(continued from The Pot Stocks)

Avery had pulled us into a meeting in the middle of the day to coach us on how we could have extracted more value out of our short on a stock called Plug Power (PLUG). We had been hunting for a huge correction on this parabolic stock and today was the day it finally collapsed, along with a few other fuel-cell related stocks. Most of us over-covered at $9 and flattened out at $8… while the stock continued to bleed towards $6 and below. We left some serious money on the table.

Avery passionately argued that if we were going to commit all our mental capital into this stock for multiple weeks, we have to capture a substantial part of the move by holding size until the closing bell or a very, very deep retracement level like 50% from highs. On one hand, he’s not wrong.

On the other hand, he didn’t even trade the stock. It can feel hollow to hear this after the fact from someone who had no skin in the game. Hold your winners longer! Oh okay, thank you sir for letting me know that. I guess this is the brilliant wisdom you get when you pay for Avery’s $10,000 personal coaching program. I’m too tired to do anything other than just nod my head and agree.

The meeting is dismissed and we go back to our desks. I was up nearly $20,000 on the day and I didn’t really expect to put on any more risk. I felt satisfied to finally net a five figure day that didn’t involve OTC stocks.

And then something took my attention… and changed everything.

(Author’s Note: the following segment is taken from another post I wrote with text mostly unchanged, with some re-mastered pictures and some extra story at the end. so yeah, now we’ve come full circle and if you’re an old reader or you had clicked on my popular posts sidebar, you probably already know where this is going)

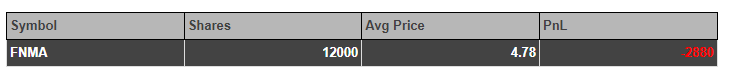

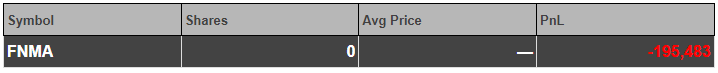

Around 1:45 EST, FNMA started to show sustained weakness. It had the look. I saw dollar signs. I started thinking about making this my first six figure day.

FINALLY!

After all those controlled pullbacks, this sucker was going to tank!

How I Learned to Stop Worrying and Love Taking Pain

When you’re considering playing an OTC bounce, you want that sucker to go down as much as possible. The panic should be as turbulent and violent and frightening — as if it’s headed towards a number below zero, if that’s even theoretically possible. The better the panic, the cleaner the pattern.

But it doesn’t always do that. Even steep pullbacks could end with controlled herky-jerky support rather than trade towards full-blown climactic exhaustion. That’s what had been happening lately. FNMA’s patterns the past couple weeks hadn’t been super clean, cut, and dry as in the past. It would look like it was about to panic, pause, chop up and down, then rip back up — patterns like that. And every time that happened, I would trade it too light and torment myself afterwards. Damn it, you’re such a coward. Look at all the money left on the table again. Only “settling” for $3,000 or $5,000 gains on these scalps when I saw others make $25,000 and more.

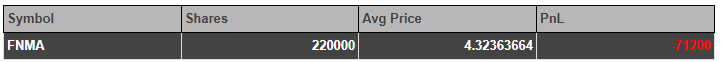

So instead of sticking to my “one-shot, one-kill” entry method, I did something very different — something I never did before when trading an FNMA bounce. I decided to scale into my MBC account. With 3,000 share tier sizes every 10-15c on the bid.

I wanted to be a hero. I wanted to be one of those gunslingers from WTG. I wanted to deliberately jump the gun (buy before a proper signal) and force myself to psychologically commit to some size. Take some pain early so I can numb myself to it later.

It’s my best play.

It’s by far the best stock I’ve ever traded.

I’m going to make sure I have more size on this than I’ve ever had before.

It’s not my money anyway.

It started innocently enough. I would bid small amounts, just to get some skin in the game. Dare the stock to go down even further than my initial entries, because that makes it an even better trade!

Pingpingpingping. That’s my platform notifying me through sound of my orders getting filled as the market makers continued to walk the stock down.

Even though it was completely unnecessary to be buying (and nevermind the fact that I should be short), I just didn’t care. My size and drawdown was still peanuts to what I anticipated my full size and actual gain was going to be.

The First Bid

The first bid to soak in came in at 4.54. Here we go! This was already a substantial move, down 2 points from highs. This bidder was the first real signal to buy, or in my case, add.

I added more in the firm’s account and initiated long in my personal account.

Pingpingpingpingpingpingping

The Fakeout

Let me digress for a second. Have you ever gotten stuck in an OTC bounce trade after the first bid drops out?

