum.

This is a good time to close your eyes and meditate, Pete. Let it go.

Peace. Acceptance. Zen.

I open my eyes. I’m not sure I feel anything–again, I’m pretty sure meditation is a scam. It’s time to abandon healthy coping habits, I say. Let’s just doom scroll twitter until I get pissed off.

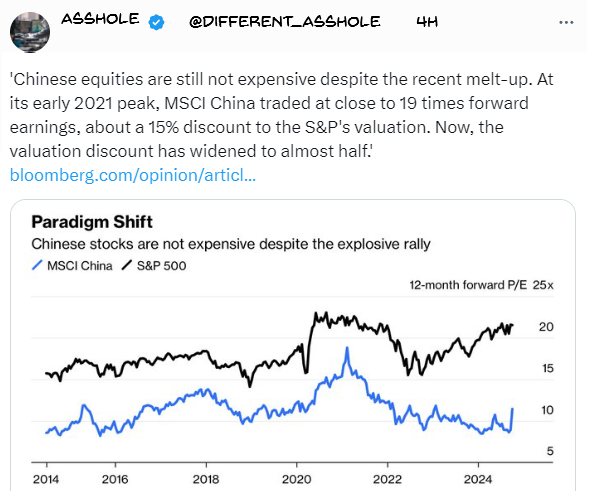

Oh look. I found something to get the blood boiling.

ok buddy, fuck you.

I didn’t want to break to my monitor. I just sort of shoveled my mouse into the general direction of it, carelessly, like a toddler throwing a tantrum. If I wanted to break my monitor, it would have been more satisfying to *really smash* it into pieces.

On October 3rd

I’m up but I refuse to trade. Nuh-uh, market’s not going to get my money this time. I refuse to play this game.

I just have to check FXI to confirm whether I covered the top yesterday, and then I’ll leave for the day.

Checking FXI on my phone aaaaaaaaaand… it’s down 3% overnight.

Well, that’s the top. I blew it, of course I did. It closed with 85 RSI the prior day, of course it had to collapse. I just don’t know how to take pain and because of that, I am sitting out of the real move.

I spend the next few days refusing to look at the market and convincing myself I’m never trading again. I don’t want to deal with this stress and anxiety anymore. Constantly looking back at your exits and evaluating what a fuckhead you are–I hate how I do that to myself.

Before I know it, it’s already Sunday night on October 6th. I’ve turned off the Dodgers game in disgust. They’re losing 7-1, our pitching stinks, and Profar is being an annoying little bitch. Fuck baseball–horrible sport–no clue why I subject myself to this every October. It’s time to replace one pain for another, I check the Hang Seng futures and it’s up 3%. I notice some semblance of hope (?) floating back into my body and I mutter under my breath: why am I doing this to myself?

On October 7th

I’m at my screen and I know I’m going to trade. I just know it. I don’t do any prep work, I don’t jot any notes, I don’t draw any lines, I don’t talk to anyone. I have a concept of a trading plan.

I think the right idea is just to hold through the ‘event’ (the event being the 10pm CCP press conference and the mainland re-opening of markets) and make it to the other side. If it’s still a loss at that point, you give up and retire. Earlier this year on another ‘sell the news’ play, I made the rookie mistake of shorting before the target date and just not knowing what to do with it if it reversed on me, and then panicking/bailing on it. Remember the bitcoin ETF selloff? I think I lost $40,000 on MARA before the day the ETFs actually traded and that was the day where it finally sold off clean. That’s what you want, the window of easy money opportunity. You don’t want to feel like you’re fighting this unlimited bid.

I short 2500 JD, 6000 TIGR, 900 FUTU, and get long 75,000 shares of YANG in my 401k. There’s a period of opening weakness where it trades to $36… and I’m up $20,000 unrealized… and it looks like it *should* go more. But then some “magical” bid steps in and everything reverses against me.

This is happening again. And I just have to take it. It might close at highs and even gap up one last time and I’m probably early but yet oh-so-close. The’s the mental challenge: take a limited amount of pain, knowing the moment of truth is right around the corner.

I actually have an unrelated coffee meeting with a private equity investor at 1pm. I think about cancelling it. To do what–stare at quotes knowing full well I’m committed to the pain and won’t get out no matter what? What’s the point.

Then I get another phone call. My daughter tripped and fell at day care and now has a small bump on the noggin. Then my wife calls me and tells me she’s very worried and I need to check up on her. Okay then. I walk to our day care and check up on her and ask what happened and she’s fine. Kids are going to fall, what can you do? My daughter is now very upset that I showed up without picking her up to go home and now I have to leave her bawling with maximum tears.

I take the train towards midtown for my coffee meeting. While the Q-train is over the bridge, I query up FXI and see it’s right at the high of the day. Now I’m firmly out of the money on everything except TIGR. I keep telling myself it doesn’t matter until tomorrow but I don’t feel good about it at all. I hate being early, it always sucks. Never, ever enjoy being early.

Meeting happens. It’s a nice hour where I don’t have to check my phone because I have to be polite. We talk about SPVs and Anduril and SpaceX and Open AI and other private equity weird stuff. He asks me about my plan for the rest of the day.

Go back home and check stocks. I’m shorting China today and I think cover by Wednesday ought to be good. He’s not a trader so he just kinda replies something along the vibes of “oh ok, that’s nice”. I don’t even know why I told him that, maybe it was to augment my own flailing confidence. We shake hands and go about our ways.

I’m back at the screen for the close. My concept of a plan is to just hold until tomorrow. I don’t think this will happen but I’m “prepared” for it–if there’s one last gap up, I have bullets to fire away. Hence why I’m only long 1/2 the amount of YANG I had from lat week. I’ll know I’m fucked if it’s not a winner by Wednesday.

In the last 30 minutes, all this volume floods into FXI for a mini-breakout up to 37.50. I don’t know why I stress over this but I just do. Being early always sucks. I start to feel this imposter syndrome, like everything in my thought process is just a lie. It’s crazy how very little ‘analysis’ there has been in my trade process. All I have is this faint notion that this parabolic line will correct itself after October 7th and I just have to see it through.

I never trade China stocks, I have no takes on them.

ADRs never trade well intraday, why do I try to short them like a small cap?

What if they keep going up until FXI $40?

I doom scroll a bit.

God he’s probably right. It’s been negative sentiment for YEARS and now *finally* getting government backing and STILL undervalued… yet I’m shorting this freight train. I don’t know what I’m doing. I’m gonna take a big loss tomorrow but it’ll be manageable and I can at least retire knowing I tried my best.3no, not really, I half-assed this the entire way

I shut everything off and the depression starts to settle back in again.

On October 7th.. 9pm EST

Monday Night Football on TV. Hang Seng Futures on my phone. I see it opens down 1%. That’s good.

The press conference happens. Now it’s down 3%. That’s usually a lot for a stock index ETF.

For whatever reason, media seems to be reporting “China is up”4(their markets are marked to Sept 30th, that’s why)

Kelce has a cool lateral play to Perine. Now it’s down 6%!5these things are not correlated

At the lows… negative 10%. Phew. Of course these mooks gotta take profits in the mainland. Obvious trade all along. I’m queuing up my stocks on RobinHood webpage to track my PnL mentally. I should really get a broker with proper overnight trading.

On October 8th.. 7am EST

I’ve been up since 4am. I actually can’t even trade until 7am because all my positions are through lame big house brokers like Schwab and Fidelity. That’s another fleeting thought I had on my trading… I should just go to zero commission trading and save money… which I did. Well, the cost of saving those pennies was not being able to cover the bottom at 4am and that probably cost me somewhere between $10,000-15,000. Oh well.

All my short positions are trading significantly lower pre-market. FUTU and TIGR down around -20%, JD close to -10%. I cover everything at 7am. Sold the YANG for a nice tax-deferred gain of 35%. Made about $95,000… subtract the prior loss and up about $82,000 overall on the trade idea.

Sell the news. Every time.

Got me laughing real good, appreciate the recap fellow namesake

Good stuff man. You’re one of the very few traders I can identify with. The raw deal. Please continue to write perfection be damned.

Happy to see you post again, Pete. One of the very few ‘real’ traders out there. Your content and thoughts are highly precious to newbies like myself. And I do hope you will eventually manage to transition to a happier state of mind while keeping trading :))

Another fun and great informative post. Keep writing, fuck the writers blockade and thinking about what to write. Just write what comes on your mind, stream of thoughts, about future of the markets, economy… whatever. We will read. There is a good book writing with power by Peter Elbow. Your material is always interesting to read. Unlike others you are sincere about your knowledge and how “sure” you are about what you trade – because you are not trying to sell us anything. I think skeptical people like me appreciate that. And yes I think meditation is a self delusion, and people who say they turn off their thoughts and just experience the world in a higher state while meditating are just ego inflated lunatics.