It’s happened to me so many times. That’s always the risk of playing a bounce trade. The best way to deal with it is to be hyper-vigilant and defensive when they sell into the first uptick attempt. If you use stops or wait for that bid to actually drop, you’re going to get slipped badly on the exit price. I call this flow trading— both the entry and exit plan is based on reaction to the order flow. Over time, this became automatic procedure, hence how I made so many momentum trades the past 4 months without being burned by any large loss. You’re not supposed to trade these plays like a position trader who scales in and out. If you’re taking pain on an FNMA bounce trade, you’re doing it wrong.

Okay, back to the trade.

In the next 3 minutes, I watched closely, waiting for that explosive move off the bid to confirm the bounce. They kept trying to lift the offer on huge volume. C’mon… that green candle should happen any minute now. I could feel the tension coiling up in my chest. Tick tick tick…in my mental clock, as the sellers refused to relent. Something felt a bit off.

This was the pivotal moment. It’s as if my internal decision maker — the little voice who I trust to manage risk in hot think-on-your-feet situations like these — decided to splinter into two factions.

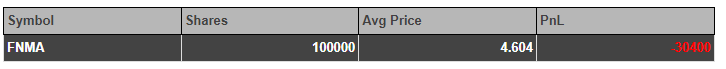

I sold flat within 60 seconds on my personal account.

This action relaxed me too much, as if my mind just totally compartmentalized the risk of holding the other 100,000 shares. It’s as if I had dismissed those 100,000 shares as a meaningless starter position to a much more massive theoretical full position (like 500k), despite having no experience with that level of drawdown and more importantly, no actual commitment or plan to such a large position size. Heck, my max daily loss limit was only $10,000. The little voice that whispered “be careful” had left thinking his duty had been done. I didn’t even type in sell orders on the Knight Direct platform. The lack of urgency was startling. It was pure cowboy delusion.

I just held on and went for the ride of my life.

Trapped

The uptick failed and it traded right back to the 4.54 bid… and it dropped quickly and violently. If you waited until now to sell rather than defensively selling near 4.50, you weren’t filling until the worst prices. Sellers were storming the front and traders were beginning to panic.

4.30.

Inner monologue

Wow. I just went red after making $22,000 on the open today. That’s new.

This is scary, maybe I should hit out and re-evaluate… save what I can until I see the next signal.

NO! You didn’t care to hit 4.50’s but you’re bailing now? That makes no sense. Stay the course.

4.15.

WHY am I even in this spot? WTF is wrong with me!? I never try to take pain, why did I start now?!

I told you to eat it 20 cents ago! Stupid! Well it’s too late now, you’re committed.

Just man up, focus and nail the next entry, that’s the only way out

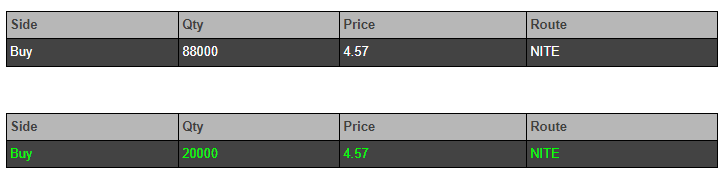

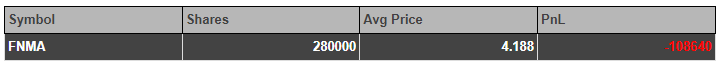

I would pay offers at prices like 4.13, 4.11 for 5000-10000 shares just…because. Because why not at this point? Just a little more.

Pingpingping

Around $4, there was a little bit of buying. A pause.

The bid didn’t quite stick it and show that surge of volume but in my desperation, I couldn’t distinguish between an OK signal and a great one. I clicked away furiously with no idea how many orders I sent in and for how much in total. I went way overboard.

Pingpingpingpingpingpingpingpingpingpingpingpingpingpingpingpingping

$4 dropped way too quickly.

Fear and Loathing

Everything just became a blur.

Pingpingpingpingping

As soon as I cross the 6-figure threshold (goal fulfilled, right?!), I can’t process anything coherently anymore. My pattern recognition and execution quality degrade to absolute shit.

There was a brief span of god knows how long (felt like hours in real time) where I panicked out of a huge chunk of size by hitting ARCA’s bid out of the market and then panicked right back into it by paying into ARCA’s offer out of the market, effectively adding $10,000 in pure slippage loss.

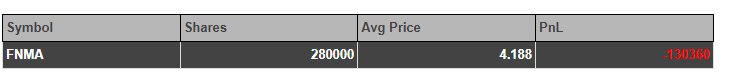

3.78. FNMA was down -35%.

Without a Lifeline

Now I was staring at around -($130,000). That was 13 times my maximum loss limit. Usually firms would blow out their traders positions at the max loss point, certainly far earlier than this, and yet… there it was… that massive red number, still ticking.

Nobody had said a word to me in person yet — no gchats, no messages, no e-mails, nothing. At this point, I was carrying an enormous level of anxiety while, on the exterior, trying to pretend nothing was wrong. I felt like a teenager who had not only totaled his parents’ car while joyriding, but had gotten involved in a hit’and’run accident as well. That poor homeless guy. I don’t know if he’s still alive. I had blood on my hands.

Oh My God. What have I done?

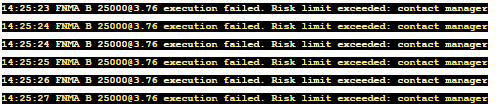

I tried to stay engaged and stem the tide. It was going to bounce somewhere…. if it bounces and fails to catch up close to my average price, it’s gonna be a loss and it will hurt but at least it will be less than this. This is too far and too much. I can’t puke it on the way down! I sold some shares thinking I could replace it at a lower price — a decision with no real impact other than to receive some feedback on how orders were filling, stay in an active management process, and try to re-gain control. Except when I tried to enter a bid at a lower price, I got this message:

The platform had locked me out. No new orders allowed other than to liquidate an existing position.

Then someone finally spoke up.

“What’s your plan?”

I turned around to see my floor manager CJ behind me, just his usual calm demeanor. We had always been on good terms. He understood the delicacy of the situation. There was no judgment in his eyes. Yet I felt stung by a pang of unassailable guilt. I fucked up and now it was official — they knew.

“Um. 3.50. Then I’ll get out.” I replied. Obviously I had no plan but I had to come up with something.

He added one more thing: “There’s news on it right now, the Senate committee agreed to a deal that’s going to phase out the GSE’s.”

Wait. This is news-driven? Now I had all these questions and thoughts rushing to the forefront.

Isn’t this old news? News that aleady had been digested earlier this morning? Or did they update it with a key item? Is there some live event going on right now? Why didn’t I pick this up on my feeds? Had I been blind all along? All along I was trading on an implicit assumption this was FNMA as usual, trading on panic rather than any kind of fundamental re-pricing. What if this is still the middle of the move? What if technical areas like 3.50 and 3 didn’t matter? What if the panic occurs at $1 with a bounce to 1.50? (that’s too late…). Fuck me… I just realized I forgot RULE #1 of OTC Trading! Nothing is ever real!

I uttered nothing except a quick “Thanks.” I knew it was over.

There was nothing left to do except feel the rope tighten up around my neck.

They continued to walk it down tick by tick. Just a marching line of red candles. There was no pattern change. No sign of bottom. No bidders stepping in front to save the day.

I didn’t care to pray. I knew I deserved everything that was about to happen. I was only thinking about the emotions that would come rushing out of the floodgates once the adrenaline wore off. How would I feel? How would I cope with that feeling? Would I want to jump off the building? The guilt, the regret, the anguish, the desperation, the self-loathing, the unbearable shame of losing big — I was dreading the moment when it would all hit me at once.

3.50. No bid. For the first time since entering the trade, I finally followed a plan.

Pingpingpingpingpingpingpingpingpingpingpingpingpingpingpingpingpingpingpingpingping

For awhile, I just sat there without speaking to anyone, or even standing up. I wasn’t ready to experience all that emotion, so I kept staring at my screen.

3.30.

Just go to $3 already…

The offer kept pressing. It wouldn’t trade over 3.35.

Why bother… they’re gonna crush all the buyers again.

It was taking a little longer for the offer to step down. It had been trading above 3.30 bid for 5 minutes now without a new low.

Hm…. seems like the pattern’s changing.

I got long in my personal account. My plan was to risk to below 3.30.

It acted right, showing the immediate explosive price action, so I never had to pull the trigger. That was the bottom.

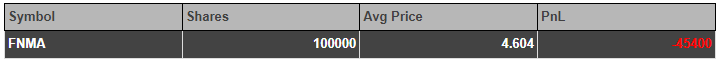

After the bounce peaked out, I just kept trading in and out of FNMA the way I always traded it. Play both sides. Precise execution. Don’t ever take pain. Never hold onto a bias, just react to the flow. Take profits and get flat when in doubt. Only trade the size you can handle, not the size that you want. My max position at any point was less than 20% of my position size when I took that huge loss. I finished the day up $48,500 in my PA.

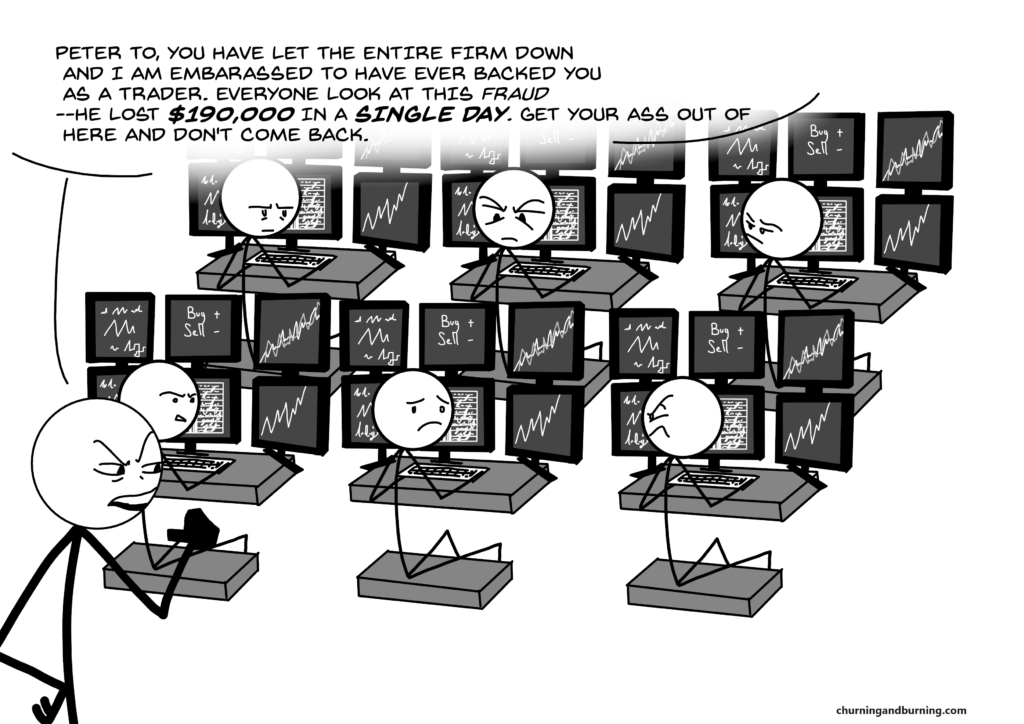

It helped to numb the pain but then the closing bell rang. Now I had to face the music. I’m bracing myself for someone to yell at me but I hear a friendly voice.

Tommy: Hey! Did you guys nail that FNMA bounce?

Clockwork: No I messed it up. BRO! I WAS DOWN FIIIFTEE-THOUSAND!

Tommy: WHAT! Fifteen thousand?

Clockwork: NO. FIFTY THOUSAND!!! Five-Zero. But I recovered most of it.1I don’t recall a single instance where Clockwork drew down more than $3,000, at this point in his career, prior to this trade.

They kept talking like -$50,000 was the most wild and inconceivable level of drawdown. After all, we were tight, nitty, Q3 MBC scalpers whom had, at one point, struggled to risk even $1,000 on a play. They have no clue what happened on my end–that I crashed and burned in spectacular fashion with a loss size that was almost quadruple the number they were so currently astounded by. I said nothing. I started to lose track of their conversation as my head swirled with all thoughts trying to process what happened.

Did that really happen?

Why did I even do that?

Am I fired?

If I just held it all with no stop, I would’ve made it to my break-even point.

I’m the world’s biggest piece of shit. I deserve everything that happens.

Then I see Victor in the corner of my eye, walking closer. Here it comes.

No. Even though that is what I deserved, that is not what happened.

Victor: P-To, come to my office for a bit.

His face didn’t give away anything–not anger, not sadness, not mild annoyance–for all I know, he could be asking for my opinion on a new coffee machine.

I took a seat in his office.

Victor: So… we probably should have got you out of that. We didn’t get word from the floor how much you were down until it was over 100,0002at this time there was no real-time risk monitor for OTC stocks and it was just a tough spot for us. We were hoping it could rebound and you could trade out of it.

I nodded.

He told me to take my time and that I had one of the in-house trading psychologists available if I needed to talk to someone. I nodded again. He left and closed the door.

Then I let it out. I cried a little bit.

(to be continued in Stopping Out)

great post. Loved it. Not to laugh at your pain. Its realness makes it great.